Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 11, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 191:

Hermo Company has just completed a hydro-electric plant at a cost of $21,000,000. The plant will provide the company's power needs for the next 20 years. Hermo will use only 60% of the power output annually. At this level of capacity', Hermo's annual operating costs will amount to $1,800,000, of which 80% are fixed. Quigley Company currently purchases its power from MP Electric at an annual cost of $1,200,000. Hermo could supply this power, thus increasing output of the plant to 90% of capacity'. This would reduce the estimated life of the plant to 14 years. The maximum amount Quigley would be willing to pay Hermo annually for the power is

A. $600,000

B. $1,050,000

C. $1,200,000

D. Some amount other than those given.

-

Question 192:

Hermo Company has just completed a hydro-electric plant at a cost of $21,000,000. The plant will provide the company's power needs for the next 20 years. Hermo will use only 60% of the power output annually. At this level of capacity, Hermo's annual operating costs will amount to $1,800,000, of which 80% are fixed. Quigley Company currently purchases its power from MP Electric at an annual cost of $1,200,000. Hermo could supply this power, thus increasing output of the plant to 90% of capacity. This would reduce the estimated life of the plant to 14 years.If Hermo decides to supply power to Quigley, it wants to be compensated for the decrease in the life of the plant and the appropriate variable costs. Hermo has decided that the charge for the decreased life should be based on the original cost of the plant calculated on a straight-line basis. The minimum annual amount that Hermo would charge Quigley would be

A. $450,000

B. $630,000

C. $990,000

D. Some amount other than those given.

-

Question 193:

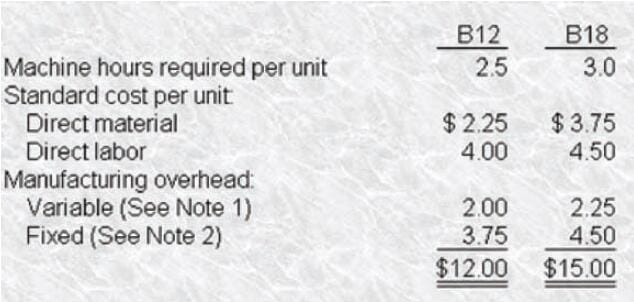

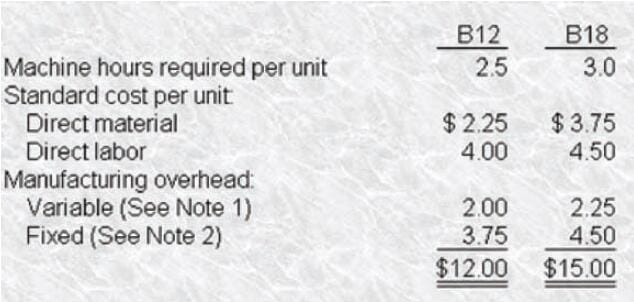

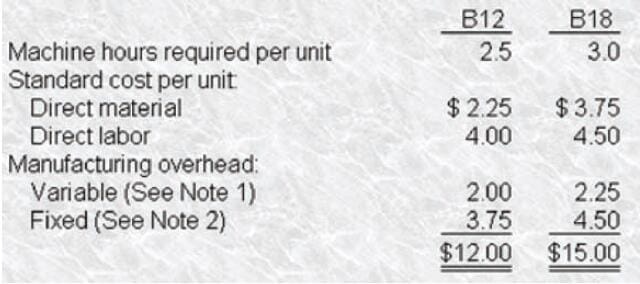

Stewart Industries has been producing two bearings, components B12 and B18, for use in production.

Stewart's annual requirement for these components is 8,000 units of B12 and 111000 units of B18. Recently, Stewart's management decided to devote additional machine time to other product lines resulting in only 41.000 machine hours per year that can be dedicated to the production of the bearings. An outside company has offered to sell Stewart the annual supply of the bearings at prices of $11.25 for B12 and $13.50 for B

18. Stewart wants to schedule the otherwise idle 41,000 machine hours to produce bearings so that the company can minimize its costs (maximize its net benefits).Assume that Stewart's idle capacity of 41,000 machine hours has a traceable avoidable annual fixed cost of $44,000 that will continue if the capacity is not used. The maximum price Stewart would be willing to pay a supplier for component B18 is

A. $10.50

B. $14.00

C. $14.50

D. Some amount other than those given.

-

Question 194:

Stewart Industries has been producing two bearings, components B12 and B18, for use in production.

Stewart's annual requirement for these components is 8,000 units of B12 and 11000 units of B18. Recently, Stewart's management decided to devote additional machine time to other product lines resulting in only 41,000 machine hours per year that can be dedicated to the production of the bearings. An outside company has offered to sell Stewart the annual supply of the bearings at prices of $11.25 for B12 and $13.50 for B18. Stewart wants to schedule the otherwise idle 411000 machine hours to produce bearings so that the company can minimize its costs (maximize its net benefits). Note 1: Variable manufacturing overhead is applied on the basis of direct labor hours. Note 2: Fixed manufacturing overhead is applied on the basis of machine hours. Srewart will maximize its net benefits by

A. Purchasing 4,800 units of B12 and manufacturing the remaining bearings.

B. Purchasing 8,000 units of B12 and manufacturing 11,000 units of B18.

C. Purchasing 11,000 units of B18 and manufacturing 8,000 units of B12.

D. Purchasing 4,000 units of B18 and manufacturing the remaining bearings.

-

Question 195:

Stewart Industries has been producing two bearings, components B12 and B18, for use in production.

Stewart's annual requirement for these components is 8,000 units of B12 and 11000 units of B18. Recently, Stewart's management decided to devote additional machine time to other product lines resulting in only 41,000 machine hours per year that can be dedicated to the production of the bearings. An outside company has offered to sell Stewart the annual supply of the bearings at prices of $11.25 for B12 and $13.50 for B18. Stewart wants to schedule the otherwise idle 411000 machine hours to produce bearings so that the company can minimize its costs (maximize its net benefits). Note 1: Variable manufacturing overhead is applied on the basis of direct labor hours. Note 2: Fixed manufacturing overhead is applied on the basis of machine hours. The net benefit (loss) per machine hour that would result if Stewart accept the supplier's offer of $13.50 per unit for Component B18 is

A. $.50

B. $(1.00)

C. $(1.75)

D. Some amount other than those given.

-

Question 196:

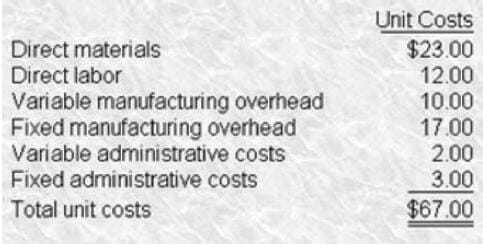

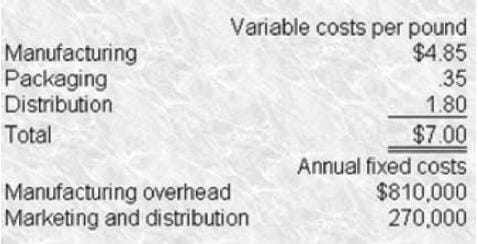

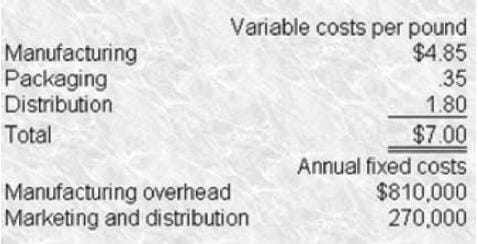

Randall Corporation is a table manufacturing company that has the following cost structure for producing table tops.

Recently, Randall Corporation received an offer from Blurr Corporation to supply the table tops to Randall. Randall is considering buying the table tops from Blurr instead of manufacturing them internally. Which one of the following statements is correct?

A. Randall should reject Blurr's offer if it is less than $47.00 and Randall has excess manufacturing capacity.

B. Randall should accept Blurr's offer if it is $50.00 or more and Randall has excess manufacturing capacity.

C. Randall should accept Blurr's offer if it is less than $47.00 and Randall has excess manufacturing capacity.

D. Randall should reject Blurr's offer if it is $50.00 or more.

-

Question 197:

A mail-order confectioner sells fine candy in one-pound boxes. It has the capacity to produce 600000 boxes annually, but forecasts that it will produce and sell only 500,000 boxes in the coming year. The costs to manufacture and distribute the candy are detailed below. The organization has invested capital of $6,750,000.

The selling price per pound that the confectioner should charge for a one-pound box of candy to obtain a 20% rate of return on invested capital is

A. $9.70

B. $11.05

C. $11.50

D. $11.86

-

Question 198:

A mail-order confectioner sells fine candy in one-pound boxes. It has the capacity to produce 600,000 boxes annually, but forecasts that it will produce and sell only 500,000 boxes in the coming year. The costs to manufacture and distribute the candy are detailed below. The organization has invested capital of $6,750,000.

The confectioner has been asked by a retailer to submit a bid for a special order of 40,000 one-pound boxes of candy; this is a one-time order that will not be repeated. While the candy would be almost identical, the candy ingredients would be $0.45 less. The total distribution costs for the entire order would be $32,000. Special setup costs required by this order would amount to $60,000. There would be no other changes in costs, rates, or amounts. The minimum selling price per one-pound box that the confectioner would bid on this special order would be

A. $7.05

B. $8.85

C. $9.05

D. $9.55

-

Question 199:

American Coat Company estimates that 60,000 special zippers will be used in the manufacture of men's jackets during the next year. Reese Zipper Company has quoted a price of $.60 per zipper. American would prefer to purchase 5,000 units per month, but Reese is unable to guarantee this delivery schedule. To ensure availability of these zippers, American is considering the purchase of all 60,000 units at the beginning of the year. Assuming American can invest cash at 8%1 the company's opportunity cost of purchasing the 60,000 units at the beginning of the year is

A. $1,320

B. $1,440

C. $2,640

D. $2,880

-

Question 200:

Briar Co. signed a government construction contract providing for a formula price of actual cost plus 10%. In addition, Briar was to receive one-half of any savings resulting from the formula price's being less than the target price of $2.2 million. Briar's actual costs incurred were $1,920,000. How much should Briar receive from the contract?

A. $2,060,000

B. $2,112,000

C. $2,156,000

D. $2,200,000

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.