Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 11, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 141:

What is the approximate lRP for a project that costs $50,000 and provides cash inflows of$20,000for3years?

A. 10%

B. 12%

C. 22%

D. 27%

-

Question 142:

Which of the following statements is most likely correct for a project costing $50,000 and returning $14,000 per year for 5 years?

A. NPV = $36,274.

B. NPV = $20,000.

C. IRR=14%.

D. IRR is greater than 10%.

-

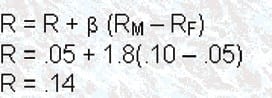

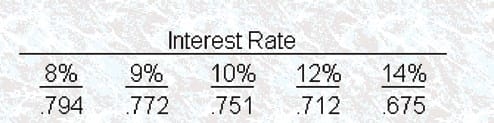

Question 143:

Comp techs is an all-equity firm that is analyzing a potential mass communications project which will require an initial after-tax cash outlay of $100,000, and will produce after-tax cash inflows of $12,000 per year for 10 years. In addition, this project will have an after-tax salvage value of $20,000 at the end of Year

10. If the risk-free rate is 5 percent, the return on an average stock is 10 percent, and the s of this project is 1.80, then what is the project's NPV?

A. $(14544)

B. $4,944

C. $(37,408)

D. $(32,008)

-

Question 144:

Dr. G invested $10.000 in a lifetime annuity for his granddaughter Emily. The annuity is expected to yield $400 annually forever. What is the anticipated internal rate of return for the annuity?

A. Cannot be determined without additional information.

B. 4.0%

C. 2.5%

D. 8.0%

-

Question 145:

The net present value of a proposed investment is negative; therefore, the discount rate used must be

A. Greater than the project's internal rate of return.

B. Less than the project's internal rate of return.

C. Greater than the firm's cost of equity.

D. Less than the risk-free rate.

-

Question 146:

The net present value method of capital budgeting assumes that cash flows are reinvested at

A. The risk-free rate.

B. The cost of debt.

C. The rate of return of the project.

D. The discount rate used in the analysis.

-

Question 147:

Suzie owns a computer reselling business and is expanding it. She is presented with two options. Under Proposal A, the estimated investment for the expansion project is $85,000, and it is expected to produce after--tax cash flows of $25,000 for each of the next 6 years. Proposal B involves an investment of $32,000 and after-tax cash flows of $10,000 for each of the next 6 years. Between which two desired rates of return will Suzie be indifferent to either proposal?

A. 10%andl2%.

B. 14%andl6%.

C. 16%andl8%.

D. 18%and2o%.

-

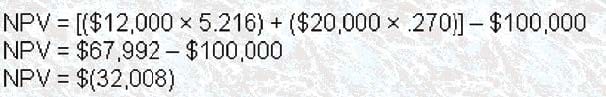

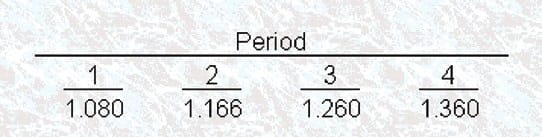

Question 148:

A project requires an initial cash investment at its inception of $10,000, and no other cash outflows are necessary. Cash inflows from the project over its 3-year life are $6,000 at the end of the first year, $5,000 at the end of the second year, and $2,000 at the end of the third year. The future value interest factors for an amount of $1 at the firm's desired rate of return of 8% are

The present value interest factors for an amount of $1 for three periods are as follows:

The modified IRR (MIRR)for the project is closest to A. 8%

B. 9%

C. 10%

D. 12%

-

Question 149:

The internal rate of return (IRR) is the

A. Hurdle rate.

B. Rate of interest for which the net present value is greater than 1.0.

C. Rate of interest for which the net present value is equal to zero.

D. Rate of return generated from the operational cash flows.

-

Question 150:

A weakness of the internal rate of return (IPP) approach for determining the acceptability of investments is that it

A. Does not consider the time value of money.

B. Is not a straightforward decision criterion.

C. Implicitly assumes that the firm is able to reinvest project cash flows at the firm's cost of capital.

D. Implicitly assumes that the firm is able to reinvest project cash flows at the project's internal rate of return.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.