Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 11, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 131:

The internal rate of return on an investment

A. Usually coincides with the company's hurdle rate.

B. Disregards discounted cash flows.

C. May produce different rankings from the net present value method on mutually exclusive projects.

D. Would tend to be reduced if a company used an accelerated method of depreciation for tax purposes rather than the straight-line method.

-

Question 132:

High-Tech Industries is considering the acquisition of a new state-of-the-art manufacturing machine to replace a less efficient machine. Hi-Tech has completed a net present value analysis and found it to be favorable. Which one of the following factors should not be of concern to Hi-Tech in its acquisition considerations?

A. The availability of any necessary financing.

B. The probability of near-term technological changes to the manufacturing process.

C. The investment tax credit.

D. Maintenance requirements, warranties, and availability of service arrangements.

-

Question 133:

The accountant of Ronier, Inc. has prepared an analysis of a proposed capital project using discounted cash flow techniques. One manager has questioned the accuracy of the results because the discount factors employed in the analysis have assumed the cash flows occurred at the end of the year when the cash flows actually occurred uniformly throughout each year. The net present value calculated by the accountant will

A. Not be in error.

B. Be slightly overstated.

C. Be unusable for actual decision making.

D. Be slightly understated but usable.

-

Question 134:

The internal rate of return for a project can be determined

A. If the internal rate of return is greater than the firm's cost of capital.

B. Only if the project cash flows are constant.

C. By finding the discount rate that yields a net present value of zero for the project.

D. By subtracting the firm's cost of capital from the project's profit ability index.

-

Question 135:

When using the net present value method for capital budgeting analysis, the required rate of return is called all of the following except the

A. Risk-free rate.

B. Cost of capital.

C. Discount rate.

D. Cutoff rate.

-

Question 136:

Project 1 has an expected NPV of $120,000 and a standard deviation of $200,000. Project 2 has an expected NPV of $100,000 and a standard deviation of $150,000. The correlation between these two projects is 0.80. What is the coefficient of variation for the portfolio of projects?

A. 1.67

B. 1.59

C. 1.51

D. 0.63

-

Question 137:

Assume that the probability distribution of Nap's is normal. The firm considers true risk occurring if the project results in a NPV that is zero or less. If the expected NPV is $1,000 and the standard deviation of NPV is $500, what is the probability that the project has an NPV of 0 or less?

A. Less than 3%.

B. Greater than 3%, but less than 9%.

C. Greater than 9%, but less than 16%.

D. Greater than 16%.

-

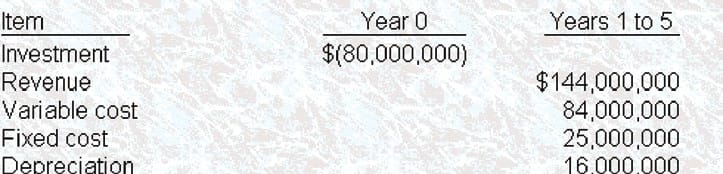

Question 138:

Drillers Inc. is evaluating a project to produce a high-tech deep-sea oil exploration device. The investment required is $80 million for a plant with a capacity of 15.000 units a year for 5 years. The device will be sold for a price of $12,000 per unit. Sales are expected to be 12,000 units per year. The variable cost is $7,000 and fixed costs, excluding depreciation, are $25 million per year. Assume Drillers employs straight-line depreciation on all depreciable assets, and assume that they are taxed at a rate of 36%. If the required rate of return is 12%, what is the approximate NPV of the project?

A. $17,225,000

B. $21511,000

C. $26.780000

D. $56117000

-

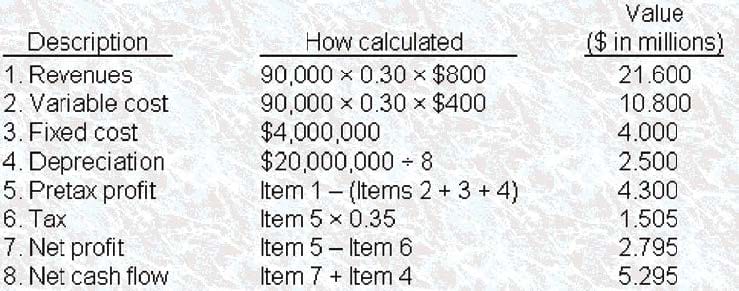

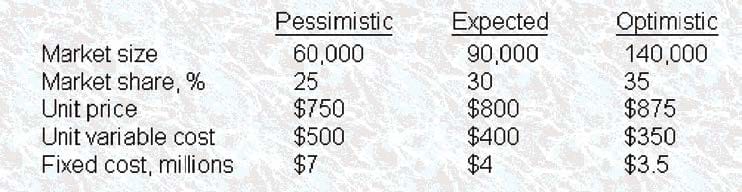

Question 139:

The following forecasts have been prepared for a new investment by Oxford Industries of $20 million with an 8-year life:

Assume that Oxford employs straight-line depreciation, and that they are taxed at 35%. Assuming an opportunity cost of capital of 14%, what is the NPV of this project, based on expected outcomes?

A. $2,626,415

B. $4,563,505

C. $6,722,109

D. $8,055,722

-

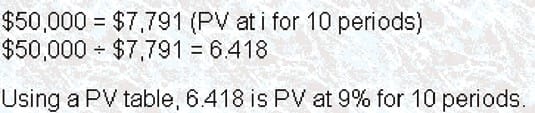

Question 140:

Pena Company is considering a project that calls for an initial cash outlay of $50,000. The expected net cash inflows from the project are $7,791 for each of 10 years. What is the PR of the project?

A. 6%

B. 7%

C. 8%

D. 9%

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.