Exam Details

Exam Code

:FINANCIAL-ACCOUNTING-AND-REPORTINGExam Name

:Financial ReportingCertification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:163 Q&AsLast Updated

:Jun 15, 2025

Test Prep Test Prep Certifications FINANCIAL-ACCOUNTING-AND-REPORTING Questions & Answers

-

Question 31:

An inventory loss from a permanent market decline of $360,000 occurred in May 1989. Cox Co. appropriately recorded this loss in May 1989 after its March 31, 1989 quarterly report was issued. What amount of inventory loss should be reported in Cox's quarterly income statement for the three months ended June 30, 1989?

A. $0

B. $90,000

C. $180,000

D. $360,000

-

Question 32:

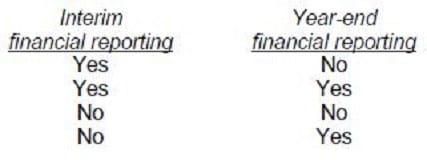

Advertising costs may be accrued or deferred to provide an appropriate expense in each period for: A. Option A

B. Option B

C. Option C

D. Option D

-

Question 33:

A planned volume variance in the first quarter, which is expected to be absorbed by the end of the fiscal period, ordinarily should be deferred at the end of the first quarter if it is:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 34:

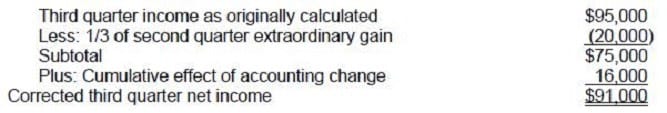

Kell Corp.'s $95,000 net income for the quarter ended September 30, 1990, included the following aftertax items:

•

A $60,000 extraordinary gain, realized on April 30, 1990, was allocated equally to the second, third, and fourth quarters of 1990.

•

A $16,000 cumulative-effect loss resulting from a change in inventory valuation method was recognized on August 2, 1990.

In addition, Kell paid $48,000 on February 1, 1990, for 1990 calendar-year property taxes. Of this amount,

$12,000 was allocated to the third quarter of 1990.

For the quarter ended September 30, 1990, Kell should report net income of:

A. $91,000

B. $103,000

C. $111,000

D. $115,000

-

Question 35:

During the second quarter of 1988, Buzz Company sold a piece of equipment at a $12,000 gain. What portion of the gain should Buzz report in its income statement for the second quarter of 1988?

A. $12,000

B. $6,000

C. $4,000

D. $0

-

Question 36:

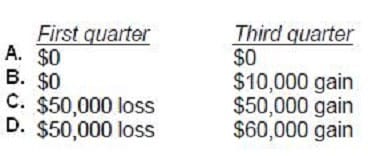

Wilson Corp. experienced a $50,000 decline in the market value of its inventory in the first quarter of its fiscal year. Wilson had expected this decline to reverse in the third quarter, and in fact, the third quarter recovery exceeded the previous decline by $10,000. Wilson's inventory did not experience any other declines in market value during the fiscal year. What amounts of loss and/or gain should Wilson report in its interim financial statements for the first and third quarters?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 37:

Dean Co. acquired 100% of Morey Corp. prior to 1989. During 1989, the individual companies included in their financial statements the following:

What amount should be reported as related party disclosures in the notes to Dean's 1989 consolidated financial statements?

A. $150,000

B. $155,000

C. $175,000

D. $330,000

-

Question 38:

Tack, Inc. reported a retained earnings balance of $150,000 at December 31,1990. In June 1991, Tack discovered that merchandise costing $40,000 had not been included in inventory in its 1990 financial statements. Tack has a 30% tax rate. What amount should Tack report as adjusted beginning retained earnings in its statement of retained earnings at December 31, 1991?

A. $190,000

B. $178,000

C. $150,000

D. $122,000

-

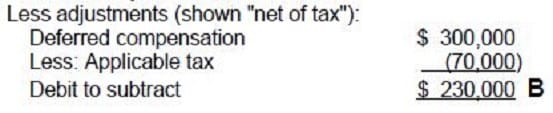

Question 39:

On January 2, 1991, Air, Inc. agreed to pay its former president $300,000 under a deferred compensation arrangement. Air should have recorded this expense in 1990 but did not do so. Air's reported income tax expense would have been $70,000 lower in 1990 had it properly accrued this deferred compensation in its December 31,1991, financial statements, Air should adjust the beginning balance of its retained earnings by a:

A. $230,000 credit.

B. $230,000 debit.

C. $300,000 credit.

D. $370,000 debit.

-

Question 40:

On August 31, 1992, Harvey Co. decided to change from the FIFO periodic inventory system to the weighted average periodic inventory system. Harvey is on a calendar year basis. The cumulative effect of the change is determined:

A. As of January 1, 1992.

B. As of August 31, 1992.

C. During the eight months ending August 31, 1992, by a weighted average of the purchases.

D. During 1992 by a weighted average of the purchases.

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFNS

Commission on Graduates of Foreign Nursing SchoolsCLEP-BUSINESS

CLEP Business: Financial Accounting, Business Law, Information Systems & Computer Applications, Management, Marketing

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your FINANCIAL-ACCOUNTING-AND-REPORTING exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.