Exam Details

Exam Code

:FINANCIAL-ACCOUNTING-AND-REPORTINGExam Name

:Financial ReportingCertification

:Test Prep CertificationsVendor

:Test PrepTotal Questions

:163 Q&AsLast Updated

:Jun 15, 2025

Test Prep Test Prep Certifications FINANCIAL-ACCOUNTING-AND-REPORTING Questions & Answers

-

Question 21:

Grum Corp., a publicly-owned corporation, is subject to the requirements for segment reporting. In its income statement for the year ended December 31, 1991, Grum reported revenues of $50,000,000, operating expenses of $47,000,000, and net income of $3,000,000. Operating expenses include payroll costs of $ 15,000,000. Grum's combined identifiable assets of all industry segments at December 31, 1991, were $40,000,000. Cott Co.'s four business segments have revenues and identifiable assets expressed as percentages of Cott's total revenues and total assets as follows: Which of these business segments are deemed to be reportable segments?

A. Ebon only.

B. Ebon and Fair only.

C. Ebon, Fair, and Gel only.

D. Ebon, Fair, Gel, and Hak.

-

Question 22:

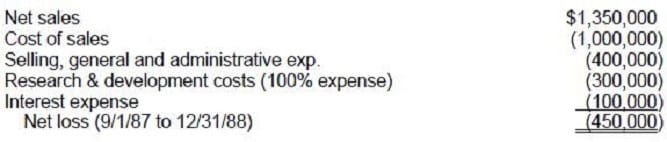

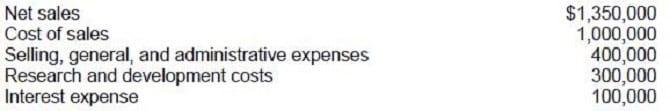

Chester Corp. was a development stage enterprise from its inception on September 1, 1987 to December 31, 1988. The following information was taken from Chester's accounting records for the above period:

For the period September 1, 1987 to December 31, 1988, what amount should Chester report as net loss?

A. $ 50,000

B. $150,000

C. $350,000

D. $450,000

-

Question 23:

Grum Corp., a publicly-owned corporation, is subject to the requirements for segment reporting. In its income statement for the year ended December 31, 1991, Grum reported revenues of $50,000,000, operating expenses of $47,000,000, and net income of $3,000,000. Operating expenses include payroll costs of $ 15,000,000. Grum's combined identifiable assets of all industry segments at December 31, 1991, were $40,000,000. In its 1991 financial statements, Grum should disclose major customer data if sales to any single customer amount to at least:

A. $300,000

B. $1,500,000

C. $4,000,000

D. $5,000,000

-

Question 24:

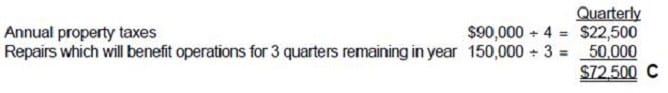

On March 15, 1992, Krol Co. paid property taxes of $90,000 on its office building for the calendar year 1992. On April 1, 1992, Krol paid $150,000 for unanticipated repairs to its office equipment. The repairs will benefit operations for the remainder of 1992. What is the total amount of these expenses that Krol should include in its quarterly income statement for the three months ended June 30, 1992?

A. $172,500

B. $97,500

C. $72,500

D. $37,500

-

Question 25:

An inventory loss from a market price decline occurred in the first quarter, and the decline was not expected to reverse during the fiscal year. However, in the third quarter the inventory's market price recovery exceeded the market decline that occurred in the first quarter. For interim financial reporting, the dollar amount of net inventory should:

A. Decrease in the first quarter by the amount of the market price decline and increase in the third quarter by the amount of the decrease in the first quarter.

B. Decrease in the first quarter by the amount of the market price decline and increase in the third quarter by the amount of the market price recovery.

C. Decrease in the first quarter by the amount of the market price decline and not be affected in the third quarter.

D. Not be affected in either the first quarter or the third quarter.

-

Question 26:

The following information pertains to Aria Corp. and its divisions for the year ended December 31, 1988:

Aria and all of its divisions are engaged solely in manufacturing operations. Aria has a reportable segment if that segment's revenue exceeds:

A. $264,000

B. $260,000

C. $204,000

D. $200,000

-

Question 27:

Hyde Corp. has three manufacturing divisions, each of which has been determined to be a reportable segment. In 1989, Clay division had sales of $3,000,000, which was 25% of Hyde's total sales, and had operating costs of $1,900,000, as reported to the CFO. In 1989, Hyde incurred operating costs of $500,000 that were not directly traceable to any of the divisions. In addition, Hyde incurred corporate interest expense of $300,000 in 1989. In reporting segment information, what amount should be shown as Clay's operating profit for 1989?

A. $875,000

B. $900,000

C. $975,000

D. $1,100,000

-

Question 28:

YIV, Inc. is a multidivisional corporation, which has both intersegment sales and sales to unaffiliated customers. YIV should report segment financial information for each division meeting which of the following criteria?

A. Segment operating profit or loss is 10% or more of consolidated profit or loss.

B. Segment operating profit or loss is 10% or more of combined operating profit or loss of all company segments.

C. Segment revenue is 10% or more of combined revenue of all the company segments.

D. Segment revenue is 10% or more of consolidated revenue.

-

Question 29:

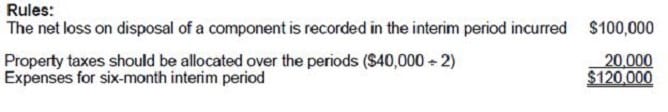

On June 30, 1991, Mill Corp. incurred a $100,000 net loss from disposal of a component of a business. Also, on June 30, 1991, Mill paid $40,000 for property taxes assessed for the calendar year 1991. What amount of the foregoing items should be included in the determination of Mill's net income or loss for the six-month interim period ended June 30, 1991?

A. $140,000

B. $120,000

C. $90,000

D. $70,000

-

Question 30:

For interim financial reporting, the computation of a company's second quarter provision for income taxes uses an effective tax rate expected to be applicable for the full fiscal year. The effective tax rate should reflect anticipated:

A. Option A

B. Option B

C. Option C

D. Option D

Related Exams:

AACD

American Academy of Cosmetic DentistryACLS

Advanced Cardiac Life SupportASSET

ASSET Short Placement Tests Developed by ACTASSET-TEST

ASSET Short Placement Tests Developed by ACTBUSINESS-ENVIRONMENT-AND-CONCEPTS

Certified Public Accountant (Business Environment amd Concepts)CBEST-SECTION-1

California Basic Educational Skills Test - MathCBEST-SECTION-2

California Basic Educational Skills Test - ReadingCCE-CCC

Certified Cost Consultant / Cost Engineer (AACE International)CGFNS

Commission on Graduates of Foreign Nursing SchoolsCLEP-BUSINESS

CLEP Business: Financial Accounting, Business Law, Information Systems & Computer Applications, Management, Marketing

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only Test Prep exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your FINANCIAL-ACCOUNTING-AND-REPORTING exam preparations and Test Prep certification application, do not hesitate to visit our Vcedump.com to find your solutions here.