Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jul 08, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 731:

Park and Graham entered into a written partnership agreement to operate a retail store. Their agreement was silent as to the duration of the partnership. Park wishes to dissociate from the partnership. Which of the following statements is correct?

A. Park may dissociate from the partnership at any time.

B. Unless Graham consents to the dissociation, Park must apply to a court and obtain a decree ordering the dissociation.

C. Park may not dissociate from the partnership unless Graham consents.

D. Park may dissociate from the partnership only after notice of the proposed dissolution is given to all partnership creditors.

-

Question 732:

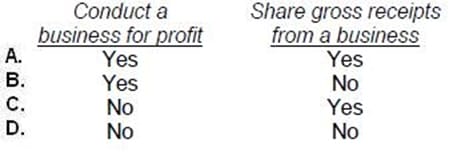

When parties intend to create a partnership that will be recognized under the Revised Uniform Partnership Act, they must agree to:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 733:

On February 1, Addison, Bradley, and Carter, physicians, formed ABC Medical Partnership. Dr. Bradley was placed in charge of the partnership's financial books and records. On April 1, Dr. Addison joined the City Hospital Medical Partnership, retaining the partnership interest in ABC. On May 1, ABC received a writ of attachment from the court attaching Dr. Carter's interest in ABC. The writ resulted from Dr. Carter's failure to pay a credit card bill. On June 1, Dr. Addison was adjudicated bankrupt. On July 1, Dr. Bradley was sued by the other partners of ABC for an accounting of ABC's revenues and expenses. Under the Revised Uniform Partnership Act, which of the preceding events resulted in the dissociation of a partner?

A. Dr. Addison joining the City Hospital Medical Partnership.

B. Dr. Carter's interest in the partnership being attached by the court.

C. Dr. Addison being adjudicated bankrupt.

D. Dr. Bradley being sued for an accounting by the other partners of ABC.

-

Question 734:

A general partnership must:

A. Pay federal income tax.

B. Have two or more partners.

C. Have written articles of partnership.

D. Provide for apportionment of liability for partnership debts.

-

Question 735:

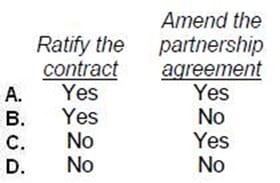

When a partner in a general partnership lacks actual or apparent authority to contract on behalf of the partnership, and the party contracted with is aware of this fact, the partnership will be bound by the contract if the other partners:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 736:

What term is used to describe a partnership without a specified duration?

A. A perpetual partnership.

B. A partnership by estoppel.

C. An indefinite partnership.

D. A partnership at will.

-

Question 737:

ABC Corp. and XYZ Corp. are contemplating entering into an unincorporated joint venture. Such a joint venture:

A. Will be treated as a partnership in most important legal respects.

B. Must be dissolved upon the completion of a single undertaking.

C. Will be treated as an association for federal income tax purposes and taxed at the prevailing corporate rates.

D. Must file a certificate of limited partnership with the appropriate state agency.

-

Question 738:

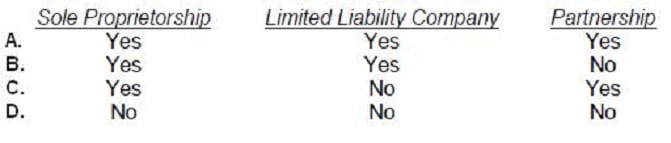

Which of the following forms of business can be formed with only one individual owning the business?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 739:

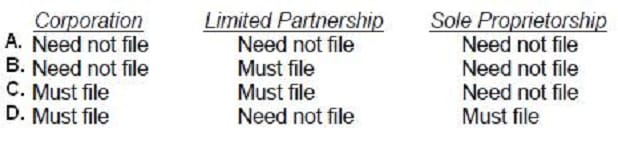

Formation of which of the following types of business does not require the filing of documents with the state?

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 740:

A sole proprietorship would be an ideal form of business to select if:

A. The individual desired no liability beyond his capital investment.

B. The individual wanted to be able sell the business at will.

C. The individual wanted the business to be a separate entity from the sole proprietor.

D. The individual wanted the business to continue indefinitely.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.