Exam Details

Exam Code

:CPA-TESTExam Name

:Certified Public Accountant Test: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, RegulationCertification

:AICPA CertificationsVendor

:AICPATotal Questions

:1241 Q&AsLast Updated

:Jun 30, 2025

AICPA AICPA Certifications CPA-TEST Questions & Answers

-

Question 1121:

The objective of a review of interim financial information of a public entity is to provide an accountant with a basis for reporting whether:

A. A reasonable basis exists for expressing an updated opinion regarding the financial statements that were previously audited.

B. Material modifications should be made to conform with generally accepted accounting principles.

C. The financial statements are presented fairly in accordance with standards of interim reporting.

D. The financial statements are presented fairly in accordance with generally accepted accounting principles.

-

Question 1122:

An independent accountant's report is based on a review of interim financial information. If this report is presented in a registration statement, a prospectus should include a statement clarifying that the:

A. Accountant's review report is not a part of the registration statement within the meaning of the Securities Act of 1933.

B. Accountant assumes no responsibility to update the report for events and circumstances occurring after the date of the report.

C. Accountant's review was performed in accordance with standards established by the Securities and Exchange Commission.

D. Accountant obtained corroborating evidence to determine whether material modifications are needed for such information to conform with GAAP.

-

Question 1123:

In which case would the accountant be least likely to perform a review of interim financial information under PCAOB (auditing) standards?

A. Quarterly reports are required to be filed with the SEC.

B. Selected quarterly financial data is included in an annual report.

C. Quarterly financial data is included in the financial statements of a nonissuer.

D. The accountant is performing an initial audit of financial statements that include selected quarterly data.

-

Question 1124:

Which of the following is not a required procedure in an engagement to review the interim financial information of a publicly held entity?

A. Obtaining corroborating evidence about the entity's ability to continue as a going concern.

B. Comparing disaggregated revenue data for the current interim period with that of comparable prior periods.

C. Obtaining evidence that the interim financial information reconciles with the accounting records.

D. Inquiring of management about their knowledge of fraud or suspected fraud.

-

Question 1125:

The annual financial statements of a publicly held company have been audited, and its interim financial statements have been reviewed. Which of the following is true about the application of professional standards to this review?

A. PCAOB standards apply.

B. Statements on Standards for Accounting and Review Services apply.

C. Both PCAOB standards and SSARS apply.

D. None of the above.

-

Question 1126:

Davidson, CPA, is performing a review under auditing standards of Gold's interim financial information. As part of planning, Davidson reads the audit documentation from the preceding year's annual audit. Which of the following is least likely to affect Davidson's review?

A. A summary of both corrected and uncorrected misstatements.

B. Identified risks of material misstatement due to fraud.

C. Significant weaknesses in internal control.

D. Scope limitations that were overcome through acceptable alternative procedures.

-

Question 1127:

Silver, CPA, has been hired by ABC Co., a publicly held company, to conduct a review of its interim financial information. While performing review procedures, Silver becomes aware of a significant change in the control activities at one of ABC's branch locations. Which of the following might Silver consider performing in response to this situation?

A. Making additional inquiries, such as whether management has monitored the changes and considered whether they were operating as intended.

B. Employing analytical procedures with a less precise expectation.

C. Both "a" and "b" above.

D. Neither "a" nor "b" above.

-

Question 1128:

Clark, CPA, compiled and properly reported on the financial statements of ABC Co., a nonissuer, for the year ended March 31, 20X1. These financial statements omitted substantially all disclosures required by generally accepted accounting principles (GAAP). ABC asked Clark to compile the statements for the year ended March 31, 20X2, and to include all GAAP disclosures for the 20X2 statements only, but otherwise present both years' financial statements in comparative form. What is Clark's responsibility concerning the proposed engagement?

A. Clark may not report on the comparative financial statements because the 20X1 statements are not comparable to the 20X2 statements that include the GAAP disclosures.

B. Clark may report on the comparative financial statements provided the 20X1 statements do not contain any obvious material misstatements.

C. Clark may report on the comparative financial statements provided an explanatory paragraph is added to Clark's report on the comparative financial statements.

D. Clark may report on the comparative financial statements provided Clark updates the report on the 20X1 statements that do not include the GAAP disclosures.

-

Question 1129:

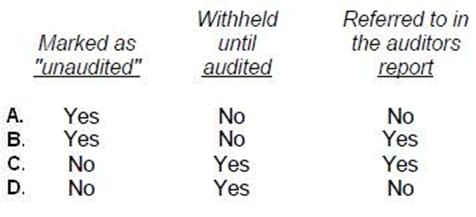

When unaudited financial statements are presented in comparative form with audited financial statements in a document filed with the Securities and Exchange Commission, such statements should be:

A. Option A

B. Option B

C. Option C

D. Option D

-

Question 1130:

When unaudited financial statements of a nonissuer are presented in comparative form with audited financial statements in the subsequent year, the unaudited financial statements should be clearly marked to indicate their status and:

I. The report on the unaudited financial statements should be reissued.

II.

The report on the audited financial statements should include a separate paragraph describing the responsibility assumed for the unaudited financial statements.

A.

I only.

B.

II only.

C.

Both I and II.

D.

Either I or II.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AICPA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPA-TEST exam preparations and AICPA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.