Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:Jun 04, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1541:

Given the following spot and forward rates, how much should an investor pay for a 3-year, annual zero-coupon bond with a face value of $1,000? The investor should pay approximately:

A. $720.

B. $724.

C. $884.

D. $886.

-

Question 1542:

Tony Ly is a Treasury Manager with Deeter Holdings, a large consumer products holding company. The

Assistant Treasurer has asked Ly to calculate the current yield (CY) and the Yield-to-first Call (YTC) on a

bond the company holds that has the following characteristics:

If Ly calculates correctly, the CY and YTC are approximately:

A. 7.80% and 15.82%, respectively.

B. 7.78% and 15.72%, respectively.

C. 3.89% and 15.72%, respectively.

D. 7.78% and 15.82%, respectively.

-

Question 1543:

Which of the following statements about refunding and redemption is TRUE?

A. A sinking fund is an example of refunding.

B. An investor concerned about premature redemption is indifferent between a noncallable bond and a nonrefundable bond.

C. Callable bonds redeemed at a special redemption price are redeemed at par.

D. A nonrefundable bond can be redeemed with funds from operations, from a new equity issue, or from a lower coupon issue.

-

Question 1544:

Simone Girau holds a callable bond and Chi Rigazio holds a putable bond. Which of the following statements about the two investors is TRUE?

A. As the yield volatility increases, the value of both Girau's bond and the underlying option increases.

B. Both investors calculate the value of the bond held by adding the value of the option to the value of a similar straight bond.

C. Girau's bond has less potential for price appreciation.

D. If yield volatility increases, the value of Rigazio's option will decrease.

-

Question 1545:

Kelly Windsor and Joe Agosti, expatriates working in Yemen, are studying for the Level 1 CFA examination. This week, they are focused on new concepts in the asset valuation material. While sitting on his balcony overlooking the desert, Agosti creates the following true/false question to test Windsor's knowledge of dollar-weighted and time-weighted returns. Which of the following statements did he make FALSE?

A. If a client adds funds to an investment during an unfavorable market, the time-weighted return will be lower than actual.

B. The dollar-weighted return applies the concept of internal rate of return (IRR) to investment portfolios.

C. The time-weighted return measures the compound rate of growth of $1 over a stated time period.

D. If the investment period is greater than one year, an analyst must use the geometric mean approach when using the time-weighted return method.

-

Question 1546:

Which bond has the greatest price volatility? A

A. 10% coupon bond with a 20-year life.

B. 5% coupon bond with a 20-year life.

C. 5% coupon bond with a 10-year life.

D. 10% coupon bond with a 10-year life.

-

Question 1547:

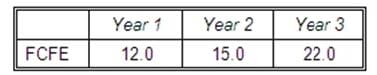

Using the information below, value the stock of Meerkat Publishing, Inc. using the free cash flow from equity (FCFE) valuation method.

Which of the following choices is closest to the correct answer? The per share value of Meerkat Publishing is:

A. $31.52.

B. $45.39.

C. $32.86.

D. $24.06.

-

Question 1548:

Myra Addison, Luz Bazo, and Erik Jenss, three equity traders, are having a quick lunch around the corner from the exchange. Bazo's cell phone beeps, letting him know that he has a text message. He reads the message, then quietly tells Addison and Jenss that Badger Distributors, Inc. has just won exclusive rights to supply all major league baseball parks with uniforms for hot dog/soda vendors. Bazo stands up, gathers his unfinished lunch, and announces, "I'm going back to the exchange to trade." Jenss calmly eats his sandwich and says, "There's plenty of time to trade." Addison shakes her head and mutters, "It's too late already." Based on their reactions to the news on Badger Distributors, which statement best identifies the trading view of these three traders?

A. Addison uses fundamental analysis, Bazo is a technician, and Jenss supports the efficient market hypothesis.

B. Addison and Jenss both use fundamental analysis and Bazo is a technician.

C. Addison and Jenss both use fundamental analysis and Bazo supports the efficient market hypothesis.

D. Addison supports the efficient market hypothesis, Bazo uses fundamental analysis, and Jenss is a technician.

-

Question 1549:

Which of the following statements about contrary-opinion and smart money technicians is INCORRECT?

A. When margin balances in brokerages accounts increase, contrary-opinion technicians are bearish.

B. The investment advisory ratio is at 0.65. Contrary-opinion technicians are bullish.

C. The OTC volume is less than 87% of the NYSE volume. Investors are bearish.

D. A narrowing of the T-bill - Eurodollar futures spread is a signal for a smart-money technician to buy.

-

Question 1550:

Which of the following statements about contrary-opinion and smart money technicians is CORRECT?

A. A contrary-opinion technician is bearish when the specialist short sale ratio falls below 30%.

B. A smart-money technician buys when futures traders are bullish on stock index futures.

C. When investor credit balances are falling, contrary-opinion technicians are bearish.

D. A smart-money technician takes a bullish position when the yield spread on high quality versus lower-quality bonds increases from 75 basis points to 150 basis points.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.