Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:Jun 04, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1561:

The management of Strings and All, Inc., a small, highly leveraged, electric guitar manufacturer, wants to reduce the company's degree of total leverage (DTL) to 2.0. Currently, the company's expected operating performance is as follows:

To obtain a DTL of 2.0, management must (all else constant):

A. increase variable expenses by 30%.

B. reduce variable expenses by 38.5%.

C. reduce variable expenses by 30%.

D. increase variable expenses by 38.5%.

-

Question 1562:

While studying for the Level 1 CFA examination, Leonard Hart draws the following graph of a firm's capital structure. Using his graph and the assumptions below, determine which of the following statements A through D below is FALSE.

A. The value for X is $90 million.

B. The weighted average cost of capital (WACC) of 10.00% uses retained earnings, the WACC of 12.25% uses common stock.

C. The firm should use this graph to adjust projects for risk.

D. As the firm needs to raise more and more capital, the weighted average cost of capital (WACC) will remain lower than the marginal cost of capital.

-

Question 1563:

All of the following comments about the capital budget post auditing process are correct EXCEPT:

A. After the initial capital budgeting decision is made, the company should follow up and compare the actual results to the projected results.

B. The project managers should explain large variances (projection versus actual).

C. The function of the post audit includes improving forecasting and operations.

D. One of the purposes of the post-audit process is to limit risky projects.

-

Question 1564:

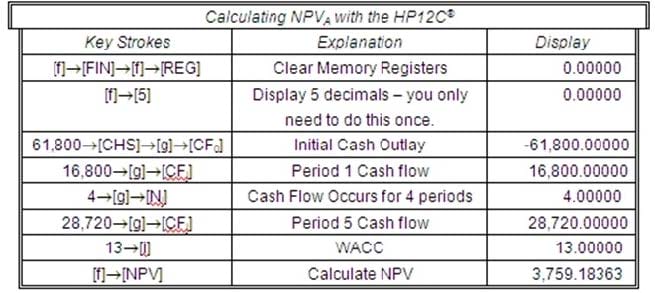

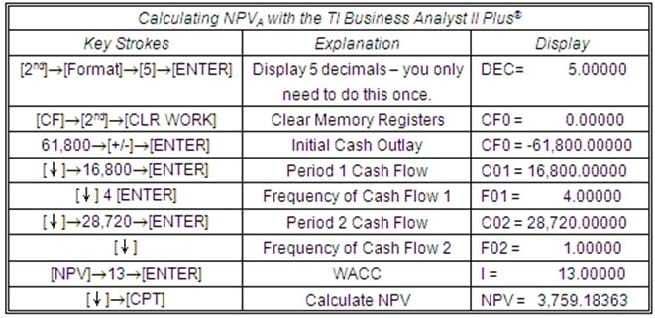

Erwin DeLavall, the Plant Manager of Patch Grove Cabinets, is trying to decide whether or not to replace

the old manual lathe machine with a new computerized lathe. He thinks the new machine will add value,

but is not sure how to quantify his opinion. He asks his colleague, Terri Wharten, for advice. Wharten`s son

just happens to be a Level 2 CFA candidate. DeLavall and Wharten provide the following information to

Wharten's son:

Company Assumptions:

New Machine Assumptions:

Which of the following choices is most correct? Patch Grove Cabinets should:

A. not replace the old lathe with the new lathe because the new one will decrease the firm's value by $5,370.

B. replace the old lathe with the new lathe because the new one will add $10,316 to the firm's value.

C. not replace the old lathe with the new lathe because the new one will decrease the firm's value by $3,132.

D. replace the old lathe with the new lathe because the new one will add $3,760 to the firm's value.

-

Question 1565:

Thomas Otto is an associate in the strategic consulting group for a medium-sized manufacturing company.

Historically, the firm has financed projects using internal equity funds. The company is approaching the

retained earnings break-even point, and the group's Executive Vice President asks Otto to determine the

change in the weighted average cost of capital (WACC) if the firm uses external equity funds instead of

internal funds. An analyst in the group provides the following information:

And, the firm's investment bank provides the following projections for a new common stock issue:

Which of the following choices best completes the following sentence? Using this information, Otto reports

that the WACC will:

A. increase by 1.82%.

B. increase by 1.66%.

C. decrease by 1.66%.

D. remain the same.

-

Question 1566:

Leveraged buyout financing is used by management to:

A. take a private firm public.

B. buy additional product lines.

C. develop new lines to revitalize the firm.

D. take a public firm private.

-

Question 1567:

Tony Nguyen works in the investor relations department of a medium sized technology firm. He recently received the following e-mail: "I am an investor concerned with agency problems between managers and stockholders. What assurance do I have that the company works to align the interests of these two groups?" Which of the following actions that the firm has taken does NOT address the e-mail's concerns?

A. Every employee receives performance shares and cash bonuses, based on his or her position and company earnings per share results.

B. The company recently expanded its executive stock-option program to include middle-level managers.

C. The company recently adopted a shareholder rights plan that allows existing shareholders favorable terms over outside parties. The plan is triggered if a person or group acquires beneficial ownership of 10 percent or more of the company's common stock.

D. The board has a reputation for aggressively monitoring current management and is quick to remove poor-performing managers.

-

Question 1568:

You have a 1 year, 10% semi annual coupon bond with a price of $975. If the 6 month T-Bill rate is 6%, what is the one year theoretical spot rate?

A. 7.4%

B. 8.7%

C. 9.9%

D. 12.8%

-

Question 1569:

The six-year spot rate is 7% and the five-year spot rate is 6%. What is the implied one-year zerocoupon bond rate five years from now?

A. 5%

B. 6.5%

C. 7%

D. 12%

-

Question 1570:

Which of the following definitions about appraisal is false?

A. The cost approach to valuation is based on what it would cost to rebuild the property at today's prices.

B. The comparative sales approach to valuation is based on the sales price of properties that are similar to the subject property.

C. The income approach to valuation projects the property's value as the present value of its future annual after-tax net operating income.

D. The `capitalization rate' equals the required rate of return minus the growth rate.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.