Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:Jun 04, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1531:

Given the following information about a manufacturing firm, determine the optimal capital structure. The optimal capital structure for this firm is:

A. 10% Debt, 90% Equity.

B. 25% Debt, 40% Equity.

C. 40% Debt, 60% Equity.

D. 50% Debt, 50% Equity.

-

Question 1532:

Using the following assumptions, calculate the stock price at which investors Helen Alba, who shorts the stock on margin, and Kobin Lubis, who purchases the stock on margin, will receive a margin call. Which of the following choices is closest to the correct answer? Alba will receive a margin call at a stock price of:

A. $33.00 and Lubis will receive a margin call at a stock price of $37.66.

B. $33.00 and Lubis will receive a margin call at a stock price of $53.45.

C. $46.85 and Lubis will receive a margin call at a stock price of $33.00.

D. $37.66 and Lubis will receive a margin call at a stock price of $53.45.

-

Question 1533:

Which of the following statements about dividend policy and capital structure is TRUE?

A. A person who believes in the clientele effect and a proponent of the "bird-in-hand" theory would have similar views on dividend payout policy.

B. Investors view a stock repurchase as a positive signal and a stock issue as a negative signal.

C. A diversified shareholder is most concerned with stand-alone risk.

D. Monte Carlo simulation is used to estimate market risks; scenario analysis measures stand-alone risk.

-

Question 1534:

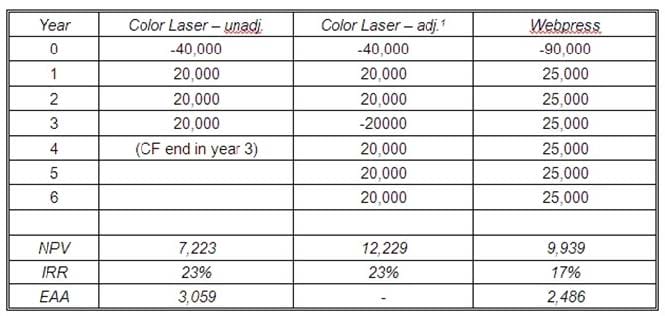

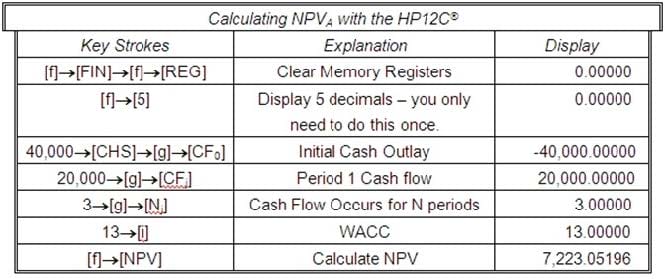

KGraphix, a small, privately owned publishing company, plans to upgrade its printing process by

purchasing either a high-speed color laser printer or a webpress (a high speed color printing machine).

Incremental cash flow information for each piece of equipment is as follows:

Assuming that the company's weighted average cost of capital (WACC) is 13 percent, which of the

following statements is most correct? KGraphix should purchase the:

A. webpress because its net present value (NPV) of $9,939 is greater than the color laser printer's NPV of $7,223.

B. color laser printer because its Internal rate of return (IRR) is higher than that of the webpress.

C. color laser printer because it has the highest equivalent annual annuity.

D. webpress because it has the longest life and the highest net present value (NPV).

-

Question 1535:

Norine Benson is studying for the Level 1 CFA examination and is having difficulty with the broader concepts of capital budgeting. Her study partner, Henri Manz, tests her understanding by asking her to identify which of the following statements is TRUE?

A. For mutually exclusive projects, the decision rule is to pick the project that has the highest net present value (NPV).

B. If the change in current liabilities is greater than the change in current assets, it means that additional financing was needed and there is a cash outflow.

C. An analyst can ignore inflation since price level expectations are built into the weighted average cost of capital (WACC).

D. Replacement decisions involve mutually exclusive projects.

-

Question 1536:

Which of the following statements about the cost of capital is TRUE?

A. New common equity used to finance projects is usually dilutive.

B. The component cost of retained earnings equals the required rate of return on new stock.

C. Using the marginal cost of capital (MCC) is superior to the weighted average cost of capital (WACC) because the MCC assumes different risks across projects.

D. A firm can shift its retained earnings breakpoint by changing the dividend policy.

-

Question 1537:

Calculate the weighted average cost of capital (WACC) for a company with the following capital component

information:

The firm can issue new common stock with a price of $40.00, floatation costs of 3.0%, and a dividend in

year 0 of D0= $3.00.

Which of the following is closest to the correct answer? The WACC equals:

A. 9.82%.

B. 9.49%.

C. 9.05%.

D. 10.05%.

-

Question 1538:

Which of the following statements about agency theory is TRUE?

A. A company that pays fixed salaries with no variable compensation schemes likely has little agency conflict.

B. An agency relationship is created when the board of directors appoints a new Chief Financial Officer.

C. Restrictive debt covenants reduce the conflict between stockholders and managers.

D. Encouraging managers to take on high-risk projects aligns their goals with that of bondholders.

-

Question 1539:

Kep Polznik is a financial consultant to an entrepreneur who owns a chain of check-cashing establishments (individuals who meet certain criteria can cash post-dated checks and then repay the money at a later date). The company's Treasurer is considering using plain vanilla swaps. Which of the following statements should Polznik NOT use to sell the Treasurer on the use of interest rate swaps?

A. The Treasurer can use swaps to exploit market inefficiencies.

B. The swap market's operational efficiency results in reduced transaction costs.

C. Swap agreements allow companies a more flexible way to package cash flows.

D. By using swaps, the Treasurer can maintain the confidentiality of business strategy.

-

Question 1540:

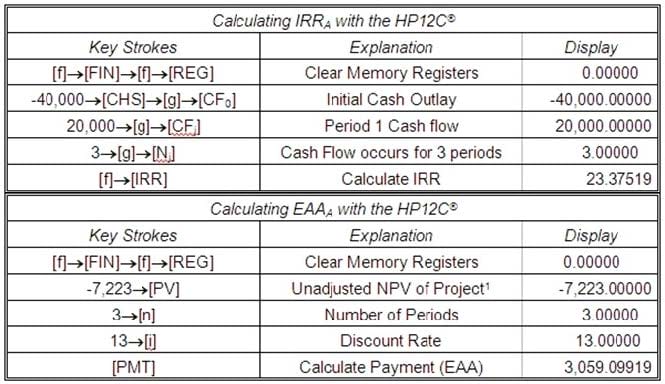

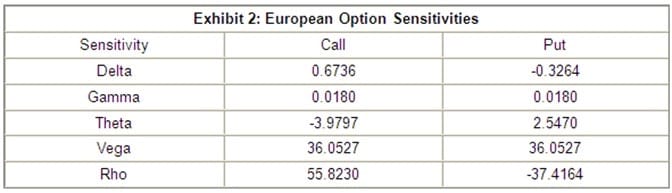

Joel Franklin, CFA, has just been promoted to junior portfolio manager for a large equity portfolio at Davidson-Sherman (DS), a large multinational investment banking firm. He is specifically responsible for the development of a new investment strategy that DS wants all equity portfolios to implement. DS has decided to begin overlaying option strategies on all equity portfolios. The reason for this decision is the relatively poor performance of many of their equity portfolios. They look at the option strategies as an opportunity to add value or reduce risk. Franklin recognizes that the behavior of an options value is dependent on many variables and decides to spend information shown in Exhibit's 1 and 2 for European style options.

Joel recognizes that his software only includes the valuation information for European style options. He wants to know how the premium of an American style option compares with its European counterpart. Which of the following is TRUE? The premium of the American option:

A. the same or lower.

B. strictly higher.

C. the same or higher.

D. strictly lower.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.