Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:Jun 04, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1551:

An analyst just received the following information for Mythical Interactions, Inc. A senior equity trader in her

group wants to know if he should purchase a large block of the stock.

Based on the assumptions above, which of the following recommendations is CORRECT? The analyst

should advise the trader to:

A. not purchase the stock. It is overvalued by approximately $10.00.

B. purchase the stock. It is undervalued by approximately $8.00.

C. purchase the stock. It is undervalued by approximately $14.20.

D. not purchase the stock. It is overvalued by approximately $14.20.

-

Question 1552:

Which of the following statements about asset valuation is FALSE?

A. The price to book value ratio can be used to value firms with negative cash flows.

B. Economic value added (EVA? measures the economic profit generated per dollar of invested capital.

C. When estimating the profit margin of a company, the higher the export/import level, the higher the competition.

D. The purpose of top-down stock analysis is to determine the best company within the best performing industry.

-

Question 1553:

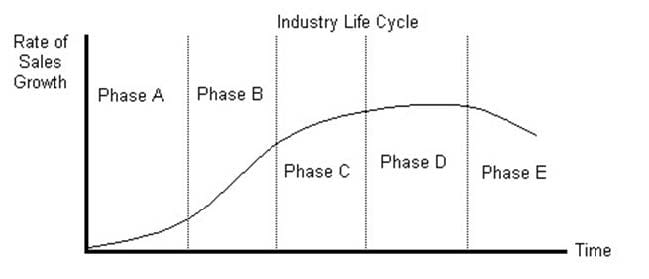

Following is a graph of the Industry Life Cycle with the names of the phases omitted.

Using the graph above, which of the following choices is INCORRECT?

A. The return on equity (ROE) on new projects is likely greater than ke for firms in Phase B.

B. The infinite period dividend discount model (DDM) works well for valuing firms in Phases C and D.

C. In general, profit margins are lower in Phase A than in Phase B.

D. For most companies, Phase C lasts the longest.

-

Question 1554:

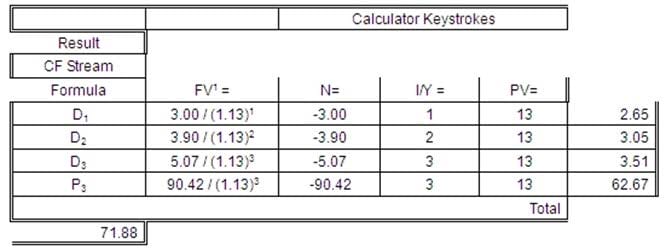

Marc Juneau, equity analyst, has just been assigned the task of valuing Avalon Games, Inc. The company is expected to grow at 30 percent for the next two years. Beginning in the year 4, the growth rate is expected to reach seven percent and stabilize. The required return for this type of company in the non-electronic games sector is estimated at 13 percent. The dividend in year 1 is estimated at $3.00. Which of the following is closest to the value Juneau should calculate for the stock of Avalon Games?

A. $71.88.

B. $64.68.

C. $73.01.

D. $45.41.

-

Question 1555:

Kaylee Sumners, Level 1 CFA candidate, has just finished reviewing flash cards for the reading on the efficient market hypothesis (EMH). Confused by the different tests for the different forms of the EMH, she outlines the information (of which four summary points appear below) from memory. It appears that Sumners should review the material because three of the points are incorrect. Which of her summary points is CORRECT?

A. Early tests of the semi-strong form used the equation: ReturnAbnormal = ReturnActual - (RMarket * BetaStock).

B. The superior historical performance of exchange specialists and corporate insiders rejects the semi-strong form of the EMH.

C. Cross-sectional tests such as the price-earnings ratio, neglected firms tests, and book value to market value tests support the semi-strong form of the EMH.

D. Statistical and trading rule tests support the weak-form of the EMH.

-

Question 1556:

Which of the following statements about the implications of tests for the efficient market hypothesis (EMH) is FALSE?

A. By purchasing an index fund, an investor can match the market return and minimize costs.

B. Technical trading rules do not consistently provide excess returns after adjusting for trading costs and taxes.

C. Other than corporate insiders and market specialists, most traders have monopolistic access to information, which rejects the strong-form EMH.

D. The best way to measure the performance of investments professionals is against a randomly selected buy-hold strategy of stocks (assuming the same risk level).

-

Question 1557:

The table below lists information on price per share and shares outstanding for three stocks ?Rocking, Payton, and Strand.

Using the information in the table, determine which of the following statements is FALSE?

A. The geometric return is less than 11.7%.

B. If the three stocks comprise an index, a change in Stock Payton would have the biggest impact if the index was market-value weighted.

C. An investor creating a price-weighted index of these three stocks would need to change his holdings at year-end to reflect the price changes.

D. If the three stocks comprise an index, a change in Stock Strand would have the biggest impact if the index was price-weighted.

-

Question 1558:

Which of the following statements about dividend policy and capital structure is FALSE?

A. A company's growth rate equals the retention ratio multiplied by return on equity.

B. Companies should use the residual dividend model to set the long-run target dividend payout ratio, but should not use it to set the dividend payment in any one year.

C. If the board of directors decreases the target payout ratio, the stock price may increase or decrease.

D. Assuming a world of taxes and bankruptcy, there is an optimal capital structure that maximizes earnings per share (EPS) and minimizes the cost of debt.

-

Question 1559:

Using the following assumptions, calculate the rate of return on a margin transaction for an investor who

purchases the stock and the stock price at which the investor who shorts the stock will receive a margin

call.

What of the following choices is closest to the correct answer? The margin transaction return is:

A. -12.00%, and the investor will receive a margin call at a stock price of $16.67.

B. 24.00%, and the investor will receive a margin call at a stock price of $30.00.

C. 48.00%, and the investor will receive a margin call at a stock price of $20.83.

D. -24.00%, and the investor will receive a margin call at a stock price of $30.00.

-

Question 1560:

Which of the following statements about securities markets is FALSE?

A. Characteristics of a well-functioning securities market include: many buyers and sellers willing to trade at below market price, low bid-ask spreads, timely information on price and volume of past transactions, and accurate information on supply and demand.

B. Secondary markets, such as the over-the-counter (OTC) market, provide liquidity and price continuity.

C. A limit buy order and a stop buy order are both placed below the current market price.

D. When Conglomerate, Inc. trades directly with MultiNational, Ltd., it is using the fourth market.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.