Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:Jun 04, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1491:

If you are going to invest in a closed-end mutual fund and were told that the net asset value of the fund is $11.20, and the share price was $11.80. What is the discount you would receive or the premium that you would pay?

A. -0.0508.

B. 0.0508.

C. 0.0536.

D. -0.0536.

-

Question 1492:

An individual investor approaches you and asks, "If I were to purchase a fund with a load of 6 percent, and I used $6,200 to purchase the fund, what dollar amount would the shares purchased be?"

A. $6,200.

B. $5,828.

C. $6,572.

D. $372.

-

Question 1493:

The buyer of a call option has the:

A. obligation to sell the underlying asset in the future under certain conditions.

B. right to sell the underlying asset in the future under certain conditions.

C. obligation to buy the underlying asset in the future under certain conditions.

D. right to buy the underlying asset in the future under certain conditions.

-

Question 1494:

A real estate analysis estimates the market value of an income-producing property at $2,560,000. The annual gross potential rental income is $596,000, the annual property operating expanses and taxes are $178,800, and the annual vacancy and collection losses are $89,400. What capitalization rate was used by the analysis to assess the property at $2,560,000.

A. 0.128.

B. 0.1275.

C. 0.129.

D. 0.127.

-

Question 1495:

If a bond has a modified duration of 7 and convexity of 100 and interest rates fall 1 percent, what will happen to the price of the bond?

A. Fall 7.5%.

B. Rise 6.5%.

C. Rise 7.5%.

D. Fall 6.5%.

-

Question 1496:

Calculating the price change in a bond caused by a 1 percent decline in interest rates using only the modified duration equation will always result in an answer that is:

A. too high.

B. just right.

C. too low.

D. insignificant.

-

Question 1497:

Which of the following statements regarding daily cash settlement before contract maturity is TRUE?

A. A futures contract requires daily cash settlement, and a forward contract does not require daily cash settlement.

B. Neither a futures contract nor a forward contract requires cash settlement before contract maturity.

C. A forward contract requires cash settlement and a futures contract does not require cash settlement.

D. Both a futures contract and a forward contract require cash settlement before contract maturity.

-

Question 1498:

Which of the following statements about the positions of the clearinghouse is CORRECT? The clearinghouse:

A. takes no position.

B. only takes short position to buyers.

C. only takes long positions to sellers.

D. takes short positions to buyers and long positions to sellers.

-

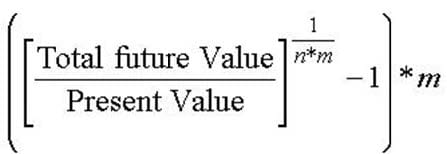

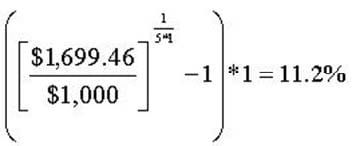

Question 1499:

An investor buys a 15-year, 10 percent annual pay coupon bond for $1,000. He plans to hold the bond for

5 years while reinvesting the coupons at 12 percent. At the end of the 5-year period he feels he can sell

the bond to yield 9 percent.

What is the expected realized (horizon) yield?

A. 10.0%.

B. 11.8%.

C. 11.2%.

D. 12.2%.

-

Question 1500:

All other things being equal, which one of the following bonds has the greatest duration?

A. 15-year, 8% coupon bond.

B. 5-year, 8% coupon bond.

C. 15-year, 12% coupon bond.

D. 5-year, 12% coupon bond.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.