Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1501:

Given the following assumptions about a companyfinancial estimates, calculate the P/E ratio, and

determine whether the stock is undervalued or overvalued.

Which of the following statements is most correct? The P/E ratio is:

A. 7.41 and the stock is overpriced.

B. 7.41 and the stock is underpriced.

C. 6.78 and the stock is overpriced.

D. 6.78 and the stock is underpriced.

-

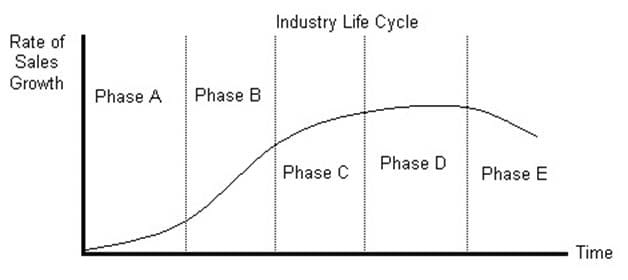

Question 1502:

Following is a graph of the Industry Life Cycle with the names of the phases omitted.

Using the graph above, which of the following choices is CORRECT?

A. To value a firm in Phase B, an analyst should use the infinite period dividend discount model (DDM).

B. Competition most likely intensifies in Phase B.

C. During Phase E, industry growth rates approach that of the economy.

D. The P/E ratio for a company in Phase D is approximated by 1/ke.

-

Question 1503:

Which of the following choices is NOT a characteristic of an efficient market?

A. Market participants react quickly to news, and these reactions are quickly reflected in prices.

B. A large number of participants value securities independent of other parties.

C. Major news announcements are made on the second Friday of each month.

D. Expected returns implicitly include a risk component.

-

Question 1504:

An investor is considering investing in Tawari Company for one year. He expects to receive $2 in dividends over the year and feels he can sell the stock for $30 at the end of the year. What is the maximum he can pay now to earn at least a 14 percent return on his investment?

A. $28.

B. $29.

C. $30.

D. $32.

-

Question 1505:

Using the one-year holding period and multiple-year holding period dividend discount model (DDM),

calculate the change in value of the stock of Monster Burger Place under the following scenarios. First,

assume that an investor holds the stock for only one year. Second, assume that the investor intends to

hold the stock for two years. Information on the stock is as follows:

The value of the stock if held for one year and the value if held for two years are, respectively:

A. $27.50 and $35.25.

B. $25.22 and $29.80.

C. $27.50 and $29.80.

D. $29.80 and $32.50.

-

Question 1506:

Which of the following statements about bond indexes and international asset indexes is FALSE?

A. Global equity indexes were created to alleviate problems with local indexes (sample selection and weighting).

B. Low correlation among monthly country indexes supports international diversification.

C. Some of the reasons that a bond index is more difficult to create than an equity index are that the universe of bonds is less than the universe of stocks and it is difficult to price the bonds because of the lack of continuous trade data.

D. Investment-grade bond indexes have a higher correlation than high-yield bond indexes.

-

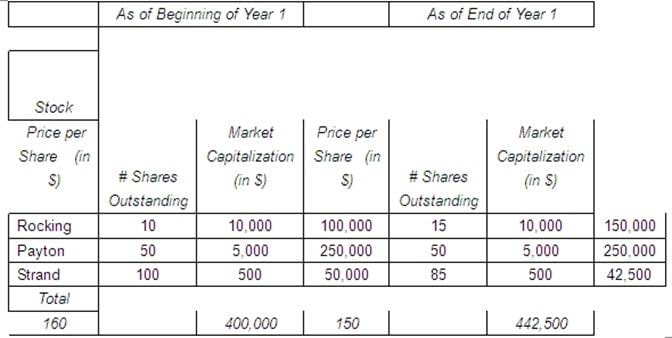

Question 1507:

The table below lists information on price per share and shares outstanding for three stocks ?Rocking, Payton, and Strand.

Using the information in the table, calculate the value of a price-weighted index at year-end and the one-year return on the market weighted index. At the beginning of the year, the value of the market weighted index was 100. (Note: The choices are listed in the order price-weighted index value, market value-weighted index percent return, respectively.) Which of the following choices is closest to the correct answer?

A. 50.0, 10.6.

B. 50.0, 110.6.

C. -6.3, 10.6.

D. -6.3, 8.4.

-

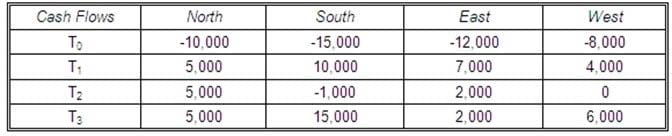

Question 1508:

Which of the following projects would have multiple internal rates of return (IRRs)? The cost of capital for all projects is 10.0%.

A. Project South only.

B. Projects South and West.

C. Project West only.

D. Projects South and East.

-

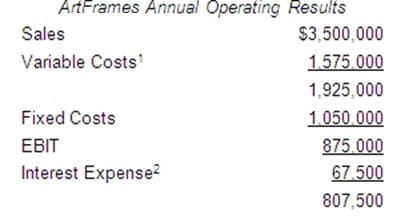

Question 1509:

Given the following information on the annual operating results for ArtFrames, a producer of quality metal

picture frames, calculate the degree of operating leverage (DOL) and the degree of financial leverage

(DFL).

Which of the following choices is closest to the correct answer? ArtFrameDOL and DFL are, respectively:

A. 3.00 and 1.50.

B. 2.20 and 1.06.

C. 2.20 and 1.08.

D. 4.53 and 1.19.

-

Question 1510:

Gerard Rouleau is studying for the Level 2 CFA examination. His friend, Sonia Fennell, is studying for Level 1. One weekday morning they are sitting at the local Cafe drinking espresso when she asks him for help with the section on margin trading. Rouleau creates the following scenario: Assume Fennell purchases 1,000 shares of Xpressoh Inc. for $35 per share. The initial margin requirement is 50 percent and the maintenance margin is 25 percent One year later, she sells the stock for $42 per share. Rouleau asks Fennell to calculate the one-year return under two cases: first, assuming an all-cash transaction,and second, assuming she buys on margin. She is to ignore transaction and borrowing costs. The earnings retention rate is 100%. Which of the following choices is closest to the correct answer? The return on an all cash transaction is:

A. 20.00%, and the return on the margin transaction is 80.00%.

B. 20.00%, and the return on the margin transaction is 40.00%.

C. 40.00%, and the return on the margin transaction is 80.00%.

D. 20.00%, and the return on the margin transaction is -40.00%.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.