Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:May 27, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1481:

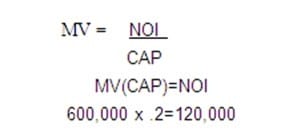

Dana Leone, Level 2 candidate in the CFA Program, is a manager in the capital planning division of a large consumer products company. Today, she must decide whether to recommend Project Forrest or Project Trieste to the Division Director. Leone's assistant has determined the following information about the projects (which are of approximately the same size and life):

Note:NPV = Net Present Value MIRR = Modified Internal Rate of Return PBP = Pay Back Period WACC = Weighted Average Cost of Capital Based on the information in the above table, which of the following statements is FALSE? If company management is most concerned with:

A. increasing the value of the firm, Leone should recommend Project Forrest.

B. liquidity, Leone should recommend Project Trieste.

C. return safety margin, Leone should recommend Project Forrest.

D. shareholder interests, Leone should recommend Project Trieste.

-

Question 1482:

Jacobi Lefebre, CFA, recently accepted a position in the Real Estate Strategy group of a large retail company. The Director of the group walks by Lefebre's cubicle, hands him a report with the following information, and asks Lefebre to determine how large a project the firm can undertake without increasing the marginal cost of capital. The firm can undertake a project costing up to approximately:

A. $54 million.

B. $81 million.

C. $83 million.

D. $29 million.

-

Question 1483:

Helmut Humm, manager at a large U.S. firm, has just been assigned to the capital budgeting area to replace a person who left suddenly. One of Humm's first tasks is to calculate the company's weighted average cost of capital (WACC) ?and fast! The CEO is scheduled to present to the board in half an hour and needs the WACC ?now! Luckily, Humm finds clear notes on the Target capital component weights in the current workpapers. Unfortunately, all he can find for the cost of capital components is some handwritten notes. He can make out the numbers, but not the corresponding capital component. As time runs out, he has to guess. Here is what Humm deciphered: If Humm guesses correctly, the WACC is:

A. 10.1%.

B. 10.4%.

C. 9.7%.

D. 11.0%.

-

Question 1484:

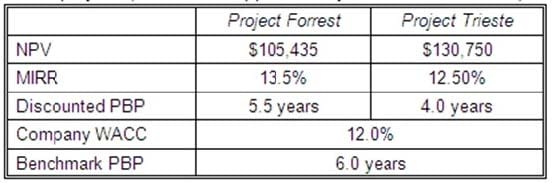

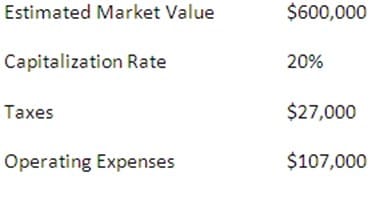

Based upon the following information, what is the net operating income of the property?

A. $104,000.

B. $98,600.

C. $114,600.

D. $120,000.

-

Question 1485:

What is the net operating income (NOI) of this property?

A. $113,124.

B. $108,599.

C. $92,886.

D. $97,410.

-

Question 1486:

What are the earnings before interest and taxes (EBIT) of the building?

A. $79,563.

B. $52,919.

C. $95,277.

D. $59,580.

-

Question 1487:

What are the earnings before taxes (EBT)?

A. $52,919.

B. $66,241.

C. $62,629.

D. $59,580.

-

Question 1488:

What is the building's net income?

A. $42,646.

B. $49,307.

C. $35,985.

D. $29,324.

-

Question 1489:

What is the after tax cash flow of the investment?

A. $52,919.

B. $35,985.

C. $26,275.

D. $42,646.

-

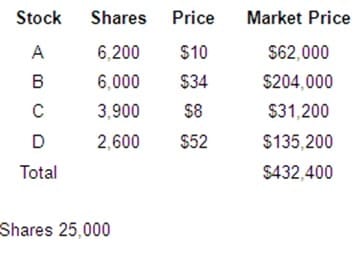

Question 1490:

The net asset value (NAV) of this fund would be:

A. $17.30.

B. $26.00.

C. $23.12.

D. $15.80.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.