Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:Jun 04, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1511:

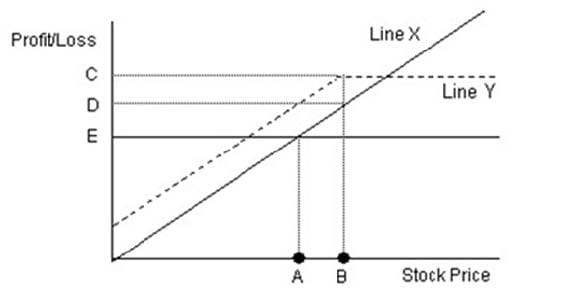

Collete Minogue holds stock in Bracken Entertainment. Although many of her associates still believe that Bracken will be a high-performing stock, Minogue has lost faith and wants to conduct a covered call transaction. Current market conditions are as follows: In assessing whether she should conduct the covered call strategy, Minogue sketches out the following graph. Although her sketch is correct, she cannot remember all the labels.

Which of the following statements about the graph and the covered call strategy is INCORRECT?

A. If Minogue goes ahead with the covered call, she will limit her gain to $11.

B. The distance between points C and D is $5.

C. The call writer will have unlimited upside potential.

D. Line Y represents the covered call's profit line.

-

Question 1512:

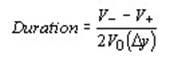

Consider an annual coupon bond with the following characteristics: For a 75 basis point change in interest rates, the bond's duration is:

A. 8.17 years.

B. 5.09 years.

C. 8.79 years.

D. 5.80 years.

-

Question 1513:

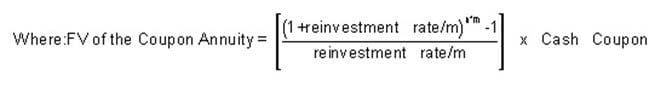

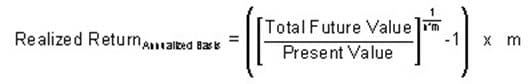

Four years ago, at the advice of J.T. Lindseth, her financial planner, T.J. Ali purchased a $1,000 face, 5.70 percent, semi-annual coupon bond with four years to maturity priced to yield 8.50 percent for $906.70. Now, the bond has matured, and Lindseth calls Ali and informs her that because he had invested the coupons at an annual rate of 10.0 percent, her realized return was approximately:

A. 8.65%.

B. 8.50%.

C. 10.00%.

D. 8.35%.

-

Question 1514:

Kwagmyre Investments, Ltd., hold two bonds: a callable bond issued by Mudd Manufacturing Inc. and a putable bond issued by Precarious Builders. Both bonds have option adjusted spreads (OAS) of 135 basis points (bp). Kevin Grisly, a junior analyst at the firm, makes the following statements (each statement is independent). Apparently, Grisly could benefit from a CFA review course, because the only statement that could be CORRECT is:

A. Given a nominal spread for Precarious Builders of 110 bp, the option cost is -25 bp.

B. The cost of the call option on the Mudd bond is -15bp.

C. The Z-spread for Mudd's bond is based on the YTM.

D. The spread over the spot rates for a Treasury security similar to Mudd's bond is 145 bp.

-

Question 1515:

Scott Malooly recently paid $109.05 for a $1000 face value, semi-annual coupon bond with a quoted price of 105 6/32. Assuming that transaction costs are zero, which of the following statements is TRUE?

A. Malooly purchased the bond between coupon dates.

B. The price Malooly paid covers the amount of the next coupon payment not earned by the seller.

C. The bond was trading ex-coupon.

D. The price Malooly paid includes the discounted amount of accrued interest due to seller.

-

Question 1516:

A 12-year, $1,000 face value zero-coupon bond is priced to yield a return of 7.00 percent on a semi-annual basis. What is the price of the bond, and how much interest will the bond pay over its life, respectively? (Select the choice that is closest to the correct answer.)

A. $562, $438.

B. $444, $556.

C. $840, $160.

D. $438, $562.

-

Question 1517:

Assume an investor makes the following investments:

During year one, the stock paid a $5.00 per share dividend. In year two, the stock paid a $7.50 per share

dividend.

The time-weighted return is:

A. 51.4%.

B. 51.7%.

C. 23.2%.

D. 14.7%.

-

Question 1518:

A bond has a yield of 10 percent and an effective duration of 7.5 years. If the market yield changes by 10 basis points, what is the change in the bond's price?

A. 0.375%.

B. 1.500%.

C. 2.000%.

D. 0.750%.

-

Question 1519:

Jay Crewson, equity analyst at a large investment bank, formerly worked with a group of contrary-opinion

technician traders who traded exclusively using contrary indicators. He was recently transferred to support

a group of smart-money technicians. Since he is still adjusting to the "new" rules, he asks Richard Ruscoe,

another analyst in the group, to review his work. Ruscoe reviews Crewson's latest recommendation list and

points out that one of the statements is incorrect.

Which of the following is the INCORRECT statement? Buy:

A. debit balances in brokerage accounts increased.

B. the ratio of short sales by specialists to total NYSE short sales fell below 0.30.

C. investor credit balances in brokerage accounts increased.

D. the yield-differential between high quality and lower-quality bonds decreased to 90 basis points.

-

Question 1520:

Mikal Cosce uses technical analysis to determine his trading behavior. Cosce would be least likely to agree with which of the following statements?

A. He supports the weak form of the efficient market hypothesis.

B. Stock prices move in trends, and these trends persist.

C. Technical analysis tells him when to buy.

D. He does not have to rely on accounting information.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.