Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:May 27, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1461:

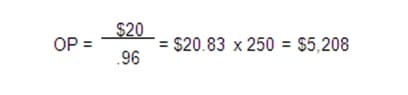

A mutual fund has a load of 4 percent and a net asset value (NAV) of $20 per share. What must an investor pay to purchase 250 shares?

A. $5,200.

B. $4,800.

C. $5,013.

D. $5,208.

-

Question 1462:

Rollins Corporation is constructing its MCC schedule. Its target capital structure is 20 percent debt, 20 percent preferred stock, and 60 percent common equity. Its bonds have a 12 percent coupon, paid semiannually, a current maturity of 20 years, and sell for $1,000. The firm could sell, at par, $100 preferred stock, which pays a 12 percent annual dividend, but flotation costs of 5 percent would be incurred. Rollins' beta is 1.2, the risk-free rate is 10 percent, and the market risk premium is 5 percent. Rollins is a constant growth firm, which just paid a dividend of $2.00, sells for $27.00 per share, and has a growth rate of 8 percent. The firm's policy is to use a risk premium of 4 percentage points when using the bond- yield-plusrisk-premium method to find k(s) (component cost of retained earnings). The firm's net income is expected to be $1 million, and its dividend payout ratio is 40 percent. Flotation costs on new common stock total 10 percent, and the firm's marginal tax rate is 40 percent. What is Rollins' cost of preferred stock?

A. 12.6%

B. 13.2%

C. 11.0%

D. 12.0%

E. 10.0%

-

Question 1463:

A trader has a long position in a wheat contract.

What is the price at which the trader will receive a maintenance margin call?

A. $1.90.

B. $2.05.

C. $2.25.

D. $1.75.

-

Question 1464:

Which of the following statements is TRUE about the profits and losses from buying a put:

A. potential losses are limited to the initial premium the buyer pays when he buys the put.

B. potential profits are theoretically unlimited.

C. potential losses are theoretically unlimited.

D. none of these choices are correct.

-

Question 1465:

XYZ company has entered into a "plain-vanilla" interest rate swap on $1,000,000 notional principal. XYZ company pays a fixed rate of 8 percent on payments that occur at 90-day intervals. Six payments remain with the next one due in exactly 90 days. On the other side of the swap, XYZ company receives payments based on the LIBOR rate. Describe the transaction between XYZ company and the dealer at the end of the sixth period if the appropriate LIBOR rate is 5 percent.

A. XYZ company receives $12,500.

B. Dealer pays XYZ company $7,500.

C. Dealer receives $20,000.

D. XYZ company pays dealer $7,500.

-

Question 1466:

What is the bond's yield to call (YTC)?

A. 10.05%.

B. 9.26%.

C. 10.34%.

D. 10.55%.

-

Question 1467:

What is the bond's yield to maturity (YTM)?

A. 9.26%.

B. 10.34%.

C. 10.05%.

D. 10.55%.

-

Question 1468:

What rate should be used to estimate the potential return on this bond?

A. the YTM.

B. 12.00%.

C. 10.34%.

D. the YTC.

-

Question 1469:

An investor buys a 25-year, 10 percent annual pay bond for $900 planning to sell the bond in 5 years when he estimates yields will be 9 percent. What is the estimate of the future price of this bond?

A. $964.

B. $1,000.

C. $1,122.

D. $1,091.

-

Question 1470:

Duration of a bond normally increases with an increase in:

A. time to maturity.

B. coupon rate.

C. yield to maturity.

D. par value.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.