Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:May 27, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1451:

Photon Corporation has a target capital structure of 60 percent equity and 40 percent debt. The firm can raise an unlimited amount of debt at a before-tax cost of 9 percent. The company expects to retain earnings of $300,000 in the coming year and to face a tax rate of 35 percent. The last dividend was $2 per share and the growth rate of the company is constant at 6 percent. If the company needs to issue new equity, then the flotation cost will be $5 per share. The current stock price is $30. Photon has the following investment opportunities: Project Cost IRR 1 $100,000 10.5% 2 $200,000 13.0 3 $100,000 12.0 4 $150,000 14.0 5 $75,000 9.0

A. $150,000

B. $450,000

C. $350,000

D. $550,000

E. $625,000

-

Question 1452:

Monte Carlo simulation

A. All of the answers are correct.

B. Is capable of using probability distributions for variables as input data instead of a single numerical estimate for each variable.

C. Produces both an expected NPV (or IRR) and a measure of the riskiness of the NPV or IRR.

D. None of the answers are correct.

E. Can be useful for estimating a project's stand-alone risk.

-

Question 1453:

Proponents of which of the following theories would claim that companies seek to balance the tax shelter benefits of debt financing with the increased interest rates and risk of bankruptcy that come with increased debt levels?

A. Modigliani and Miller's "with-taxes" Theory of Capital Structure

B. Bird-in-the-Hand Theory

C. Modigliani and Miller's Theory of Capital Structure

D. Tax Preference Theory

E. Signaling Theory

F. Trade-off Theory of Leverage

-

Question 1454:

Despite relative congruence in their ranking methods, NPV and MIRR will sometimes produce conflicting answers. Which of the following correctly illustrates an example in which the two methods would likely produce conflicting rankings?

I. When examining projects with non-normal cash flows

II. When examining projects that differ substantially in scale

III. When examining independent projects

IV.

When examining projects that differ substantially in their lifespan

A.

I and III

B.

I and II

C.

II and IV

D.

II and IV

-

Question 1455:

If a new option contract is listed on an option exchange and only one trader buys one contract in the first day, the open interest after that day is:

A. two contract.

B. zero contract.

C. cannot be determined with this information.

D. one contract.

-

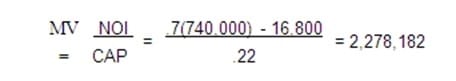

Question 1456:

A property has a potential gross rental income (PGRI) of $740,000. Operating expenses, excluding insurance and property taxes, amount to 30 percent of gross rents. Insurance and property taxes total $16,800. If the market capitalization rate is 22 percent, what is the value of this property?

A. $1,726,667.

B. $2,410,667.

C. $2,430,909.

D. $2,278,182.

-

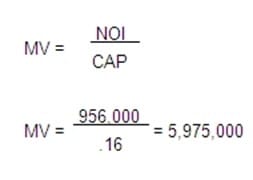

Question 1457:

You need to estimate the market value of an income producing property located in your town. Through research you have found that the property should have net operating income of $956,000, taxes of $143,400, a capitalization rate of 16 percent, and an inflation rate of 3 percent. What is the estimated property value?

A. $5,078,750.

B. $5,975,000.

C. $7,353,846.

D. $8,456,923.

-

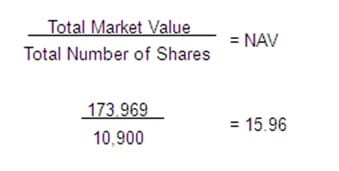

Question 1458:

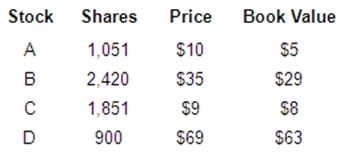

Based on the following information, what is the net asset value (NAV) per share. There are currently no expenses and no load. Cap Stock Sold $109,000 Price per share $10

A. $13.26.

B. $27.03.

C. $15.96.

D. $27.03.

-

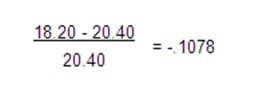

Question 1459:

You are going to invest in a closed-end mutual fund and are told that the net asset value of the fund is $20.40, and the share price is $18.20. What is the discount you would receive or the premium that you would pay?

A. 0.1209.

B. -0.1209.

C. -0.1078.

D. 0.1078.

-

Question 1460:

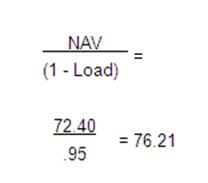

A fund to be purchased had a net asset value (NAV) of $72.40 and a load of 5 percent. What is the offering price per share?

A. $76.211.

B. $3.811.

C. $76.020.

D. $72.400.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.