8008 Exam Details

-

Exam Code

:8008 -

Exam Name

:PRM Certification - Exam III: Risk Management Frameworks, Operational Risk, Credit Risk, Counterparty Risk, Market Risk, ALM, FTP - 2015 Edition -

Certification

:PRMIA Certifications -

Vendor

:PRMIA -

Total Questions

:362 Q&As -

Last Updated

:Jan 10, 2026

PRMIA 8008 Online Questions & Answers

-

Question 1:

Which of the following objectives are targeted by rating agencies when assigning ratings:

I - Ratings accuracy II - Ratings stability III - High accuracy ratio (AR) IV - Ranked ratings

A. II and III

B. III and IV

C. I and II

D. I, II and III -

Question 2:

Which of the following statements are true in relation to the current state of the financial network?

I - Interconnectivity between countries has reduced while that between institutions in the same country has increased significantly II - The degrees of separation between institutions has gone up III - The average path length connecting any two given institutions has shrunk IV - Knife-edge dynamics imply that systemic risk arises from the financial system flipping from risk sharing to risk spreading

A. II and III

B. I and IV

C. III and IV

D. I and II -

Question 3:

What would be the consequences of a model of economic risk capital calculation that weighs all loans equally regardless of the credit rating of the counterparty?

A. Create an incentive to lend to the riskiest borrowers II. Create an incentive to lend to the safest borrowers III. Overstate economic capital requirements IV. Understate economic capital requirements

B. III only

C. I and IV

D. II and III

E. I only -

Question 4:

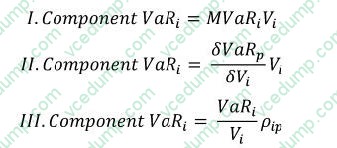

Which of the following formulae correctly describes Component VaR. (p refers to the portfolio, and i is the i-th constituent of the portfolio. MVaR means Marginal VaR, and other symbols have their usual meanings.)

A. III

B. II

C. I

D. I and II -

Question 5:

Which of the following statements is true?

I - If no loss data is available, good quality scenarios can be used to model operational risk II - Scenario data can be mixed with observed loss data for modeling severity and frequency estimates III - Severity estimates should not be created by fitting models to scenario generated loss data points alone IV - Scenario assessments should only be used as modifiers to ILD or ELD severity models

A. I

B. I and II

C. III and IV

D. All statements are true -

Question 6:

A bullet bond and an amortizing loan are issued at the same time with the same maturity and with the same principal. Which of these would have a greater credit exposure halfway through their life?

A. Indeterminate with the given information

B. They would have identical exposure half way through their lives

C. The amortizing loan

D. The bullet bond -

Question 7:

An operational loss severity distribution is estimated using 4 data points from a scenario. The management institutes additional controls to reduce the severity of the loss if the risk is realized, and as a result the estimated losses from a 1-in10-year losses are halved. The 1- in-100 loss estimate however remains the same. What would be the impact on the 99.9th percentile capital required for this risk as a result of the improvement in controls?

A. The capital required will decrease

B. The capital required will stay the same

C. The capital required will increase

D. Can't say based on the information provided -

Question 8:

Which of the following are valid objectives of a reverse stress test:

I - Ensure that a firm can survive for long enough after risks have materialized for it to either regain market confidence, restructure or be sold, or be closed down in an orderly manner,

II - Discover the vulnerabilities of the current business plan,

III - Better integrate business and capital planning,

IV - Create a 'zero-failure' environment at the systemic level in the financial sector

A. I and IV

B. I, II and III

C. II and III

D. All of the above -

Question 9:

Which of the following is the best description of the spread premium puzzle:

A. The spread premium puzzle refers to observed default rates being much less than implied default rates, leading to lower credit bonds being relatively cheap when compared to their actual default probabilities

B. The spread premium puzzle refers to dollar denominated non-US sovereign bonds being priced a at significant discount to other similar USD denominated assets

C. The spread premium puzzle refers to AAA corporate bonds being priced at almost the same prices as equivalent treasury bonds without offering the same liquidity or guarantee as treasury bonds

D. The spread premium puzzle refers to the moral hazard implicit in the monoline insurance market -

Question 10:

For a given notional amount, which of the following carries the greatest counterparty exposure (assuming the same counterparty credit rating for each):

A. A futures contract on an equity index

B. A one year certificate of deposit

C. A one year forward foreign exchange contract

D. A one year interest rate swap

Related Exams:

-

8002

PRM Certification - Exam II: Mathematical Foundations of Risk Measurement -

8004

PRM Certification - Exam IV: Case Studies; Standards: Governance, Best Practices and Ethics -

8006

Exam I: Finance Theory Financial Instruments Financial Markets - 2015 Edition -

8007

Exam II: Mathematical Foundations of Risk Measurement - 2015 Edition -

8008

PRM Certification - Exam III: Risk Management Frameworks, Operational Risk, Credit Risk, Counterparty Risk, Market Risk, ALM, FTP - 2015 Edition -

8009

Exam IV: Case Studies: Standards: Governance, Best Practices and Ethics - 2015 Edition -

8010

Operational Risk Manager (ORM) -

8011

Credit and Counterparty Manager (CCRM) Certificate

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only PRMIA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your 8008 exam preparations and PRMIA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.