Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 27, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 661:

A firm's dividend policy may treat dividends either as the residual part of a financing decision or as an active policy strategy. Treating dividends as an active policy strategy assumes that

A. Dividends provide information to the market.

B. The firm should pay dividends only after investing in all investment opportunities having an expected return greater than the cost of capital

C. Dividends are irrelevant.

D. Dividends are costly, and the firm should retain earnings and issue stock dividends

-

Question 662:

A firm's dividend policy may treat dividends either as the residual part of a financing decision or as an active policy strategy. Treating dividends as the residual part of a financing decision assumes that

A. Earnings should be retained and reinvested as long as profitable projects are available.

B. Dividends are important to shareholders, and any earnings left over after paying dividends should be invested in high-return assets

C. Dividend payments should be consistent.

D. Dividends are relevant to a financing decision.

-

Question 663:

Residco; Inc expects net income of $800,000 for the next fiscal year. Its targeted and current capital structure is 40% debt and 60% common equity. The director of capital budgeting has determined that the optimal capital spending for next year is $1 2 million. If Residco follows a strict residual dividend policy, what is the expected dividend-payout ratio for next year'?

A. 90.0%

B. 66.7%

C. 40.0%

D. 10.0%

-

Question 664:

In practice, dividends

A. Usually exhibit greater stability than earnings.

B. Fluctuate more widely than earnings.

C. Tend to be a lower percentage of earnings for mature firms.

D. Are usually changed every year to reflect earnings changes.

-

Question 665:

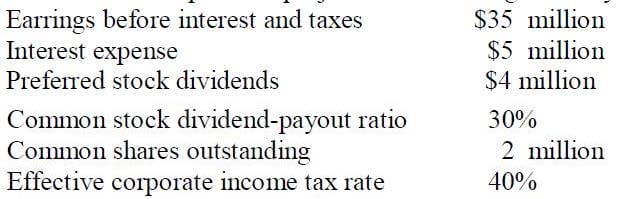

The Dawson Corporation projects the following for the year Earrings before interest and taxes $35 million

The expected common stock dividend per share for Dawson Corporation is The company's net income is $18,000,000 [($35,000,000 EBIT - $5,000,000 interest) x (1.0 – .4 tax rate)]. Thus, the earnings available to common shareholders equal $14,000,000 ($18,000,000 - $4,000,000 preferred dividends), and EPS is $7 ($14,000,000 ÷ 2,000,000 common shares). Given a dividend-payout ratio of 30%, the dividend to common shareholders is expected to be $2.10 per share ($7 x 30%).

A. $2.34

B. $2.70

C. $1.80

D. $2.10

-

Question 666:

A financial manager usually prefers to issue preferred stock rather than debt because

A. Payments to preferred stockholders are not considered fixed payments

B. The cost of fixed debt is less expensive since it is tax deductible even if a sinking fund is required to retire the debt.

C. The preferred dividend is often cumulative, whereas interest payments are not.

D. In a legal sense, preferred stock is equity, therefore, dividend payments are not legal obligations

-

Question 667:

From an investor's viewpoint, the least risky type of bond in which to invest is a(n)

A. Debenture bond

B. Deep discount bond.

C. Income bond

D. Secured bond.

-

Question 668:

If a bond sells at a premium, the

A. Stated coupon rate must be less than the required market rate

B. Nominal rate must be less than the yield rate.

C. Bond purchase price must be more than the fair market value of the bond.

D. Stated coupon rate must be more than the required market rate.

-

Question 669:

Randolf Castell opened a small general store in 1964. A cousin, Alfred Bedford, served as bookkeeper and office manager while Castell concentrated on operations. The business prospered and each of Castell's three sons joined their father in the business. In fact, as each son finished school, Castell opened a new store and put the son in charge. In time, each son began to specialize: one in hardware; another in dry goods, and the third in furniture. Further expansion took place, and the business was incorporated as Four Castles Inc. with all of the stock being held by the family. Castell closed his original store to serve as president and concentrate on administration. As Four Castles prospered and more stores opened, the company needed additional capital Bedford suggested "going public" but pointed out that this required accounting and reporting procedures with which he was unfamiliar. Therefore, a trained and qualified accountant was hired as controller. The new controller has had to provide explanations to Castell and Bedford on the accounting and reporting requirements of public companies. From the viewpoint of the investor, which of the following securities provides the least risk?

A. Mortgage bond.

B. Subordinated debenture

C. Income bond.

D. Debentures.

-

Question 670:

A firm has $3 million in total assets and $1.65 million in equity. How much of its $500,000 capital budget should be debt- financed to retain the same debt-equity ratio?

A. $50,000

B. $225,000

C. $275,000

D. $450,000

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.