Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 27, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 681:

The par value of a common stock represents

A. The estimated market value of the stock when it was issued.

B. The liability ceiling of a shareholder when a company undergoes bankruptcy proceedings.

C. The total value of the stock that must be entered in the issuing corporation's records.

D. A theoretical value of $100 per share of stock with any differences entered in the issuing corporation's records as discount or premium on common stock

-

Question 682:

On January 1 of the current year, Bongo Company issued convertible bonds with $1000 per value and a conversion ratio of 50. Which of the following should be the market price per share of the company's common stock on January 1?

A. Under$20

B. $20

C. Between $20 and $50.

D. Above $50

-

Question 683:

Growl Corporation's $1,000 par value convertible debentures are selling at $1,040 when its stock is selling for $46.00 per share. If the conversion ratio is 20, what will be the conversion price?

A. $22.61

B. $46.00

C. $50.00

D. $52.00

-

Question 684:

The market value of a share of stock is $50, and the market value of one right prior to the ex-rights date is $2.00 after the offering is announced but while the stock is still selling rights-on. The offer to the shareholder is that it will take three rights to buy an additional share of stock at a subscription price of $40 per share. If the theoretical value of the stock when it goes ex-rights is $47.50, then the shareholder

A. Does not receive any additional benefit from a rights offering

B. Receives an additional benefit from a rights offering.

C. Merely receives a return of capital

D. Should redeem the right and purchase the stock before the ex-rights date

-

Question 685:

A company's stock trades rights-on for $50.00 and ex-rights for $48.00. The subscription price for rights holders is $40.00, and four rights are required to purchase one share of stock. The value of a right when the stock is trading ex-rights is

A. $0.40

B. $0.50

C. $2.00

D. $2.50

-

Question 686:

A company's stock trades rights-on for $50.00 and ex-rights for $48.00. The subscription price for rights holders is $40.00, and four rights are required to purchase one share of stock.The value of a right while the stock is still trading rights-on is

A. $0.40

B. $0.50

C. $1.60

D. $2.00

-

Question 687:

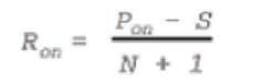

The formula for determining the value of one stock right when the price of the stock is rights-on is

If: Ron = market value of one right when the stock is selling rights-on. Pon = market value of one share of stock with rights-on. N = number of nights necessary to purchase one share of stock. S = subscription price per share. If the market price of a stock is $50 per share, the subscription price is $40 per share, and three rights are necessary to buy an additional share of stock, the theoretical market value of one right used to buy the stock prior to the ex-rights date is

A. $2.00

B. $2.50

C. $10.00

D. $40.00

-

Question 688:

The equity section of Smith Corporation's Statement of Financial Position is presented below. Preferred stock, $100 par $12,000,000 Common stock, $5 par 10,000,000 Paid-in capital in excess of par 18,000,000 Retained earnings 9,000000 Net worth $49,000,000

The common shareholders of Smith Corporation have preemptive rights. If Smith Corporation issues 400,000 additional shares of common stock at $6 per share, a current holder of 20,000 shares of Smith Corporation's common stock must be given the option to buy

A. 1,000 additional shares

B. 3,774 additional shares.

C. 4,000 additional shares.

D. 3,333 additional shares.

-

Question 689:

In general, it is more expensive for a company to finance with equity capital than with debt capital because

A. Long-term bonds have a maturity date and must therefore be repaid in the future.

B. Investors are exposed to greater risk with equity capital.

C. The interest on debt is a legal obligation

D. Equity capital is in greater demand than debt capital

-

Question 690:

The term `underwriting spread" refers to the

A. Commission percentage an investment banker receives for underwriting a security issue.

B. Discount investment bankers receive on securities they purchase from the issuing company.

C. Difference between the price the investment banker pays for a new security issue and the price at which the securities are resold.

D. Commission a broker receives for either buying or selling a security on behalf of an investor.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.