Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 27, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 641:

Essex Corporation is evaluating a lease that takes effect on March 1. The company must make eight equal payments, with the first payment due on March 1. The concept most relevant to the evaluation of the lease is the

A. Present value of an annuity due.

B. Present value of an ordinary annuity

C. Future value of an annuity due.

D. Future value of an ordinary annuity.

-

Question 642:

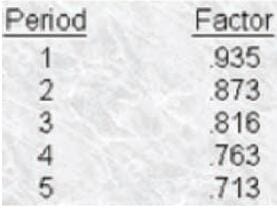

A company has purchased a $1000. 7%, 5-year bond at par that pays interest annually. The discount tractors for he present value $1at 7% for five periods are as follows

For purposes of duration hedging, the duration of the bond is

A. 39years.

B. 5O0years

C. 439years.

D. 3.8lyears

-

Question 643:

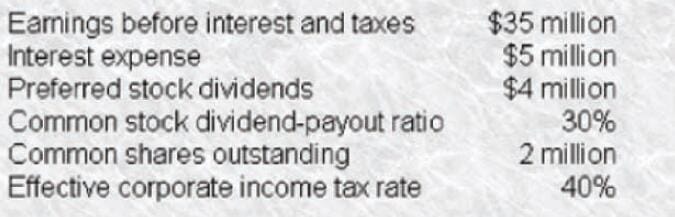

The Dawson Corporation projects the following for the year

If Dawson Corporation's common stock is expected to trade at a price-earnings ratio of eight, the market price per share (to the nearest dollar) would be

A. $104

B. $56

C. $72

D. $68

-

Question 644:

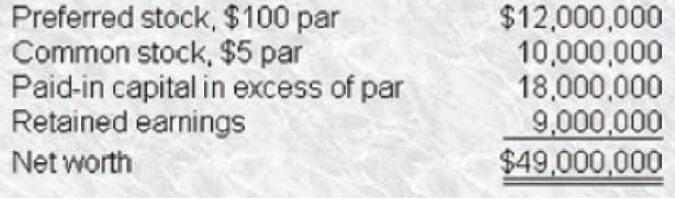

The equity section of Smith Corporation's Statement of Financial Position is presented below.

The book value per share of Smith Corporation's common stock is

A. $18.50

B. $5.00

C. $14.00

D. $100

-

Question 645:

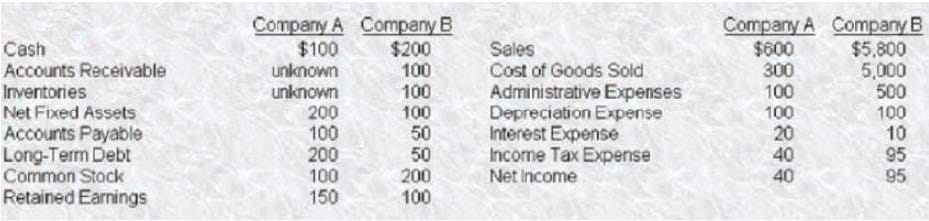

Presented below are partial year-end financial statement data for companies A and B.

If Company A has 60 common shares outstanding, then it has a book value per share, to the nearest cent, of

A. $1.67

B. $2.50

C. $4.17

D. $5.00

-

Question 646:

A company has 100,000 outstanding common shares with a market value of $20 per share. Dividends of $2 per share were paid in the current year and the company has a dividend payout ratio of 40%. The price to earnings ratio of the company is

A. 2.5

B. 4

C. 10

D. 50

-

Question 647:

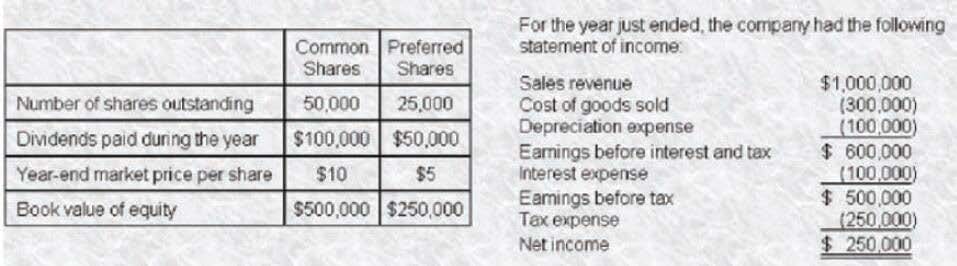

Alberto Corp. has common and preferred shares outstanding with the following characteristics:

Alberto Corp. has earnings per share of

A. $2.67

B. $3.33

C. $4.00

D. $5.00

-

Question 648:

All else being equal, a company with a higher dividend-payout ratio will have a

- debt-to-assets ratio and a

- current ratio. ListA ListB

A. Higher Higher

B. Higher Lower

C. Lower Higher

D. Lower Lower

-

Question 649:

In calculating diluted earnings per share when a company has convertible bonds outstanding, the number of common shares outstanding must be

- to adjust for the conversion feature of the bonds, and the net income must be

- by the amount of interest expense on the bonds, net of tax List A List B

A. Increased Increased

B. Increased . Decreased

C. Decreased Increased

D. Decreased Decreased

-

Question 650:

Everything else being equal, a

- highly leveraged firm will have

- earnings per share. ListA ListB

A. More Lower

B. More Less volatile

C. Less Less volatile

D. Less Higher

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.