Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 431:

The total sales revenue at which Siberian Ski Company would make the same profit or loss regardless of the ski model it decided to produce is

A. $880000

B. $422400

C. $924000

D. $686.400

-

Question 432:

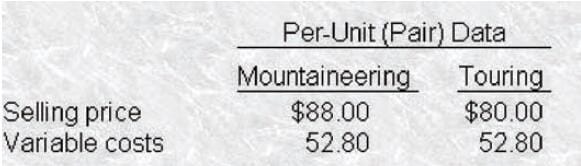

Siberian Ski Company recently expanded its manufacturing capacity, which will allow it to produce upto 15,000 pairs of cross country skis of the mountaineering model or the touring model. The Sales Department assures management that it can sell between 9,000 pairs and 13000 pairs of either product this year. Because the models are very similar, Siberian Ski will produce only one of the two models. The following information was compiled by the Accounting Department

Fixed costs will total $369,600 if the mountaineering model is produced but will be only $316,800 if the touring model is produced. Siberian Ski is subject to a 40% income tax rate.If the Siberian Ski Company Sales Department could guarantee the annual sale of 12,000 pairs of either model, Siberian Ski would

A. Produce 12,000 pairs of touring skis because they have a lowerfixed cost.

B. Be indifferent as to which model is sold because each model has the same variable cost per unit.

C. Produce 12,000 pairs of mountaineering skis because they have a lower breakeven point.

D. Produce 12,000 pairs of mountaineering skis because they are more profitable.

-

Question 433:

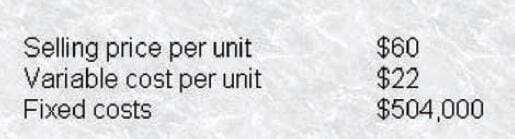

Austin Manufacturing, which is subject to a 40% income tax rate, had the following operating data for the period just ended.

Management plans to improve the quality of its sole product by (1) replacing a component that costs $3.50 with a higher-grade unit that costs $5.50, and (2) acquiring a $180,000 packing machine. Austin will depreciate the machine over a 10-year life with no estimated salvage value by the straight-line method of depreciation. If the company wants to earn after-tax income of $172,800 in the upcoming period, it must sell

A. 19,300 units.

B. 21,316 units.

C. 22,500 units.

D. 23,800 units.

-

Question 434:

How many surge protectors (rounded to the nearest hundred) must Bruell Electronics sell at a selling price of $14 per unit to gain $30 p000 additional income before taxes?

A. 10700 units.

B. 12100 units.

C. 20,000 units.

D. 25,000 units.

-

Question 435:

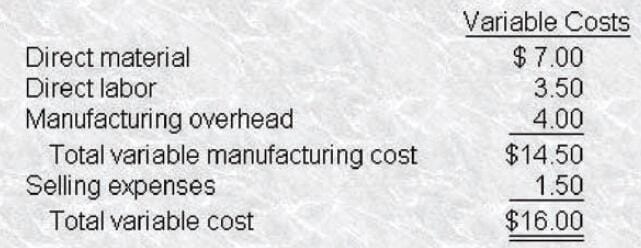

Bruell Electronics Co. is developing a new product, surge protectors for high-voltage electrical flows. The cost information below relates to the product

The company will also be absorbing $120.000 of additional fixed costs associated with this new product. A corporate fixed charge of $20,000 currently absorbed by other products will be allocated to this new product.How many surge protectors (rounded to the nearest hundred) must Bruell Electronics sell at a selling price of $14 per unit to increase after4ax income by $30,000? Bruell Electronics' effective income tax rate is 40%.

A. 10,700 units.

B. 12,100 units.

C. 20,000 units.

D. 28,300 units.

-

Question 436:

BEandH Manufacturing is considering dropping a product line. It currently produces a multi-purpose woodworking clamp in a simple manufacturing process that uses special equipment. Variable costs amount to $6.00 per unit. Fixed overhead costs, exclusive of depreciation, have been allocated to this product at a rate of $3.50 a unit and will continue whether or not production ceases. Depreciation on the special equipment amounts to $20,000 a year. If production of the clamp is stopped, the special equipment can be sold for $18,000; if production continues, however, the equipment will be useless for further production at the end of 1 year and will have no salvage value. The clamp has a selling price of $10 a unit. Ignoring tax effects, the minimum number of units that would have to be sold in the current year to break even on a cash flow basis is

A. 4,500 units.

B. 5,000 units.

C. 20.000 units.

D. 36,000 units.

-

Question 437:

Bruell Electronics Co. is developing a new product, surge protectors for high-voltage electrical flows. The cost information below relates to the product The company will also be absorbing $120,000 of additional fixed costs associated with this new product. A corporate fixed charge of $20000 currently absorbed by other products will be allocated to this new product.If the selling price is $14 per unit, the breakeven point in units (rounded to the nearest hundred) for surge protectors is

A. 8,500 units.

B. 10,000 units.

C. 15,000 units.

D. 20,000 units.

-

Question 438:

Delphi Company's management has stipulated that it will not approve the continued manufacture of the new product after the next fiscal year unless the after-tax profit is at least $75,000 the first year. The unit selling price to achieve this target profit must be at least

A. $37.00

B. $36.60

C. $34.60

D. $39.00

-

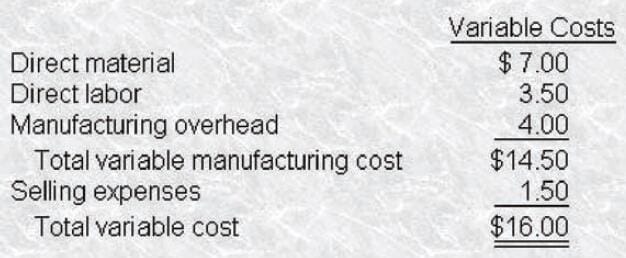

Question 439:

Delphi Company has developed a new project hat will be marketed for the first time during the next fiscal year. Although the Marketing Department estimates that 35,000 units could be sold at $36 per unit, Delphi's management has allocated only enough manufacturing capacily to produce a maximum of 25,000 units of the new product annually. The fixed costs associated with the new product are budgeted at $450,000 for the year, which includes $60,000 for depreciation on new manufacturing equipment. Data associated with each unit of product are presented as follows. Delphi is subject to a40% income tax rate.

The maximum after-tax profit that can be earned by Delphi Company from sales of the new product during the next fiscal year is

A. $30,000

B. $50,000

C. $110,000

D. $66,000

-

Question 440:

Delphi Company has developed a new project that will be marketed for the first time during the next fiscal year. Although the Marketing Department estimates that 35,000 units could be sold at $36 per unit, Delphi's management has allocated only enough manufacturing capacity to produce a maximum of 25,000 units of the new product annually. The fixed costs associated with the new product are budgeted at $450,000 for the year, which includes $60,000 for depreciation on new manufacturing equipment. Data associated with each unit of product are presented as follows Delphi is subject to a40% income tax rate.

The number of units of the new product that Delphi Company must sell during the next fiscal year in order to break even is

A. 20.930

B. 18,140

C. 22,500

D. 25,500

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.