Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 451:

Von Stutgatt International's breakeven point is 8,000 racing bicycles and 12,000 5- speed bicycles. If the selling price and variable costs are $570 and $200 for a racer, and $180 and $90 for a 5-speed respectively, what is the weighted- average contribution margin?

A. $100

B. $145

C. $179

D. $202

-

Question 452:

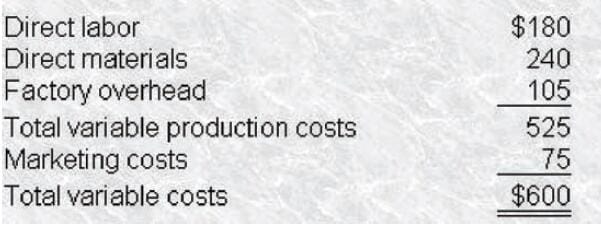

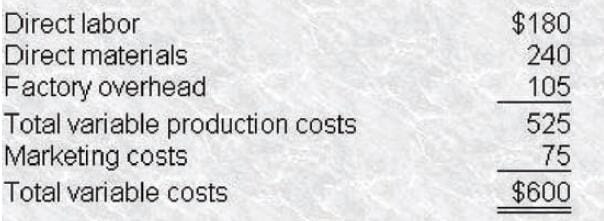

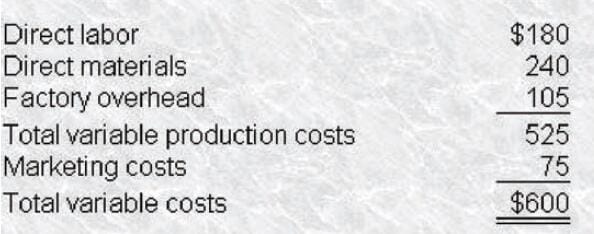

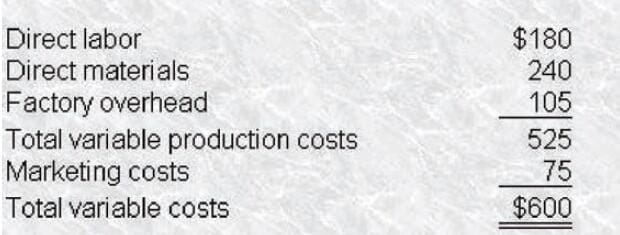

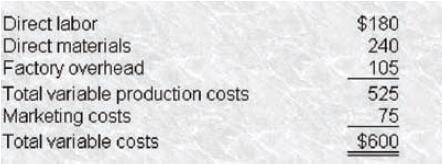

Madengrad Company manufactures a single electronic product called Precisionmix. This unit is a batch-density monitoring device attached to large industrial mixing machines used in flour, rubber, petroleum, and chemical manufacturing. Precisionmix sells for $900 per unit. The following variable costs are incurred to produce each Precisionmix device: Madengrad's income tax rate is 40%, and annual fixed costs are $6,600,000. Except for an operating loss incurred in the year of incorporation, the firm has been profitable over the last 5 years.Assume a 10% increase in annual fixed costs, a 20% unit cost increase for direct labor1 and a reduction in unit material costs of 25%, with no change in selling price. Madengrad Company's breakeven point would increase (decrease) (rounded to the nearest whole unit) by

A. 3,960 units.

B. (1.620) units.

C. 1,604 units.

D. 407 units.

-

Question 453:

Madengrad Company manufactures a single electronic product called Precisionmix. This unit is a batch-density monitoring device attached to large industrial mixing machines used in flour, rubber, petroleum, and chemical manufacturing. Precisionmix sells for $900 per unit. The following variable costs are incurred to produce each Precisionmix device:

Madengrad's income tax rate is 40%, and annual fixed costs are $6,600,000. Except for an operating loss incurred in the year of incorporation, the firm has been profitable over the last 5 years.Assume a 10% increase in annual fixed costs, a 20% unit cost increase for direct labor1 and a reduction in unit material costs of 25%, with no change in selling price. After incorporating these changes, Madengrad Compans contribution margin would be

A. 34%

B. 69%

C. 36%

D. 64%

-

Question 454:

Madengrad Company manufactures a single electronic product called Precisionmix. This unit is a batch-density monitoring device attached to large industrial mixing machines used in flour, rubber, petroleum, and chemical manufacturing. Precisionmix sells for $900 per unit. The following variable costs are incurred to produce each Precisionmix device:

Madengrad's income tax rate is 40% and annual fixed costs are $6,600,000. Except for an operating loss incurred in the year of incorporation, the firm has been profitable over the last 5 years.For Madengrad Company to achieve an after-tax net income of $540,000, annual sales revenue must be

A. $23,850,000

B. $225,000,000

C. $2,700,000

D. $21,420,000

-

Question 455:

Madengrad Company manufactures a single electronic product called Precisionmix. This unit is a batch-density monitoring device attached to large industrial mixing machines used in flour, rubber, petroleum, and chemical manufacturing. Precisionmix sells for $900 per unit. The following variable costs are incurred to produce each Precisionmix device: Madengrad's income tax rate is4O%, and annual fixed costs are $6,600,000. Except for an operating loss incurred in the year of incorporation, the firm has been profitable over the last 5 years.The annual sales volume required for Madengrad Company to break even is

A. 22,000 units.

B. 11,000units.

C. 8,400 units.

D. 13,888 units.

-

Question 456:

Madengrad Company manufactures a single electronic product called Precisionmix. This unit is a batch-density monitoring device attached to large industrial mixing machines used in flour, rubber, petroleum, and chemical manufacturing. Precisionmix sells for $900 per unit. The following variable costs are incurred to produce each Precisionmix device:

Madengrad's income tax rate is 40%, and annual fixed costs are $6,600,000. Except for an operating loss incurred in the year of incorporation, the firm has been profitable over the last 5 years.If Madengrad Company achieves a sales and production volume of 8.000 units, the annual before-tax income (loss) will be

A. $(4,200000)

B. $1,780,000

C. $(2,520,000)

D. $(420,000)

-

Question 457:

What is the breakeven point in units for a product that sells for $10 if fixed costs are $4,000 and variable costs are 20%?

A. 250

B. 500

C. 800

D. 2,000

-

Question 458:

The change in period-to-period operating income when using variable costing can be explained by the change in the

A. Unit sales level multiplied by the unit sales price.

B. Finished goods inventory level multiplied by the unit sales price.

C. Unit sales level multiplied by a constant unit contribution margin.

D. Finished goods inventory level multiplied by a constant unit contribution margin.

-

Question 459:

A manufacturer contemplates a change in technology that would reduce fixed costs from $800,000 to $700 .000. However, the ratio of variable costs to sales will increase from 68% to 80%.Whatwill happen to break-even level of revenues?

A. Decrease by $301,470.50

B. Decrease by $500,000

C. Decrease by $1,812,500

D. Increase by $1,000,000

-

Question 460:

How much does each additional sales dollar contribute toward profit for a firm with $4 million break-even level of revenues and $1 .2 million in fixed costs including depreciation?

A. $0.30

B. $0.33

C. $0.50

D. $0.67

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.