Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 19, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 421:

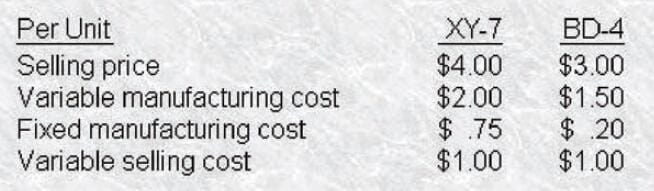

Moorhead Manufacturing Company produces two products for which the following data have been tabulated. Fixed manufacturing cost is applied at a rate of $1 .00 per machine hour. The sales manager has had a $160,000 increase in the budget allotment for advertising and wants to apply the money to the most profitable product. The products are not substitutes for one another in the eyes of the company's customers.

Suppose the sales manager chooses to devote the entire $160,000 to increased advertising for BD-4. The minimum increase in sales dollars of BD-4 required to offset the increased advertising would be

A. $160,000

B. $320,000

C. $960,000

D. $1,600,000

-

Question 422:

Moorhead Manufacturing Company produces two products for which the following data have been tabulated. Fixed manufacturing cost is applied at a rate of $1 .00 per machine hour. The sales manager has had a $160,000 increase in the budget allotment for adverbsing and wants to apply the money to the most profitable product. The products are not substitutes for one another in the eyes of the company's customers.

Suppose the sales manager chooses to devote the entire $160,000 to increased advertising for XY-7, The minimum increase in sales units of XY-7 required to offset the increased advertising is

A. 640,000 units.

B. 160,000 units.

C. 128,000 units.

D. 80,000 units.

-

Question 423:

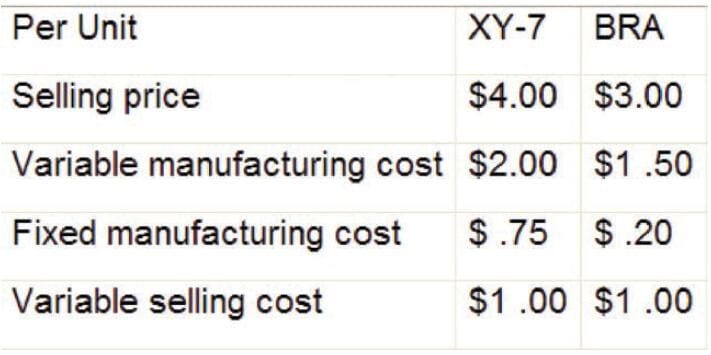

Orange Company's controller developed the following direct-costing income statement for Year 1: Orange Co. based its next year's budget on the assumption that fixed costs, unit sales, and the sales price would remain as they were in Year 1, but with net income being reduced to $300,000. By July of Year 2, the controller was able to predict that unit sales would increase over Year 1 levels by 10%. Based on the Year 2 budget and the new information, the predicted Year 2 net income would be

A. $300,000

B. $330,000

C. $420,000

D. $585,000

-

Question 424:

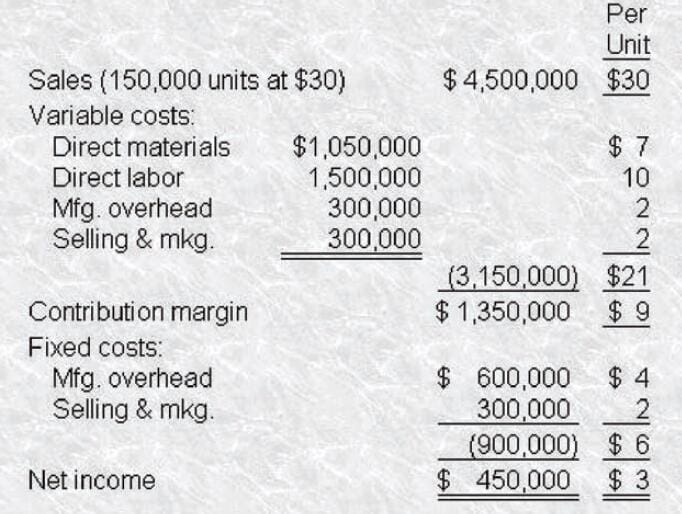

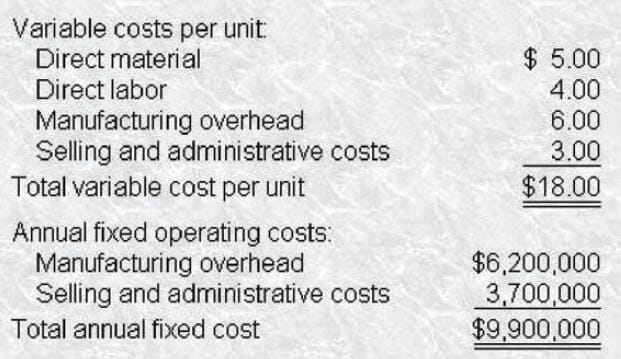

Green Company produces Product A and sells it for $18.00. The following cost data apply: Green has thought of marketing a new Product B with the same cost structure as Product A except that the price will be $15.60. Green Company currently has the plant capacityr necessary for this expansion. Because of the cost structure, Green Company will find the production and sale of Product B in the short run to be

A. Not profitable unless the price can be raised to $17.10.

B. Not profitable at any price.

C. Not profitable at $15.60 because the fixed selling expense and fixed manufacturing overhead will not be covered by the price.

D. Profitable to produce and sell Product B in the short run at the price of $15.60.

-

Question 425:

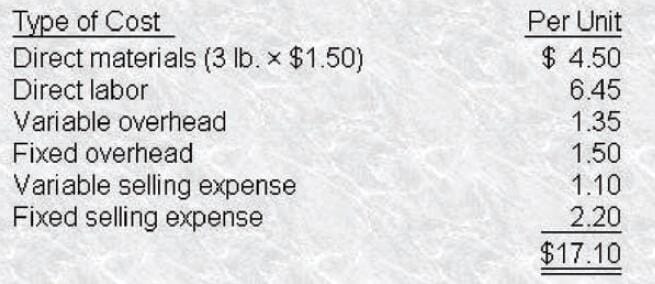

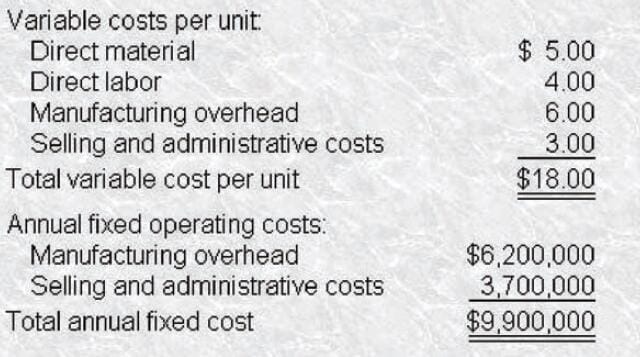

A company that sells its single product for $40 per unit uses cost-volume-profit analysis in its planning. The company's after4ax net income for the past year was $1,188,000 after applying an effective tax rate of 40% . The projected costs for manufacturing and selling its single product in the coming year are in the next column.

The company has learned that a new direct material is available that will increase the quality of its product. The new material will increase the direct material costs by $3 per unit. The company will increase the selling price of the product to $50 per unit and increase its marketing costs by $1 .575,000 to advertise the higher-quality product. The number of units the company has to sell in order to earn a 10% before-tax return on sales would be

A. 337,500 units.

B. 346875 units.

C. 425,000 units.

D. 478,125 units.

-

Question 426:

A company that sells its single product for $40 per unit uses cost-volume-profit analysis in its planning. The compans after-tax net income for the past year was $1.1 88,000 after applying an effective tax rate of 40%. The projected costs for manufacturing and selling its single product in the coming year are in the next column.

The dollar sales volume required in the coming year to earn the same after4ax net income as the past year is

A. $20,160,000

B. $21,600,000

C. $23,400,000

D. $26,400,000

-

Question 427:

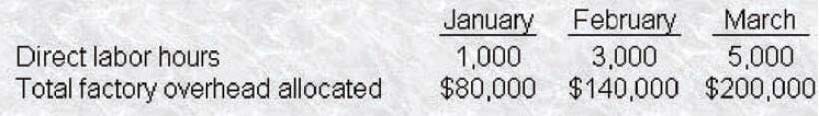

A company allocates its variable factory overhead based on direct labor hours. During the past 3 months1 the actual direct labor hours and the total factory overhead allocated were as follows:

Based upon this information, monthly fixed factory overhead was

A. $50,000

B. $46,667

C. $33,333

D. $30,000

-

Question 428:

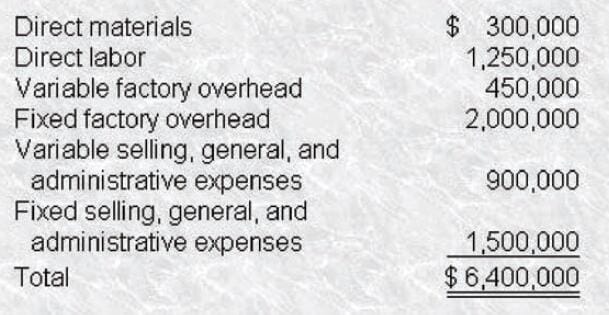

A company has just completed the final development of its only product, general recombinant bacteria, which can be programmed to kill most insects before dying themselves. The product has taken 3 years and $6,000,000 to develop. The following costs are expected to be incurred on a monthly basis for the normal production level of 1,000,000 pounds of the new product:

Ata sales price of $5.90 per pound1 the sales in pounds necessary to ensure a $3,000,000 profit the first year would be (to the nearest thousand pounds)

A. 13,017,000 pounds.

B. 14,000,000 pounds.

C. 15,000,000 pounds.

D. 25,600,000 pounds.

-

Question 429:

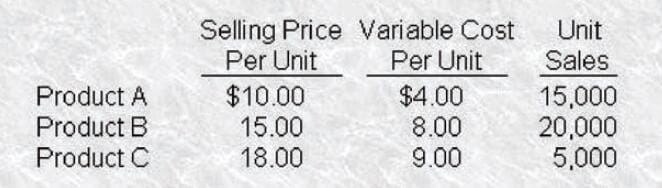

Mason Enterprises has prepared the following budget for the month of July:

Assuming thattotal fixed costs will be $150,000 and the mix remains constant, the breakeven point (rounded to the next higher whole unit) will be

A. 20,455 units.

B. 21,429units.

C. 21,8l9units.

D. 6,818 units.

-

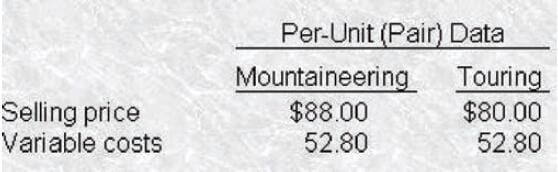

Question 430:

Siberian Ski Company recently expanded its manufacturing capacity, which will allow it to produce up to 15,000 pairs of cross country' skis of the mountaineering model or the touring model. The Sales Department assures management that it can sell between 9.000 pairs and 13,000 pairs of either product this year. Because the models are very similar, Siberian Ski will produce only one of the two models. The

following information was compiled by the Accounting Department:

Fixed costs will total $369600 if the mountaineering model is produced but will be only $316,800 if the touring model is produced. Siberian Ski is subject to a 40% income tax rate.If Siberian Ski Company desires an after-tax net income of $24,000, how many pairs of touring model skis will the company have to sell?

A. 13,118pairs.

B. 12,529 pairs.

C. 13,853 pairs.

D. 4,460 pairs.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.