Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 11, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 111:

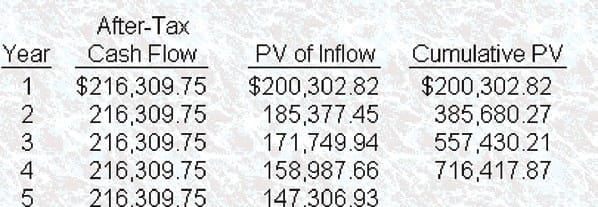

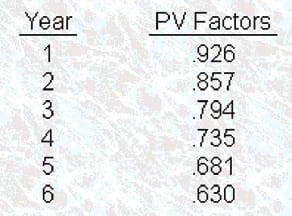

lrwinn Co. is considering an investment in a capital project. The sole outlay will be $800,000 at the outset of the project and the annual net after-tax cash inflow will be $216,309.75 for 6 years. The present value factors at lrwinn's 8% cost 01 capital are

What is the breakeven time (BET)?

A. 3.70 years.

B. 4.57 years.

C. 5.O0years.

D. 6.O0years.

-

Question 112:

When evaluating projects, breakeven time is best described as

A. Annual fixed costs ?monthly contribution margin.

B. Project investment + annual net cash inflows.

C. The point where cumulative cash inflows on a project equal total cash outflows.

D. The point at which discounted cumulative cash inflows on a project equal discounted total cash outflows.

-

Question 113:

The capital budgeting model that is generally considered the best model for long-range decision making is the

A. Payback model.

B. Accounting rate of return model.

C. Unadjusted rate of return model.

D. Discounted cash flow model.

-

Question 114:

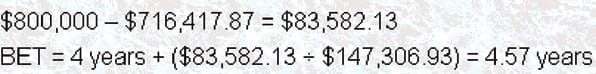

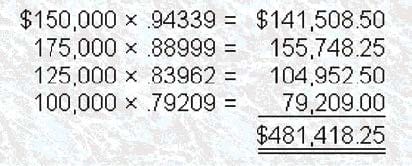

Henderson, Inc. has purchased a new fleet of trucks to deliver its merchandise. The trucks have a useful life of 8 years and cost a total of $500.000. Henderson expects its net increase in after-tax cash flow to be $150,000 in Year 1, $175,000 in Year 2, $125,000 in Year 3, and $100,000 in each of the remaining years. Based on a 6% annual interest rate, what is the discounted payback period for Henderson's fleet of trucks?

A. 3.Syears.

B. 3.98 years.

C. 4.25years.

D. 5.0 years.

-

Question 115:

Henderson, Inc. has purchased a new fleet of trucks to deliver its merchandise. The trucks have a useful life of 8 years and cost a total of $500.000. Henderson expects its net increase in after-tax cash flow to be $150,000 in Year 1, $175,000 in Year 2, $125,000 in Year 3, and $100,000 in each of the remaining years. If the net cash flow is $ 130,000 a year, what is the payback time for Henderson's fleet of trucks?

A. 3years.

B. 3.l5years.

C. 3.85 years.

D. 4years.

-

Question 116:

Henderson, Inc. has purchased a new fleet of trucks to deliver its merchandise. The trucks have a useful life of 8 years and cost a total of $500,000. Henderson expects its net increase in after4ax cash flow to be $150,000 in Year 1, $175,000 in Year 2, $125,000 in Year 3, and $100,000 in each of the remaining years. What is the payback reciprocal for Henderson's fleet of trucks?

A. 29%

B. 25%

C. 0. 24%

D. 20%

-

Question 117:

Henderson, Inc. has purchased a new fleet of trucks to deliver its merchandise. The trucks have a useful life of 8 years and cost a total of $500.000. Henderson expects its net increase in after-tax cash flow to be $150,000 in Year 1, $175,000 in Year 2, $125,000 in Year 3, and $100,000 in each of the remaining years. Ignoring the time value of money, how long will it take Henderson to recover the amount of investment?

A. 3.5 years.

B. 4.0 years.

C. 4.2 years.

D. 5 years.

-

Question 118:

Depreciation is incorporated explicitly in the discounted cash flow analysis of an investment proposal because it

A. Is a cost of operations that cannot be avoided?

B. Is a cash inflow.

C. Reduces the cash outlay for income taxes.

D. Represents the initial cash outflow spread over the life of the investment.

-

Question 119:

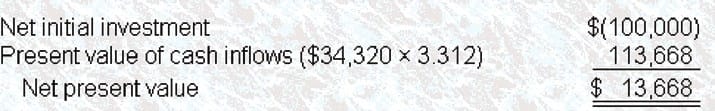

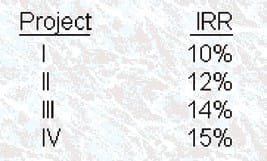

A company is considering two mutually exclusive projects with the following projected cash flows: The company has a required rate of return of 8%. If the company's objective is to maximize shareholder wealth, which one of the following is the most valid reason for selecting one of the projects?

A. The net present value of Project A is greater than the net present value of Project B, therefore select Project A.

B. The net present value of Project A is less than the net present value of Project B, therefore select Project B.

C. The internal rate of return of Project A is greater than the internal rate of return of Project B, therefore select Project A.

D. The internal rate of return of Project A is less than the internal rate of return of Project B, therefore select Project B.

-

Question 120:

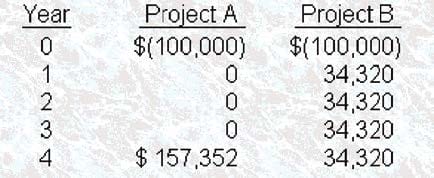

Brown and Company uses the internal rate of return (IRR) method to evaluate capital projects. Brown is considering four independent projects with the following lRRs:

Brown's cost of capital is 13%. Which one of the following project options should Brown accept based on IRR?

A. Projects I and II only.

B. Projects Ill and IV only.

C. Project IV only.

D. Projects I, II, Ill and IV.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.