Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 11, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 91:

In which product-mix pricing strategy is it appropriate for the seller to accept any price that exceeds the storage and delivery costs for the product?

A. By-product pricing.

B. Optional-product pricing.

C. Captive-product pricing.

D. Product-bundle pricing.

-

Question 92:

Which of the following pricing policies involves the selling company setting freight charges to customers at the actual average freight cost?

A. Freight absorption pricing

B. Uniform delivered pricing

C. Zone pricing

D. FOB-origin pricing.

-

Question 93:

Market-skimming pricing strategies could be appropriate when

A. No buyers want the product at a high price.

B. The costs of producing a small volume are low.

C. Competitors can easily enter the market

D. The product is of poor quality.

-

Question 94:

Which of the following price adjustment strategies is designed to stabilize production for the selling firm'?

A. Cash discounts

B. Quantity discounts.

C. Functional discounts.

D. Seasonal discounts

-

Question 95:

Buyer-based pricing involves

A. Adding a standard markup to the cost of the product.

B. Determining the price at which the product will earn a target profit.

C. Basing prices on the product's perceived value

D. Basing prices on competitors' prices.

-

Question 96:

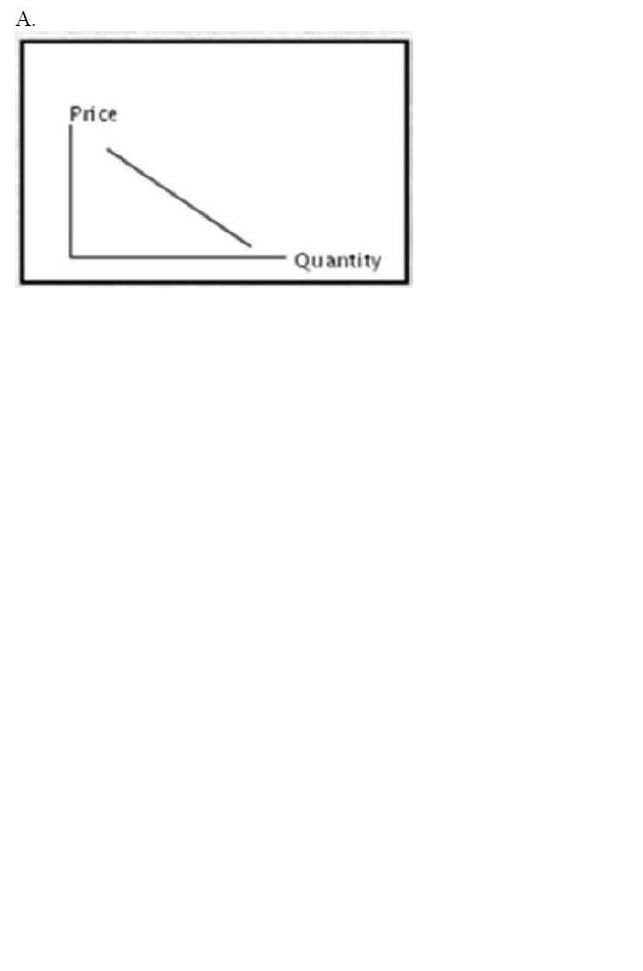

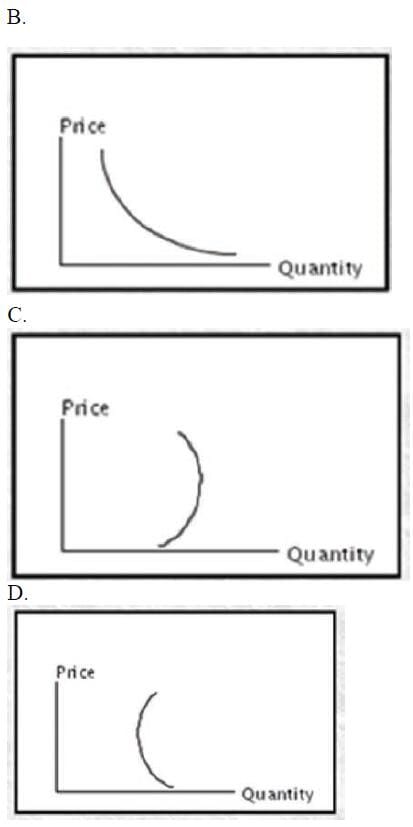

Which one of the graphs depicts the demand curve for presage goods?

A. Option A

B. Option B

C. Option C

D. Option D

-

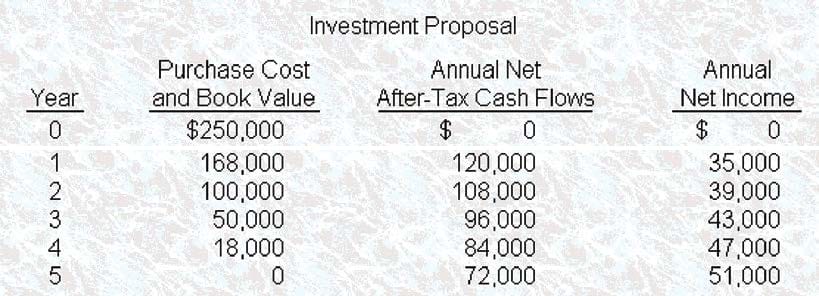

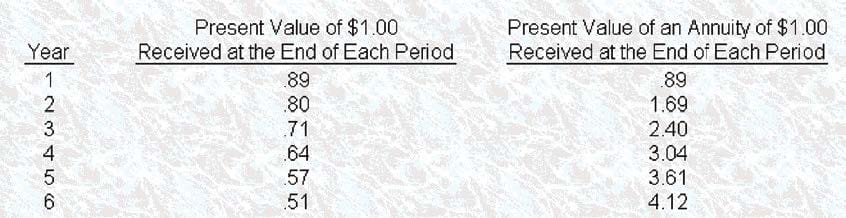

Question 97:

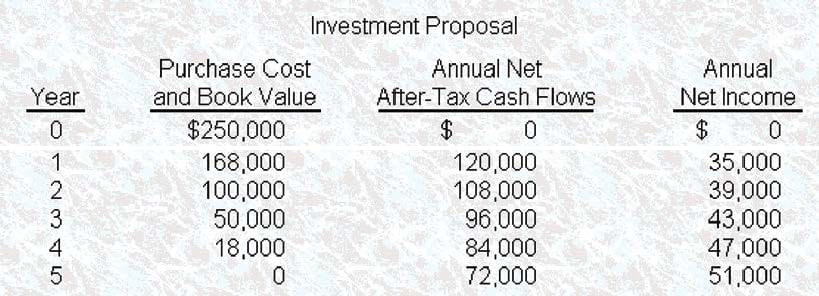

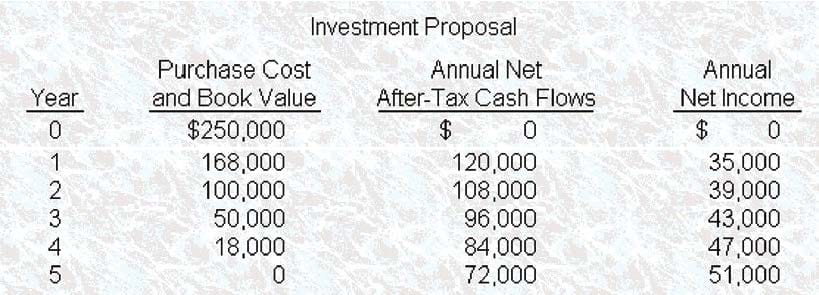

Jorelle Company's financial staff has been requested to review a proposed investment in new capital equipment. Applicable financial data is presented below. There will be no salvage value at the end of the investment's life and, due to realistic depreciation practices, it is estimated that the salvage value and net book value are equal at the end of each year. All cash flows are assumed to take place at the end of each year. For investment proposals, Jorelle uses a 12% after-tax target rate of return.

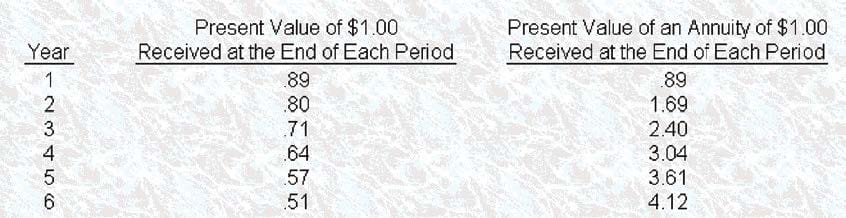

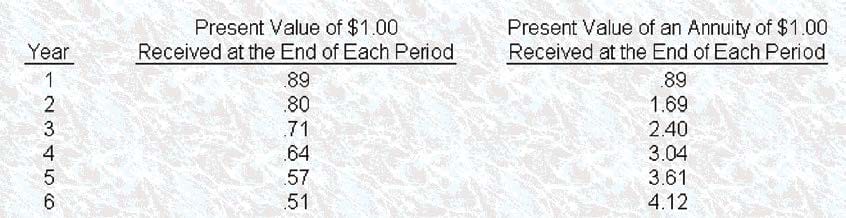

Discounted Factors for a 12% Rate of Return

The traditional payback period for the investment proposal is

A. Over5years.

B. 2.23 years.

C. 1.65 years.

D. 2.83 years.

-

Question 98:

Jorelle Company financial staff has been requested to review a proposed investment in new capital equipment. Applicable financial data is presented below. There will be no salvage value at the end of the investment's life and, due to realistic depreciation practices, it is estimated that the salvage value and net book value are equal at the end of each year.. All cash flows are assumed to take place at the end of each year. For investment proposals, Jorelle uses a 12% after-tax target rate of return.

Discounted Factors for a 12% Rate of Return

The net present value for the investment proposal is

A. $106,160

B. $(97,970)

C. $356,160

D. $96,560

-

Question 99:

Jorelle Company's financial staff has been requested to review a proposed investment in new capital equipment. Applicable financial data is presented below. There will be no salvage value at the end of the investment's life and, due to realistic depreciation practices, it is estimated that the salvage value and net book value are equal at the end of each year. All cash flows are assumed to take place at the end of each year. For investment proposals, Jorelle uses a 12% after-tax target rate of return.

Discounted Factors for a 12% Rate of Return

The accounting rate of return on the average investment proposal is

A. 12.0%

B. 17.2%

C. 28.0%

D. 34.4%

-

Question 100:

The bailout payback method

A. Is used by firms with federally insured loans.

B. Calculates the payback period using the sum of the net cash flows and the salvage value.

C. Calculates the payback period using the difference between net cash inflow and the salvage value.

D. Estimates short-term profit ability.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.