Exam Details

Exam Code

:CPP-REMOTEExam Name

:Certified Payroll ProfessionalCertification

:APA CertificationsVendor

:APATotal Questions

:249 Q&AsLast Updated

:Jun 27, 2025

APA APA Certifications CPP-REMOTE Questions & Answers

-

Question 41:

Which of the following is tax-free to all employees even if only provided to highly paid employees?

A. Cafeteria plans

B. Athletic facilities

C. 401(k) plans

D. Transportation fringe benefits

-

Question 42:

What is the purpose of the payroll accrual entry?

A. to reverse an entry from a previous period

B. to recognize expenses in the period in which they were incurred

C. to reverse an entry made in error

D. to recognize expenses in the period in which they were paid

-

Question 43:

Under the FLSA, which of the following restrictions apply when hiring minors under the age 18?

A. Work cannot be performed pursuant to jobs considered hazardous by the U.S. Department of Labor

B. They are not subject to overtime

C. Social Security and Medicare are not deducted for the first 90 days

D. If the employees do not have drivers' licenses, the employer may not hire them

-

Question 44:

In 2009, employee Chris was transferred from her company's headquarters to a distribution center 1,000 miles away. The company reimbursed her for meal expenses totaling $100 and lodging expenses totaling $300 incurred while driving from her old residence to her new. Chris' company directly paid the moving company $2,000 for transporting her household goods. What portion of Chris' employer-paid relocation expenses is reported in box 1, "wages, tips, other compensation?"

A. $100

B. $2,400

C. $2,300

D. $0

-

Question 45:

Which of the following would NOT be an asset account?

A. Work-in-progress

B. Cash

C. Employee receivables

D. Wages payable

-

Question 46:

The entry to record an employee's repayment of a salary advance is (employee repays advance by personal check):

A. Debit cash, credit accounts receivable

B. Debit cash, credit wages payable

C. Debit salary expense, credit accounts receivable

D. Debit accounts receivable, credit cash

-

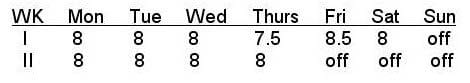

Question 47:

Under the FLSA, how many hours would be paid at time and one half for the following biweekly period, assuming that the employee is an garment worker?

A. 0

B. 0.5

C. 8

D. 8.5

-

Question 48:

The FLSA term "exempt" generally means the employer need NOT:

A. Withhold federal income tax

B. Pay overtime

C. Pay federal income tax

D. Pay a minimum amount

-

Question 49:

Under the FLSA, how long are employers required to keep records relating to wages, hours, and conditions of employment?

A. permanently

B. 4 years or until the file is no longer active

C. 3 years

D. 7 years

-

Question 50:

FLSA coverage does not apply under which of the following conditions?

A. Employees are minors under the age of 18

B. Employees are paid $2.13 per hour

C. Employer and employees are not engaged in interstate commerce

D. All employees are part time workers

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only APA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPP-REMOTE exam preparations and APA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.