CPP-REMOTE Exam Details

-

Exam Code

:CPP-REMOTE -

Exam Name

:Certified Payroll Professional -

Certification

:APA Certifications -

Vendor

:APA -

Total Questions

:249 Q&As -

Last Updated

:Jan 22, 2026

APA CPP-REMOTE Online Questions & Answers

-

Question 1:

Which of the following sets of data should be maintained on the payroll master file?

A. Employee's prior employment history

B. Name and address of benefits provider

C. Employer's date of incorporation

D. Deductions made to satisfy an IRS levy -

Question 2:

Which of the following is not likely to be included in payroll documentation?

A. Auditors' Questionnaire

B. Proofing and Balancing Payroll

C. Tax Set Up

D. Correcting Errors -

Question 3:

The effective minimum hourly rate that tipped employees must receive is which of the following?

A. No particular rate is required

B. 100% of the federal minimum wage

C. 50% of the federal minimum wage

D. 20% of the federal minimum wage -

Question 4:

What is the difference between policy and a procedure?

A. None, they serve the same purpose

B. Policies are rules; procedures are instructions

C. Procedures need to be documented; policies do not

D. Policies can be overridden; procedures may not -

Question 5:

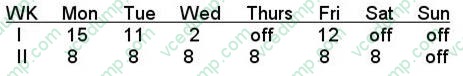

Under FLSA, how many hours must be paid at the overtime rate of pay for the following biweekly period:

Represents 8 hours of sick pay leave:

A. 10

B. 16

C. 2 -

Question 6:

A payroll department manager should assure:

A. appropriate training and equipment resources for staff members

B. an independent mission statement

C. top payment of staff

D. immediate enactment of employee suggestions -

Question 7:

Under FLSA, how many hours must be paid at the overtime rate of pay for the following biweekly period assuming the employer is a hospital qualified under the special provisions of the FLSA?

B. 4

C. 15

D. 14 -

Question 8:

Federal tax withheld from a distribution of $50,000 from a qualified retirement plan paid directly to a retiree age 65 is:

A. $14,000

B. $10, 000

C. $0

D. $15,500 -

Question 9:

In a customer service situation, Payroll should:

A. get in the last word

B. avoid addressing stressful issues

C. assure the caller everything is okay, even when it's not

D. remain assertive and stays focused -

Question 10:

The Fair Labor Standards Act specifically governs which of the following?

A. When holiday pay must be provided

B. Record keeping requirements

C. When severance pay must be paid

D. How vacation pay is accrued

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only APA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPP-REMOTE exam preparations and APA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.