Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:May 11, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 861:

Two stocks, Rich Shaw Inc., and Melon Inc., have identical total risk. The Rich Shaw stock risk is comprised of 60% systematic risk and 40% unsystematic risk, while the Melon stock risk is comprised of 40% systematic risk and 60% unsystematic risk. Relative to the Melon stock, the Rich Shaw stock has:

A. a higher required return.

B. a lower required return.

C. the same required return.

-

Question 862:

Bill Smythe and Katherine Banning want to invest 100% of their available funds in the optimal risky portfolio. Smythe invests his money in a portfolio with an expected return of 14% and a standard deviation of 10%. Banning invests her funds in a portfolio with an expected return of 19% and a standard deviation of 12%. Which of the two investors has invested his/her funds in the optimal portfolio?

A. Smythe, since his portfolio has minimized total risk.

B. Banning, since the expected return per unit of risk is higher for her investment.

C. Both, since the optimal portfolio depends on an investor's individual utility function.

-

Question 863:

Bill Turner is a security analyst for Secure-Invest Inc. The firm has concerns about the equal borrowing and lending rate assumption made by the traditional capital asset pricing model (CAPM), and, instead, tells Turner to use the zero-beta CAPM when selecting assets. Turner finds that the return on the zero-beta portfolio exceeds the risk-free rate. Which of the following most accurately describes the effect of relaxing the equal borrowing and lending assumption?

A. The slope of the security market line will increase.

B. The slope of the security market line will decrease.

C. The slope of the security market line will stay the same.

-

Question 864:

WSX Capital management is considering changing the allocation of its clients' portfolios to include commodities. The portfolios are currently invested in stocks, bonds, real estate, and hedge funds. Which of the following is the most important investment attribute to evaluate when adding commodities as an asset class?

A. The return volatility of commodities.

B. The relationship between commodity returns and other asset class returns.

C. The beta of the portfolio after adding commodities.

-

Question 865:

Derek Bonney, CFA, is writing an investment policy statement for one of his high net worth clients, Joey Rook. Rook is a retiree who receives Social Security benefits but because he was self-employed, has no pension income. Rook's social security benefits cover all but $1,000 of his monthly living expenses. He has a portfolio of SI.2 million, an effective tax rate of 30%, and recently purchased a vacation cabin with mortgage and maintenance expenses of $6,000 per month. After meeting with his client, Bonney writes the following policy statement: "The total return objective is to earn 7% after-tax. At no time should the principal amount decline in value by more than 15%." The most valid criticism of this return objective statement is that:

A. it considers only the after-tax return.

B. the return objective is too conservative.

C. it fails to consider Rook's current income needs.

-

Question 866:

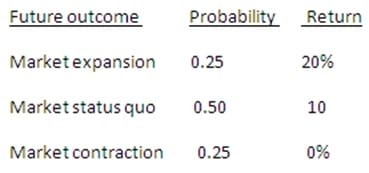

The probability distribution of stock returns for Kokomo Beach Tours, Inc., is provided below.

From the data provided, the expected standard deviation of returns for Kokomo is closest to:

A. 1.3%.

B. 2.5%.

C. 7.1%.

-

Question 867:

GBM stock currently trades at S54 per share and is expected to trade at $62 per share in one year, the required return on the market over the same period is 12%. Which of the following statements about GBM stock is most likely correct?

A. GBM stock has greater than average systematic risk and is undervalued.

B. GBM stock has less than average systematic risk and is overvalued.

C. GBM stock has average systematic risk and is properly valued.

-

Question 868:

Which of the following statements about security market line (SML) is least likely to be true?

A. The SML must be graphed using the standard deviation of the market portfolio.

B. The SML measures risk using the standardized covariance of the stock with the market.

C. Securities plotting above the SML are undervalued.

-

Question 869:

Penny Linn, CFA, predicts that both Stock X and Y will return 20% next year. The Treasury bill rate is 5% and the market risk premium is 8%. The beta for Stock X is 1.5 and for Stock Y is 2. The standard deviation for Stock X is 20% and for Stock Y is 30%. Determine if Linn's predictions lie above or below the security market line.

A. Only Stock X lies below the SML.

B. Only Stock Y lies below the SML.

C. Both Stock X and Stock Y lie below the SML.

-

Question 870:

Bruce Johansen, CFA, is currently fully invested in the market portfolio that lies on the capita! market line (CML). Johansen desires to increase the expected return from his portfolio. Johansen is risk aversebut willing to accept higher risk if he can increase the expected return from his portfolio. According to capital market theory, Johansen can meet his risk and return objectives best by:

A. allocating a higher proportion of the portfolio to higher risk assets

B. borrowing at the risk-free rate to invest in the risky market portfolio

C. owning the risky market portfolio and lending at the risk-free rate

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.