Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:May 11, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 871:

Adding the risk-free asset to a portfolio of risky assets will:

A. decrease portfolio standard deviation because it is uncorrelated with risky assets

B. not affect portfolio standard deviation because it is uncorrelated with risky assets.

C. decrease portfolio standard deviation due to its negative correlation with risky assets

-

Question 872:

Chuck Hill, CFA, is explaining an efficient frontier analysis to one of his clients. Which of Hill's following statements regarding the efficient frontier is correct?

A. The left endpoint of the efficient frontier is represented by the portfolio with the lowest level of risk.

B. Portfolios that are further to the right on the efficient frontier dominate portfolios that are to the left.

C. Only efficient assets are on the efficient frontier.

-

Question 873:

Steve McCool is estimating the expected return and standard deviation of his equity portfolio. Steve has estimated a 20% chance that the portfolio will provide an 8% rate of return, a 40% chance that theportfolio will provide a 10% return, and a 40% chance that the portfolio will provide a 12% rate of return. Calculate the standard deviation of McCool's portfolio.

A. 0.00022

B. 0.01497

C. 0.02240

-

Question 874:

Danielle Paftee, age 55, has an investment account designed to ftind her granddaughter's college education. Paftee's granddaughter is two years old. Paftee also will use the account for intermittent health care expenses for her elderly parents, whose health plans and retirement plans do not adequately cover their expenses. Which of the following statements regarding Paftee's investment objectives and constraints is least likely correct?

A. Paftee has a long-term time horizon.

B. Paftee has an significant liquidity requirement.

C. Paftee should focus on total return with very low current income requirements.

-

Question 875:

Consider two individuals, David Lywie and Julio Stromek who have requested advice on their investment policy statements. Lywie is mid-career, has very little insurance coverage, and has fairly low job-related income expectations. In contrast, Stromek has fairly high net worth and long-term job-related earning potential. Which of the following statements is most likely correct?

A. Lywie has higher risk tolerance than Stromek.

B. Stromek has higher risk tolerance than Lywie.

C. Stromek and Lywie have equivalent levels of risk tolerance.

-

Question 876:

An analyst predicts that the return on Royal Company stock will be 15%. The analyst is provided with the

following data for Royal and the broad market:

Royal Company beta 1.5

Risk-free rate 5%

Expected market return 11 %

From the data, determine if Royal Company stock is undervalued, overvalued, or correctly valued.

A. Overvalued.

B. Undervalued.

C. Correctly valued.

-

Question 877:

An analyst is interested in the relationship between the stock prices of two companies. After downloading a time series of stock prices for each company, the analyst concludes that Company A has a variance equal to 0.25 and Company B has a variance equal to 0.20, and the covariance between the two stocks is -0.10. Calculate the correlation coefficient between the two stocks.

A. -0.45

B. -0.50

C. -1.00.

-

Question 878:

The standard deviation of a two-stock portfolio least likely:

A. must be less than or equal to the weighted-average standard deviation.

B. can be reduced by increasing the relative weight of the stock with lower standard deviation.

C. will be the lowest when the correlation between the two stocks equals zero.

-

Question 879:

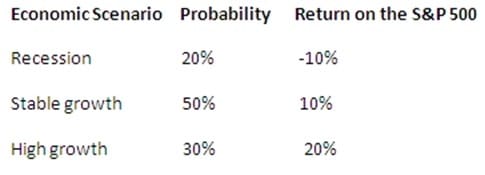

Milra Choudra is considering how to invest her $100,000 investment portfolio- Choudra's investment advisor has recommended that she invest 60% in the SandP 500 stock market index and 40% in the risk-free asset. The advisor has derived the following forecasts for the SandP 500:

Assuming a risk-free rate of 5%, the expected return on Choudra's portfolio is closest to:

A. 6.6%.

B. 7.4%.

C. 9.0%.

-

Question 880:

Carl Vandenberg has been asked to explain the security market line (SML), including its slope. Which of the following is equal to the slope of the SML?

A. Beta.

B. Alpha.

C. Market risk premium.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.