Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:May 11, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 851:

An analyst makes the following two statements about the assumptions underlying the use of the efficient

frontier to construct an optimal portfolio of assets.

Statement 1:Investors believe all investments are represented by a probability distribution of expected

returns.

Statement 2:Investors base investment decisions solely on the expected risk of the investment-Determine

whether each statement correctly describes one of the assumptions.

A. Only Statement 1 is correct.

B. Only Statement 2 is correct.

C. Both Statement 1 and 2 are correct.

-

Question 852:

Joe Finn is a highly paid corporate executive who will retire in two years. Over 25 years ago, Finn invested in a portfolio of growth stocks that has performed quite well. Finn has asked his financialadviser to consider switching from stocks to high-yielding bonds. The investment issue of greatest concern in implementing this strategy will be the client's:

A. liquidity needs.

B. time horizon

C. tax considerations

-

Question 853:

Stephanie Dell is evaluating two stocks (X and Y) using the capital asset pricing model. Dell predicts that the betas for the two stocks will be identical, but that the unsystematic risk for Stock X will be much higher than for Stock Y. Using the capital asset pricing model, determine which of the following statements is correct.

A. Stock X will have a higher expected return than Stock Y, but a standard deviation less than or equal to Stock Y.

B. Stock X will have a higher standard deviation than Stock Y, but an expected return less than or equal to Stock Y.

C. Both the expected return and standard deviation for Stock X will be higher than Stock Y.

-

Question 854:

All portfolios that lie on the capital market line:

A. contain the same mix of risky assets unless only the risk-free asset is held.

B. have some unsystematic risk unless only the risk-free asset is held.

C. contain at least some positive allocation to the risk-free asset.

-

Question 855:

Donald Northerland forecasts the stock return, beta, and standard deviation for three stocks: Cayman, Bonaire, and Lucia. The expected return and standard deviation for the broad market equal 12% and 20%, respectively. The risk-free rate equals 5%.

Using the capital asset pricing model, determine which of the following statements is least likely correct.

A. Cayman is overvalued.

B. Bonaire is undervalued.

C. Lucia is overvalued.

-

Question 856:

William Moore is explaining the attributes and importance of asset allocation for investment portfolios to a group of wealthy individual investors. Which of Moore's following statements is least likely correct?

A. Asset allocation involves assigning policy weights to relevant asset classes.

B. Asset allocation is the process of selecting specific securities to include in the portfolio.

C. 85-95% of a typical portfolio's return can be explained by the target asset allocation.

-

Question 857:

Colin Pollard currently owns a portfolio lying on the Markowitz efficient frontier that has an expected return equal to 15% and a standard deviation equal to 15%. Pollard tells his adviser he would prefer a portfolio tying on the Markowitz efficient frontier with a standard deviation equal to 10%. Which of the following most likely describes the expected return on Pollard's new portfolio?

A. The expected return will be equal to 10%.

B. The expected return will be less than 10%.

C. The expected return will be greater than 10%.

-

Question 858:

Omar Henry is a firm believer in capital market theory and the capita! asset pricing model. Henry has developed a model to select overpriced stocks as indicated by the security market line. The model identifies the overpriced securities and then executes a short position in the overpriced stocks. Which of the following practical conditions would prevent Henry from using his model to explain capital market behavior?

A. All investors use exactly the same two-stage dividend discount model to evaluate stocks.

B. All investors pay the same commission rate of $0.03/share on all equity trades.

C. All changes in Federal Reserve policy are perfectly anticipated by investors.

-

Question 859:

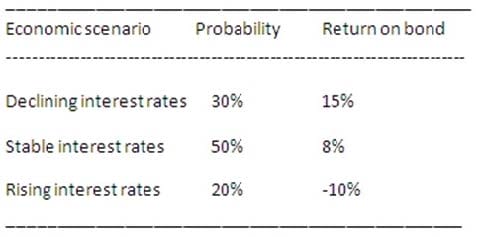

Thomas Reid is planning his $1 million retirement fund and decides to invest $300,000 in stocks, $500,000 in bonds, and $200,000 in Treasury bills. Donna Craig decides to invest all of her $500,000 retirement fund in bonds. The expected return on stocks equals 12% and the expected return on Treasury bills equals 4%. Both investors compare their performance against a benchmark portfolio that equally weights stocks, bonds, and Treasury bills. The following data are provided for bonds: Which portfolio has the highest expected return?

A. Craig's portfolio.

B. Reid's portfolio.

C. The equally weighted benchmark.

-

Question 860:

Greg Burns, CFA, manages a portfolio, P, with expected return equal to 10% and standard deviation equal to 20%. The risk-free rate is 5%. Burns advises Victoria Hull to invest 40% in portfolio P and the remainder in the risk-free asset. The standard deviation for Hull's overall investment will be:

A. 7%.

B. 8%.

C. 12%.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.