Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:Jun 04, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1671:

Two junior portfolio managers at ContraFunds, a hedge fund manager, have been asked to summarize the mechanics of utilizing futures contracts for the firm's training manual. The first manager, Tina Kent, submits a paragraph explaining that administering a futures position will require bringing the margin account balance back to the initial margin level by posting maintenance margin any time the balance falls below the variation margin level. The second manger, Martin Ramsey, submits a paragraph explaining margin requirements are determined according to the daily settlement price which is the average of the last few trades of the day. Are Kent and Ramsey correct or incorrect with regard to their explanation of the mechanics of futures positions?

A. Only Kent is correct.

B. Only Ramsey is correct.

C. Neither is correct.

-

Question 1672:

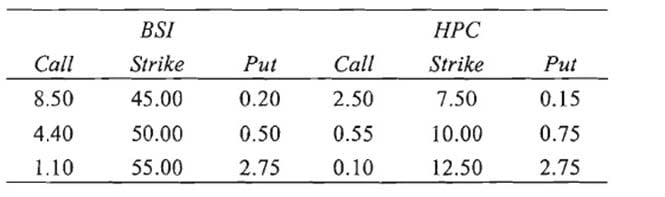

Wilma Green has been following the stock price movements of Bakery Supply International (BSI) and Hull Petrochemical Company (HPC). Green is convinced that the price of BSI stock is going to dramatically increase from its current price of $53.60 and that the price of HPC stock is going to dramatically decrease from its current price of $9.80. She has decided to use options to take advantage of the situation and has thus gathered the following data on three-month put and call options for the two stocks: If after three months, the price of BSI stock is $54.60 and the price of HPC stock is $8.13, which of the following strategies would have yielded Green the greatest profits?

A. Short BSI put with a $45.00 strike; Short HPC call with a S7.50 strike.

B. Long BSI put with a $45.00 strike; Long HPC call with a $7.50 strike.

C. Short BSI call with a $55.00 strike; Long HPC put with a $10.00 strike.

-

Question 1673:

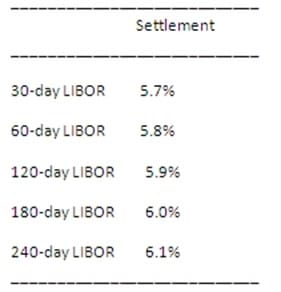

Janice Grass, CFA, created a gourmet baby food line. To get the production lines up and running, she must borrow $12 million. Grass is concerned that the US Federal Reserve (Fed) will raise interest rates dramatically, so she enters into a 2 x 8 FRA agreement. The FRA is quoted at 6%. LIBOR interest rates on the expiration day of the FRA are presented in the table below.

Based on the table, calculate the payoff on Grass' transaction.

A. 0.

B. -$2,630.81

C. -$2,956.39

-

Question 1674:

Coleman Industries' stock is currently trading in the market for a price of $21. Three months ago, Myong Packard wrote a 6-month put option on 100 shares of Coleman stock for a premium of $3. The exercise price on the put option is equal to S25. The put option is now trading in the market for $5.25. Determine the moneyness of the put option.

A. Out-of-the money.

B. In-the-money.

C. At-the-money.

-

Question 1675:

A 1-year U.S. Treasury bill is priced to yield 4.10%. A 2-year U.S. Treasury security is priced to yield 4.65%. The 1-year forward rate one year from now is closest to:

A. 3.55%.

B. 4.38%.

C. 5.20%.

-

Question 1676:

The 8% McClintock bonds maturing in 10 years are currently trading at 97.55. These bonds are option-free and pay coupons semiannually. Which of the following statements is most likely to be TRUE?

A. The yield to maturity is greater than 8.0%.

B. The current yield is less than 8.0%.

C. The nominal yield is greater than 8.2%.

-

Question 1677:

JonesCorp just entered into a plain vanilla interest rate swap as the fixed-rate receiver. The swap has a tenor of four years and makes payments quarterly on a netted basis. At the time the swap was initiated the LIBOR term structure was flat causing LIBOR to be equal to the swap fixed rate. Under which of the following circumstances would JonesCorp be required to make a future net payment to the swap counterparty?

A. The LIBOR term structure becomes upward sloping.

B. The LIBOR term structure remains flat but shifts down.

C. The LIBOR term structure becomes downward sloping.

-

Question 1678:

Gretchen Miller has been analyzing options on the common stock of Spirit Electronics Group (SEG), which last traded on the NASDAQ for $25.96. Miller has collected the following data on put options for SEG stock that expire in three months: StrikePut

22.500.25

25.000.65

27.502.00

Miller has been asked by her supervisor to determine the profit on a protective put strategy using a strike price of $25.00 if the stock price is $27.13 on the option expiration date. What figure should Miller report to her supervisor?

A. $0.00

B. $0.52

C. S0.65

-

Question 1679:

Black Oil is an oil and gas exploration and production company. Black's management hedges its crude oil production using futures contracts. Which of the following would be the least likely method Black would use to close out the futures position?

A. Holding the cash settled future until expiration.

B. Physically settling according to exchange rules.

C. Offsetting the transaction by shorting the oil futures contract on the same exchange.

-

Question 1680:

Two firms, Groening Inc. and Shearer Co., have just completed simultaneous bond issuances. Both issues have a stated coupon rate of 5%, pay interest semiannually, and have a face value of $i,000 per bond. The Groening and Shearer issues both have a maturity of 15 years and their duration is approximately the same. If the Groening bond have a higher convexity measure than the Shearer bonds, which issuance will sell for the higher price?

A. Groening, since the bonds will depreciate less in a period of rising interest rates.

B. Groening, since the bonds will depreciate less in a period of falling interest rates.

C. Shearer, since the bonds will depreciate less in a period of rising interest rates.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.