Exam Details

Exam Code

:CFA-LEVEL-1Exam Name

:CFA Level I - Chartered Financial AnalystCertification

:CFA Institute CertificationsVendor

:CFA InstituteTotal Questions

:3960 Q&AsLast Updated

:Jun 04, 2025

CFA Institute CFA Institute Certifications CFA-LEVEL-1 Questions & Answers

-

Question 1661:

The creation of bond indexes is relatively new. Which of the following is the least likely reason a bond index would be difficult to create?

A. Lack of continuous trading data.

B. Constantly changing duration for bonds.

C. The universe of bonds is limited.

-

Question 1662:

Gregory Johansson has collected the following data on Trilby and Tribble, Ltd: The sustainable growth rate of the firm is closest to:

A. 6.0%.

B. 7.1%.

C. 8.4%.

-

Question 1663:

In explaining the factors in the dividend discount model that affect a stock's expected price-to-earnings (/) ratio, which of the following statements is least accurate? Holding other factors constant:

A. as the difference between k (required rate of return on the stock) and g (expected constant growth rate of dividends) widens, the value of/decreases.

B. as g increases, the value of/increases.

C. as the expected dividend payout ratio decreases, the value of/increases.

-

Question 1664:

Jack George is evaluating Dunger Inc., a waste management firm. The company has been experiencing a strong 15% growth rate, which is forecasted to continue over the next three years before growth settles down to a sustainable level. Dunger's annual return on equity is expected to be 10%. The company recently paid a dividend of $0.50 per share from reported earnings of $2.50 per share. George has calculated a 10% weighted average cost of capital for Dunger Inc. The firm has no debt. The company's last reported trade on the New York Stock Exchange was $35 per share. Based on the multi-stage dividend discount model, George should:

A. not buy the stock because its intrinsic value is $32 per share.

B. buy the stock because its intrinsic value is $38 per share.

C. buy the stock because its intrinsic value is $41 per share.

-

Question 1665:

Harold Stone, CFA, is an analyst for Spartacus Venture Capital. Stone is considering investing $3 million in a project with a potential $150 million return over a ten year life. The current risk-free rate is 5%, the equity risk premium is 5%, and the project's beta is 2.0. Stone believes that the project has a 22% probability of failure in the first four years and 13% thereafter. The expected net present value of the project is closest to:

A. SI million

B. $2 million

C. $3 million

-

Question 1666:

Giovanni DiPaglia is VP of strategic planning for Megaquistion Holdings, a global conglomerate active in the mergers and acquisition market. DiPaglia is looking to invest in a new portfolio company for Megaquistion, and has selected Temptytarg, Inc. as a potential candidate. He has gathered the following information for Temptytarg, Inc. Price/Book Value (P/BV) for Temptytarg is closest to:

A. 1.1.

B. 1.5.

C. 2.0.

-

Question 1667:

Allen Jackson believes the stock of JMH Corporation is severely overvalued. JMH trades for 12.3 times annualized earnings, but Jackson thinks the multiple should be 8.1 times. In order to take advantage of the expected 35% drop in the price, Jackson decides to establish a short position in JMH stock. Which of the following is Jackson least likely to do in order to establish a short position?

A. Borrow the stock from another investor.

B. Reinvest any dividend payments.

C. Post margin with his brokerage firm.

-

Question 1668:

A buy side analyst is discussing the relative functionality of the Australian stock market with her colleagues. She states three specific attributes of the Australian stock market that infer that the market is a well-functioning securities market. She says, 'The Australian stock market is characterized by (1) rapid adjustment of prices to reflect new information, and (2) price continuity in the absence of significant new information." Are these accurate descriptions of attributes of a well functioning market?

A. Both descriptions are accurate.

B. Neither description is accurate.

C. Only one of these descriptions is accurate.

-

Question 1669:

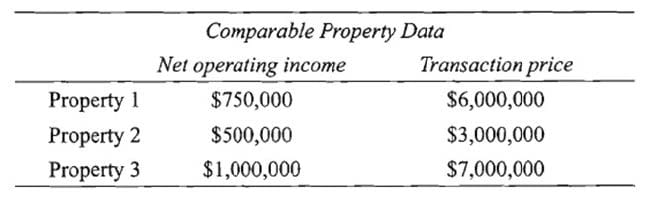

Sandy Hart, CFA, is evaluating the possible purchase of an apartment building. As part of her research, Hart found the following data on three comparable properties:

The market cap rate that Hart would be willing to pay for the apartment building is closest to:

A. 0.125

B. 0.143

C. 0.145

-

Question 1670:

Which of the following would be the most likely reason to use ETFs instead of similar index funds?

A. Lower market risk.

B. Intraday valuation and trading.

C. ETFs do not experience tracking error.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CFA Institute exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CFA-LEVEL-1 exam preparations and CFA Institute certification application, do not hesitate to visit our Vcedump.com to find your solutions here.