Exam Details

Exam Code

:2016-FRRExam Name

:Financial Risk and Regulation (FRR) SeriesCertification

:GARP CertificationsVendor

:GARPTotal Questions

:342 Q&AsLast Updated

:Jun 08, 2025

GARP GARP Certifications 2016-FRR Questions & Answers

-

Question 161:

Which of the following statements is a key difference between customer loans and interbank loans?

A. Customers are less credit-worthy than banks on average and hence yields are higher on average for customer loans as compared to interbank loans

B. Customer loans are of shorter duration than interbank loans

C. Customer loans are easier to sell than interbank loans

D. Interbank loans are more customized than commercial loans

-

Question 162:

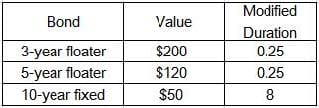

A bank owns a portfolio of bonds whose composition is shown below.

What is the modified duration of the portfolio?

A. 1.30

B. 8.5

C. 2.30

D. 0.5

-

Question 163:

Which one of the following four statements regarding commodity exchanges is INCORRECT?

A. Banks have no natural direct exposure to commodities.

B. Banks trade in OTC contracts primarily to serve clients and facilitate client hedging and lending.

C. Customers rarely trade physical commodities with banks.

D. Commodity markets are mot liquid than debt markets.

-

Question 164:

For two variables, which of the following is equal to the average product of the deviations from their respective means?

A. Standard deviation

B. Kurtosis

C. Correlation

D. Covariance

-

Question 165:

In the United States, stock investors must comply with the Regulation T of the Federal Reserve Bank and may borrow up to ___ of the value of the securities from their brokers.

A. 30%

B. 40%

C. 50%

D. 60%

-

Question 166:

Alpha Bank estimates that the annualized standard deviation of its portfolio returns equal 30%; The daily volatility of the portfolio is closest to which of the following?

A. 1.0%

B. 2.0%

C. 2.5%

D. 3.0%

-

Question 167:

To estimate the price of gold forwards, an investment analyst focuses on the cost of holding physical gold (bullion) and the cost of shorting the same. Given that physical gold spot price is $1,000, the annual risk-free rate is 5%, and the gold lease rate equals 2% annually, the analyst's best estimate of the gold forward price to equal

A. $950

B. $1030

C. $1070

D. $1100

-

Question 168:

On January 1, 2010 the TED (treasury-euro dollar) spread was 0.4%, and on January 31, 2010 the TED spread is 0.9%. As a risk manager, how would you interpret this change?

A. The decrease in the TED spread indicates a decrease in credit risk on interbank loans.

B. The decrease in the TED spread indicates an increase in credit risk on interbank loans.

C. Increase in interest rates on both interbank loans and T-bills.

D. Increase in credit risk on T-bills.

-

Question 169:

Which of the following statements regarding collateralized debt obligations (CDOs) is correct?

I. CDOs typically have loans or bonds as underlying collateral.

II. CDOs generally less risky than CMOs.

III.

There is a correlation among defaults in the CDO collateral which should be considered in valuation of these complex instruments.

A.

I only

B.

I and III

C.

II and III

D.

I, II, and III

-

Question 170:

James Johnson purchased a plain vanilla bond that has modified duration of 10 and convexity of 0.5. If yields increase by 1%, its modified duration is expected to

A. increase by 0.5.

B. increase by 1.5.

C. decrease by 0.5.

D. decrease by 1.5.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only GARP exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your 2016-FRR exam preparations and GARP certification application, do not hesitate to visit our Vcedump.com to find your solutions here.