Exam Details

Exam Code

:2016-FRRExam Name

:Financial Risk and Regulation (FRR) SeriesCertification

:GARP CertificationsVendor

:GARPTotal Questions

:342 Q&AsLast Updated

:Jun 08, 2025

GARP GARP Certifications 2016-FRR Questions & Answers

-

Question 151:

Modified duration of a bond measures:

A. The change in value of a bond when yields increase by 1 basis point.

B. The percentage change in a bond price when yields increase by 1 basis point.

C. The present value of the future cash flows of a bond calculated at a yield equal to 1%.

D. The percentage change in a bond price when the yields change by 1%.

-

Question 152:

John owns a bond portfolio worth $2 million with duration of 10. What positions must he take to hedge this portfolio against a small parallel shifts in the term structure.

A. Long position worth $2 million with duration of 10.

B. Long position worth $20 million with duration of 1.

C. Short position worth $2 million with duration of 10.

D. Short position worth $20 million with duration of 1.

-

Question 153:

Which of the following measure describes the symmetry of a statistical distribution?

A. Mean

B. Standard deviation

C. Skewness

D. Kurtosis

-

Question 154:

Samuel Teng owns a portfolio of bonds and is trying to compute the convexity of his portfolio. Which of the following choices equals the convexity of Samuel's portfolio?

A. Minimum of the convexities of the component bonds

B. Value-weighted average convexity of the component bonds

C. Coupon-weighted average convexity of the component bonds

D. Maximum of the convexities of the component bonds

-

Question 155:

When the cost of gold is $1,100 per bullion and the 3-month forward contract trades at $900, a commodity trader seeks out arbitrage opportunities in this relationship. To capitalize on any arbitrage opportunities, the trader could implement which one of the following four strategies?

A. Short-sell physical gold and take a long position in the futures contract

B. Take a long position in physical gold and short-sell the futures contract

C. Short-sell both physical gold and futures contract

D. Take long positions in both physical gold and futures contract

-

Question 156:

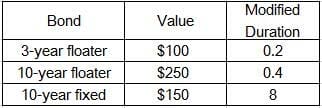

A portfolio consists of two floating rate bonds and one fixed rate bond.

Based on the information below, modified duration of this portfolio is

A. 2.64

B. 3.00

C. 4.28

D. 4.44

-

Question 157:

Sam has hedged a portfolio of bonds against a small parallel shift in the yield curve using the duration measure. What should Sam do to ensure that the portfolio is hedged against larger parallel shifts in the yield curve?

A. Take positions to reduce the duration

B. Take positions to increase the duration

C. Take positions to make the convexity zero

D. Since the portfolio is duration hedged Sam does not need to take additional positions.

-

Question 158:

What does correlation between two variables measure?

A. Symmetry of a joint distribution of the two variables.

B. Association between the two variables and the strength of a possible statistical relationship.

C. The proportion of variability in one of the variables that is explained by the other.

D. Extreme returns of both variables.

-

Question 159:

Which one of the following four statements regarding floating rate bonds is incorrect?

A. Floating rate bonds have coupon payments tied to floating interest rates or floating interest rate indexes.

B. Floating rate bonds typically have less price risk than fixed rate bonds.

C. Floating rate bonds are very sensitive to changes in interest rates.

D. Floating rate bonds only have a small degree of interest rate risk.

-

Question 160:

Banks duration match their assets and liabilities to manage their interest risk in their banking book. A bank has $100 million in interest rate sensitive assets and $100 million in interest rate sensitive liabilities. Currently the bank's assets have a duration of 5 and its liabilities have a duration of 2. The asset-liability management committee of the bank is in the process of duration-matching. Which of the following actions would best match the durations?

A. Increase the duration of liabilities by 2 and increase the duration of assets by 1.

B. Increase the duration of liabilities by 2 and decrease the duration of assets by 1.

C. Decrease the duration of liabilities by 1 and increase the duration of assets by 1.

D. Decrease the duration of liabilities by 1 and decrease the duration of assets by 1.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only GARP exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your 2016-FRR exam preparations and GARP certification application, do not hesitate to visit our Vcedump.com to find your solutions here.