Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 27, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 821:

A working capital technique which delays the outflow of cash is

A. Factoring.

B. A draft.

C. A lock-box system.

D. Electronic funds transfer.

-

Question 822:

Average daily collection of checks for a firm is $40,000.The firm also writes on the average $35,000 of checks daily. If the collection period for checks is 5 days, calculate the net float.

A. $25,000

B. $40,000

C. $175,000

D. $200,000

-

Question 823:

What is the be naif for affirm with daily sales of $15,000 to be able to speed up collections by2 days, assuming an 8% annual opportunely cost of funds?

A. $2,400 daily benefit.

B. $2,400 annual benefit.

C. $15,000 annual benefit.

D. $30,000 annual benefit.

-

Question 824:

The carrying costs associated with inventory management include

A. Insurance costs, shipping costs, storage costs, and obsolescence.

B. Storage costs, handling costs, capital invested, and obsolescence.

C. Purchasing costs, shipping costs, set-up costs, and quantity discounts lost.

D. Obsolescence, set-up costs, capital invested, and purchasing costs.

-

Question 825:

The level of safely stocking inventory manage mend depends on all of the following except the

A. Level of uncertainty of the sales forecast.

B. Level of customer dissatisfaction for back orders.

C. Cost of running out of inventory.

D. Cost to reorder stock.

-

Question 826:

The economic order quantity for a product is 500 units. However, new orders require 4 working-days lead time during which 80 units will be used. Given this information, the correct economic order quantity' is

A. 420 units.

B. 500 units.

C. 509 units.

D. 580 units.

-

Question 827:

As a company becomes more conservative with respect to working capital policy, it would tend to have a

(n)

A.

Increase in the ratio of current liabilities to concurrent liabilities.

B.

Decrease in the operating cycle.

C.

Decrease in the quick ratio.

D.

Increase in the ratio of current assets to concurrent assets.

-

Question 828:

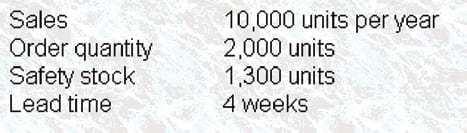

The following information regarding inventor policy was assembled by the JRJ Corporation. The company uses a 50- week year in all calculations.

The reorder point is

A. 3,300 units.

B. 2,100 units.

C. 800 units.

D. 1,300 units.

-

Question 829:

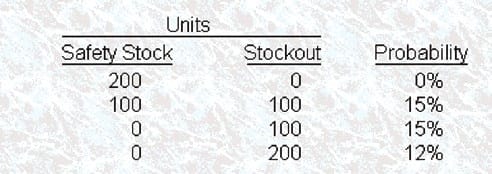

Handy operates a chain of hardware stores across Ohio. The controller wants to determine the optimum safely stock levels for an air purifier unit. The inventory manager compiled the following data: ?The annual carrying cost of inventory approximates 20% of the investment in inventory. ?The inventory investment per unit averages $50. ?The stock out cost is estimated to be $5 per unit. ?The company orders inventory on the average of 10 times per year. ?Total cost = carrying cost + expected stock out cost. ?The probabilities of a stock out per order cycle with varying levels of safely stock are as follows:

The total cost of safely stock on an annual basis with a safely stock level of 100 units is

A. $1750

B. $1950

C. $550

D. $2000

-

Question 830:

A major supplier has offered Alpha Corporation a year-end special purchase whereby Alpha could purchase 180,000 cases of sport drink at $10 per case. Alpha normally orders 30,000 cases per month at $12 per case. Alpha's cost of capital is 9%. In calculating the overall opportunity cost of this offer, the cost of carrying the increased inventory would be

A. $32,400

B. $40,500

C. $64,800

D. $81,000

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.