Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 27, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 811:

Which one of the following would increase the networking capital ofa firm?

A. Cash payment of payroll taxes payable.

B. Purchase of a new plant financed by a 20-year mortgage.

C. Cash collection of accounts receivable.

D. Refinancing a short-term note payable with a two-year note payable.

-

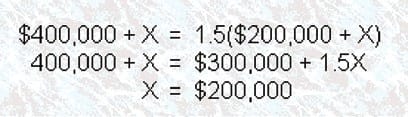

Question 812:

A firm's current ratio is 2to 1. Its bond indenture states that its current ratio cannot fall below 1.5 to 1.11 current liabilities are $200,000, the maximum amount of new short- term debt the firm can assume in or deer to finance invent Tory with out defaulting is

A. $200,000

B. $66,667

C. $266,667

D. $150,000

-

Question 813:

All of the following are inventory carrying costs except

A. Storage.

B. Insurance.

C. Opportunity cost of inventory investment.

D. Inspections.

-

Question 814:

An automated clearinghouse (ACH) electronic transfer is a(n) A. Electronic payment to a company's account at a concentration bank.

B. Check that must be immediately cleared by the Federal Reserve Bank.

C. Computer-generated deposit ticket veiling deposit of funds.

D. Check-like instrument drawn against the pay or and not against the bank.

-

Question 815:

All of the following are valid reasons flora business to hold cash and marketable securities except to

A. Sati's N compensating balance requirements.

B. Maintain adequate cash needed for transactions.

C. Meet future needs.

D. Earn maximum returns on investment assets.

-

Question 816:

A company serves as a distributor of products by ordering finished products once a quarter and using that inventory to accommodate the demand over the quarter. If it plans to ease its credit policy for customers, the amount of products ordered for its inventory every quarter will be

A. Increased to accommodate higher sales levels.

B. Reduced to offset the increased cost of carrying accounts receivable.

C. Unaffected if safety stock is part of the current quarterly order.

D. Unaffected if the JIT inventory control system is used.

-

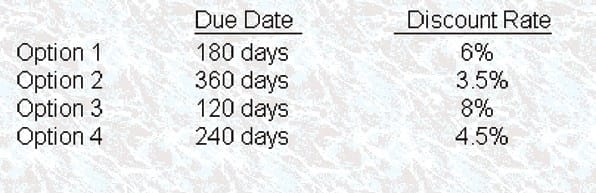

Question 817:

Hendrix, Inc. is interested in purchasing a $100 U.S. Treasury bill andwas presented with the following options:

If Hendrix wishes to buy the Treasury bill at the lowest purchasing price, which option should be chosen, assuming a 360-day year?

A. Option 1.

B. Option 2.

C. Option 3.

D. Option 4.

-

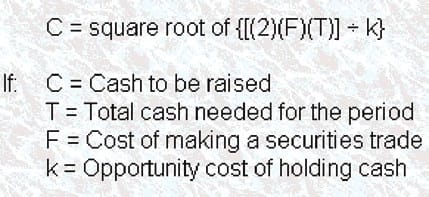

Question 818:

Determining the amount and timing of conversions of marketable securities to cash is a critical element of a financial manager's performance. In terms of the rate of return forgone on converted securities and the cost of such transactions, the optimal amount of cash to be raised by selling securities is

A. Inversely related to the rate of return forgone and directly related to the cost of the transaction.

B. Directly related to the rate of return forgone and directly related to the cost of the transaction.

C. Directly related to the rate of return forgone and inversely related to the cost of the transaction.

D. Inversely related to the rate of return forgone and inversely related to the cost of the transaction.

-

Question 819:

All decisions by financial managers should be driven by the primary goal to

A. Maximize revenues.

B. Minimize fixed costs and variable costs.

C. Stabilize growth.

D. Maximize stockholder wealth

-

Question 820:

A credit card account that charges interest at the rate of 1.25% per month would have an annually compounded rate of (Column 1) and an APR of (Column 2).

Column 1 Column 2

A. 16.08% 15%

B. 14.55% 16.08%

C. 12.68% 15%

D. 15% 14.55%

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.