Exam Details

Exam Code

:CPP-REMOTEExam Name

:Certified Payroll ProfessionalCertification

:APA CertificationsVendor

:APATotal Questions

:249 Q&AsLast Updated

:Jun 27, 2025

APA APA Certifications CPP-REMOTE Questions & Answers

-

Question 151:

Which of the following forms is completed by an individual who is eligible for and wishes to receive advance payment of the earned income credit?

A. W-4S

B. W-4

C. W-5

D. W-10

-

Question 152:

The popular term used to describe traditional theories and perceptions is":

A. Paradigm

B. Cognizance

C. Presumption

D. Hypothesis

-

Question 153:

Assuming that the moving expense was incurred in 2009, which of the following expense reimbursements is excludable from gross income?

A. Travel expenses of spouse to search for new residence at new job location

B. Mileage for a pre-move house hunting trip

C. Lodging expenses while waiting for the new home to be built

D. Mileage while moving from the old residence to the new

-

Question 154:

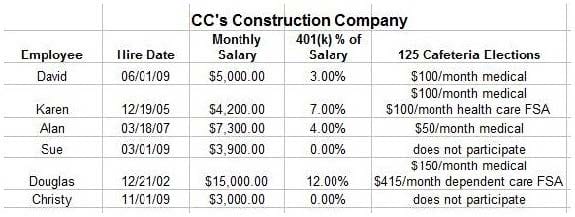

What is the total amount that must be reported in box 14?

A. $4,980

B. $ 0

C. $10,480

D. $23,582

-

Question 155:

Which of the following statements describes a self-insured workers' compensation plan?

A. The employer funds the workers' compensation payments

B. The state pays the workers' compensation payments

C. The wages will continue as if the employee is still working

D. The individual employee is responsible for his own insurance

-

Question 156:

Using federal child support guidelines, calculate the maximum amount of support that can be withheld from an employee's semimonthly disposable earnings of $1,500.00. The employee is four months in arrears in making child support payments and has no other dependents.

A. $900.00

B. $825.00

C. $750.00

D. $975.00

-

Question 157:

Under the existing NACHA rules, amounts transmitted to the RDFI by 5:00 p.m. the day before payday must be posted to employees' accounts no later than:

A. The evening before payday

B. The end of the business day on payday

C. The opening of the business day on payday

D. Two days before payday

-

Question 158:

The final due date for the second quarter Form 941, assuming that the employer paid all taxes on time is:

A. August 10

B. June 30

C. July 10

D. July 31

-

Question 159:

The annual "bright-line" salary test to meet the definition of exempt under the FLSA is:

A. $90,000

B. $100,000

C. $50,000

D. $45,500

-

Question 160:

Which of the following employees' wages is likely to be exempt from FICA?

A. A parent working for a child

B. A spouse working for a spouse

C. A statutory employee

D. A child under age 18 employed by a parent

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only APA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CPP-REMOTE exam preparations and APA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.