Exam Details

Exam Code

:CIMAPRO19-P02-1Exam Name

:P2 - Advanced Management AccountingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:202 Q&AsLast Updated

:Jun 29, 2025

CIMA CIMA Certifications CIMAPRO19-P02-1 Questions & Answers

-

Question 31:

A company comprises several divisions.

One of these divisions was originally expected to earn an operating profit next year of $800,000 on net assets of $4 million.

However, the divisional manager is considering investing in a project that would generate a project return on investment (ROI) of 38% on additional net assets of $500,000. What would be the divisional ROI next year if the project was

implemented? Give your answer to the nearest percentage.

A. 22 %

-

Question 32:

A company is determining the selling price for its new product. At a selling price of $16 per unit there will be zero demand but for every $1 reduction in the price, demand will increase by 100 units per period.

Production must be in batches of 100 units. The variable cost per unit will be $8 if 400 units are produced in a period. For each additional batch produced in a period the variable cost per unit will increase by $1 per unit for the additional batch

only.

No inventories will be held.

Which of the following sales and production volumes will generate the highest contribution per period?

A. 400 units

B. 500 units

C. 600 units

D. 700 units

-

Question 33:

Which of the following statements are fundamental concepts that underlie the Beyond Budgeting approach?

1.

Use traditional budgeting in conjunction with other techniques.

2.

Use adaptive management processes rather than the more rigid annual budget.

3.

Move towards devolved networks rather than centralized hierarchies.

4.

Move towards centralized hierarchies rather than devolved networks.

A. Statements 1 and 2 apply.

B. Statements 1, 2 and 3 apply.

C. Statements 2 and 3 apply.

D. Statements 2, 3 and 4 apply.

-

Question 34:

A company has recently developed a new lawnmower with an estimated market life of 5 years. Production and sale of the lawnmower will require investment in new production equipment costing $750,000. It is expected that this equipment

could be sold back to the original vendor for $50,000 at the end of five years.

Purchase of the equipment would be financed by a 5 year fixed rate bank loan at an interest rate of 6%.

A manager already employed by the company would be moved from their current position to manage production of the new lawnmower. Their original position would be filled by a new recruit on a fixed annual salary of $35,000.

Which of the following statements is NOT correct?

A. If the lawnmower is a failure then management can terminate the project early and sell the equipment, giving them an abandonment option.

B. The salary of the replacement manager is a relevant cash flow in the decision.

C. The interest costs on the bank loan are a relevant cash flow in the decision.

D. Launching a new lawnmower gives an opportunity to launch more new versions and provides a follow-on option.

-

Question 35:

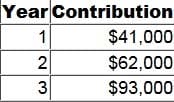

A company is considering investing $150,000 in a project which will generate the following contributions during the first three years. Tax depreciation allowance is 25% each year of the reducing balance.

The taxation rate is 30% of taxable profits and tax is payable in the year after that in which it arises. To the nearest $10, what is the forecast total project cash flow in year 3?

A. $82,840

B. $74,400

C. $85,650

D. $71,430

-

Question 36:

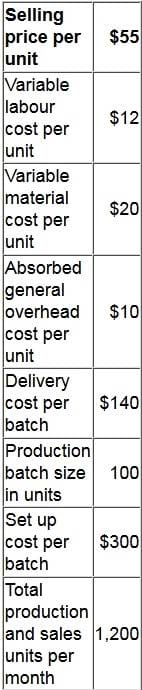

A large manufacturing company sells a range of products. Details of one of these products are as follows.

Each completed batch is delivered immediately in full to the one customer that purchases this product. The delivery vehicle is currently only 50% full when it makes these deliveries. The customer will accept deliveries of any size.

Managers are considering changing the production batch size to 150 units. Increased material storage would be needed; this can be rented nearby at a cost of $1,500 per month.

The additional storage facility would enable an increase in the reorder quantity for the materials. As a result a 5% discount would be received on all materials purchased. Using direct product profitability (DPP), what will be the monthly profit

attributable to the product if the production batch size is changed to 150 units?

Give your answer to the nearest whole $.

A. $23780

-

Question 37:

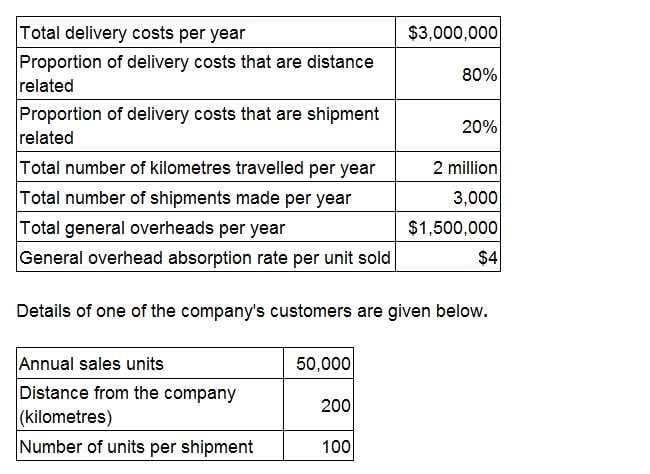

A large company that sells a single product has many customers. The contribution per unit of the product is $40. Data for the company as a whole are given below.

Using customer profitability analysis, what is the total annual profit for this customer?

A. $1,660,000

B. $1,780,000

C. $1,460,000

D. $2,340,000

-

Question 38:

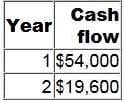

A project requires an initial investment of $50,000. It will generate positive cash flows for two years as follows.

The cost of capital is 12% per year.

What is the equivalent annual net present value of the project? Give your answer to the nearest $10.

A. $8191

-

Question 39:

It is often claimed that a two-part transfer pricing system offers a number of advantages to organizations which use it. Which of the following statements is NOT an advantage of using a two-part transfer pricing system?

A. Transfers are made at the marginal cost of the supplying division and both divisions should be able to report profits from inter-divisional trading.

B. The receiving division is made aware of and charged for the full cost of obtaining intermediate products from other divisions.

C. It stimulates planning, communication and coordination amongst divisions.

D. The agreed fixed fee simply compensates the supplying division for incurring the fixed costs associated with the item transferred.

-

Question 40:

Which of the following statements is NOT correct?

Transfer prices between responsibility centers should be set at a level that:

A. provides an artificial selling price that enables the transferring division to earn a return for its efforts and the receiving division to incur a cost for benefits received.

B. enables profit centre performance to be measured 'commercially'.

C. encourages a balance of goal congruence, managerial effort and centralized management.

D. encourages profit centre managers to agree on the amount of goods and services to be transferred at a level that is consistent with organizational aims.

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRO19-P02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.