Exam Details

Exam Code

:CIMAPRO19-P02-1Exam Name

:P2 - Advanced Management AccountingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:202 Q&AsLast Updated

:Jun 29, 2025

CIMA CIMA Certifications CIMAPRO19-P02-1 Questions & Answers

-

Question 21:

A company is considering investing $680,000 in a machine to manufacture a new product. A consultant has been appointed to advise on the investment and the company is committed to paying $10,000 to the consultant in year 1, even if the project does not go ahead. 300,000 units of the new product will be produced and sold each year. Unit cost and revenue information based on this level of output is as follows.

60% of the overhead cost is variable. Of the remainder, 10% consists of allocated head office overheads.

The selling price will increase by 2% each year in line with inflation, beginning in year 2. Fixed price contracts mean that all unit costs will remain unaltered.

Taxation information:

100% first year allowance will be available for the purchase of the machinery.

The taxation rate is 30% of taxable profits, payable in the year after that in which the liability arises.

For the purpose of deciding whether to proceed with the investment, what is the relevant cash flow in year 2?

A. $1,102,320

B. $1,099,320

C. $1,326,960

D. $1,288,800

-

Question 22:

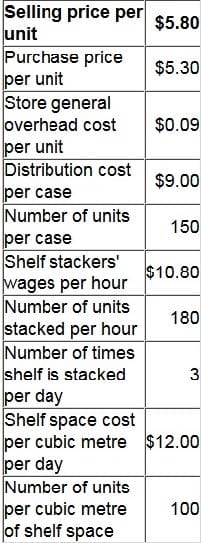

A large supermarket is applying direct product profitability analysis to establish the profit earned by each of the products it sells. Data for product P are as follows.

The shelf is stacked each time that all units are sold and there are no units of product P left unsold at the end of each day. What is the direct product profit per unit of product P? Give your answer to the nearest $0.01.

A. $0.34

-

Question 23:

An organization is considering purchasing a new machine which will cost $600,000. The new machine will generate cost savings of $200,000 each year for five years. The cost of capital is 12%. The profitability index (PI) for the investment in

the new machine is:

Give your answer to one decimal place.

A. 1.2, 0.2

-

Question 24:

Which TWO of the following are reasons why cost-based approaches to transfer pricing are often used in practice?

A. The buying division will want to maximize its profits.

B. The transferring division will want to maximize its profits.

C. Because the external market is imperfect.

D. Because there is often no external market for the product that is being transferred.

E. The approach allows the organization to cover all the costs.

-

Question 25:

If transfer prices are set at variable costs, the supplying division does not cover its fixed costs. Which of the following does NOT resolve this problem?

A. Each division can be given a share of the overall contribution earned by the organization.

B. A system of dual pricing can be adopted.

C. Reduce the level of fixed costs.

D. Central management can impose a range within which the transfer price should fall.

-

Question 26:

A firm of accountants uses an activity-based costing system. The firm's costing system permits staff to indicate specific tasks undertaken for clients, such as requesting missing information. The amount charged for a request for missing

information is based on the following analysis. Each request takes an average of 15 minutes of professional staff time. Professional staff are charged out at $100 per hour.

Administrators then process the information request and prepare a standard letter. The average time administration staff spend on each information request is 20 minutes. The cost of administration staff at the firm is $75,600 per year.

Administration staff work for a total of 6,000 hours per year. The cost of printing and posting a letter is $1.

Calculate the cost of an information request.

Give your answer to 2 decimal places.

A. $30.20

-

Question 27:

SQ has the opportunity to invest in project X. The net present value for project X is $12,600. Cash inflows occur in years 1, 2 and 3. The company's cost of capital is 14%. Calculate the annualized equivalent annuity of project X. Give your answer to the nearest whole $.

A. $5429

-

Question 28:

The net present value of the cost of operating a machine for the next 4 years is £6,340. The discount rate used is 10%.

What is the equivalent annual cost and the present value of the cost in perpetuity of operating this machine?

Use discount factors to 3 decimal places.

A. Equivalent annual cost = £92,825 Present value of cost in perpetuity = £9,283

B. Equivalent annual cost = 9,283 Present value of cost in perpetuity = £92,825

C. Equivalent annual cost = £2,000 Present value of cost in perpetuity = £20,000

D. Equivalent annual cost = £20,000 Present value of cost in perpetuity = £2,000

-

Question 29:

A company has a 31 December year end and pays corporation tax at a rate of 30%. Corporation tax is payable 12 months after the end of the year to which the cash flows relate. The company can claim tax allowable depreciation at a rate of

25% reducing balance. It pays $1 million for a machine on 31 December 20X4. The company's cost of capital is 10%.

What is the present value of the benefit of the first portion of tax allowable depreciation?

A. $250,000

B. $227,500

C. $75,000

D. $68,175

-

Question 30:

Which TWO of the following expressions are correct?

A. 1 + money rate = (1 + real rate) x (1 + inflation rate)

B. 1 + real rate = (1 + money rate) / (1 + inflation rate)

C. 1 + real rate = (1 + inflation rate) / (1 + money rate)

D. 1 + money rate = (1 + inflation rate) / (1 + real rate)

E. 1 + inflation rate = (1 + money rate) x (1 + real rate)

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRO19-P02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.