Exam Details

Exam Code

:CIMAPRO19-P02-1Exam Name

:P2 - Advanced Management AccountingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:202 Q&AsLast Updated

:Jun 29, 2025

CIMA CIMA Certifications CIMAPRO19-P02-1 Questions & Answers

-

Question 101:

The following calculation of the net present value (NPV) of a project has been produced.

By how much can the forecast revenue decrease before the project is not viable?

A. 7.2%

B. 35.6%

C. $20,000 per year

D. $21,380 in total

-

Question 102:

A manager must decide which one of three projects should be implemented. For each project the possible outcomes and their associated probabilities can be estimated reliably. The manager has decided to make the decision based solely on

which project has the highest expected value of profit.

Which of the following statements are correct?

Select ALL that apply.

A. The manager will select the project with the lowest standard deviation.

B. The range of possible outcomes for each project is not important to the manager.

C. The decision is characterized by uncertainty and the manager is risk seeking.

D. The manager will select the project with the highest of all of the possible outcomes.

E. The decision is characterized by risk and the manager is risk neutral.

-

Question 103:

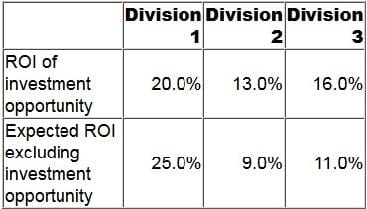

A company has three divisions, each of which is an investment centre. The divisional managers' performance is assessed using return on investment (ROI). A higher ROI will result in a higher bonus for the divisional manager.

The company's cost of capital is 15%.

For the forthcoming year each divisional manager has one investment opportunity available as follows:

The manager(s) of which division(s) will proceed with their respective investment opportunity?

A. Division 1 and Division 3

B. Division 2 and Division 3

C. Division 3 only

D. Division 1 only

-

Question 104:

An organization has a decentralized structure in which division A supplies division B with an intermediate product for which there is no external market. Division B carries out further processing and then sells the final product on the external

market. Due to organizational policy the current transfer pricing basis is variable cost.

The manager of division A has stated, "The current transfer price is unfair because it does not enable us to recoup our costs".

The manager of division B has stated, "The current transfer pricing system enables us to quote competitive prices for the finished product".

The Chief Executive of the organization is considering imposing a transfer pricing policy that uses dual pricing.

Dual pricing would:

A. be welcomed by the manager of division A but the manager of division B would resist it.

B. be welcomed by both divisional managers.

C. increase divisional autonomy.

D. involve a lump sum payment to division A in addition to the payment of the variable cost per unit.

-

Question 105:

A goal congruent transfer price will always:

A. motivate divisional managers by maximising divisional autonomy.

B. align the decision making of divisional managers with the objectives of the organization as a whole.

C. align the decision making of divisional managers with the maximization of divisional profit.

D. ensure that profits are shared equally between the supplying and receiving divisions.

-

Question 106:

Three years ago the large number of faulty products being returned by its customers resulted in a company adopting total quality management (TQM). The company has increased expenditure on staff training and product inspections. This

has resulted in a reduction in the number of faulty products returned.

Which of the following statements is correct?

A. Spending more on conformance costs has resulted in a reduction in internal failure costs.

B. Spending more on conformance costs has resulted in a reduction in external failure costs.

C. Spending more on non-conformance costs has resulted in a reduction in conformance costs.

D. Spending more on prevention costs has resulted in a reduction in appraisal costs.

-

Question 107:

An organization is comprised of two divisions. One of the divisions manufactures a product that it sells both to an imperfect external market and to the other division. The organization wishes to establish the most suitable basis for the transfer

price for this product and is considering either a negotiated transfer price or a market-based transfer price.

Which of the following statements is correct?

A. A negotiated transfer price could help to overcome the problem of establishing a single price for this external market.

B. A single market price for all of the division's output can be determined easily whereas a negotiated transfer price may result in protracted negotiations.

C. A negotiated transfer price will always result in goal congruence whereas this is not always true when using a single market-based transfer price.

D. A market-based transfer price will ensure both divisional autonomy and goal congruence because part of the division's output is sold to the external market.

-

Question 108:

Which of the following is a correct description of the key features of net present value?

A. It adjusts the relevant cash flows of a project to reflect the time value of money. The discount rate used is always the company's weighted average cost of capital.

B. It adjusts the relevant cash flows of a project to reflect the time value of money. The discount rate used reflects the risk of the project.

C. It adjusts the relevant profits of a project to reflect the time value of money. The discount rate used reflects the risk of the project.

D. It adjusts the relevant cash flows of a project after the deduction of depreciation charges to reflect the time value of money. The discount rate used is always the company's weighted average cost of capital.

-

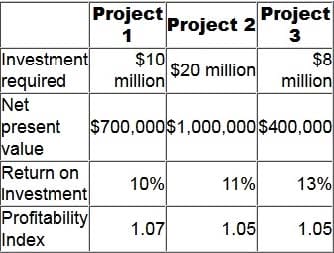

Question 109:

A company has a cost of capital of 12% and a maximum of $20 million to invest. It has identified three possible investment projects, none of which is divisible, as follows.

Which project(s) should the company invest in?

A. Project 1 only

B. Project 2 only

C. Project 3 only

D. Projects 1 and 3 only

-

Question 110:

An organization uses a balanced scorecard approach to performance measurement, both at the corporate level and to assess the performance of each of its responsibility centre managers. Which THREE of the following statements are valid in respect of the effect of this approach on the behavior of the responsibility centre managers?

A. It encourages them to focus mainly on short-term financial measures.

B. It provides them with a range of performance measures to discourage a tendency to focus on only one measure.

C. It provides them with clear guidance as to how customer satisfaction problems should be solved.

D. It encourages them to make decisions that are in line with corporate objectives.

E. It encourages them to identify, and deal with, problems at an earlier stage.

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRO19-P02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.