Exam Details

Exam Code

:CIMAPRO19-P02-1Exam Name

:P2 - Advanced Management AccountingCertification

:CIMA CertificationsVendor

:CIMATotal Questions

:202 Q&AsLast Updated

:Jun 29, 2025

CIMA CIMA Certifications CIMAPRO19-P02-1 Questions & Answers

-

Question 121:

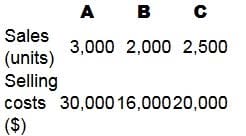

One of a company's products is sold to three customers: A, B and C. These customers do not buy anything else from the company. The product costs $20 per unit to manufacture and is sold to the customers for $50 per unit. The following table shows data for sales and selling costs for the latest period.

Delivery costs of $32,000 and general overheads of $60,000 were incurred during the period. Deliveries to customers A and B were made by a courier in batches of 100 units; the courier charged $300 for each batch delivered to customer A and $400 for each batch delivered to customer B. Deliveries to customer C were made by mail in batches of 10 units at a cost of $60 per batch.

Which of the following statements is correct?

A. Customers B and C have the same profit:sales ratio.

B. Customer A has the highest sales revenue, the highest profit, and the highest profit:sales ratio

C. Customer B has the lowest sales revenue, the lowest profit, and the lowest profit:sales ratio.

D. Customer B has the highest profit:sales ratio.

-

Question 122:

Which of the following statements about modified internal rate of return (MIRR) and internal rate of return (IRR) is correct?

A. MIRR uses a more realistic reinvestment assumption than IRR.

B. MIRR favours projects with long payback periods whereas IRR does not.

C. MIRR and IRR will always rank competing projects in the same order.

D. A project's MIRR will always be higher than its IRR.

-

Question 123:

When considering a capital investment, relevant costs for decision making have which THREE of the following features?

A. They are future costs.

B. They are committed costs.

C. They are incremental costs.

D. They are unavoidable costs.

E. They are cash flows.

-

Question 124:

An organization employs a dual pricing basis for the transfer of components between its divisions. This means that:

A. each division has a separate transfer price for a single transaction.

B. the transfer price is based on marginal cost with a separate charge to allow for fixed costs.

C. the transfer price is based on the cost of the product plus a mark-up for profit.

D. the transfer price is based on the market price less a discount.

-

Question 125:

The starting point for developing a balanced scorecard for an organization should be:

A. the organization's vision and strategy

B. the external market that the organization is operating in

C. benchmarking the organization's current performance

D. the organization's non-financial targets

-

Question 126:

A company is comprised of two divisions, each of which manufactures a single product. Division A manufactures a product which can be sold in a perfect external market or transferred as an intermediate product to division B. Division B

finishes the intermediate product and sells this in a perfect external market.

Due to company policy, internal transfers are recorded at the external market price. At this transfer price both divisions make a profit from their activities. Which of the following will NOT be achieved by the company's transfer pricing policy?

A. Divisional autonomy

B. A fair basis for divisional performance evaluation

C. Motivation of divisional managers to produce and sell as much as possible

D. Goal congruence

-

Question 127:

In an inflationary environment which is the correct way of calculating net present value (NPV)?

A. Using nominal cash flows and a nominal discount rate.

B. Forecasting the cash flows including the effect of inflation and then using a real discount rate.

C. Using real cash flows and a nominal discount rate.

D. Forecasting the cash flows excluding the effect of inflation and then using a nominal discount rate.

-

Question 128:

An organization's transfer pricing system involves:

The transferring division receiving $20 per unit; an amount equal to its variable costs.

The receiving division paying an additional $30,000 every month to the transferring division.

Which transfer pricing system is the organization using?

A. Dual transfer prices

B. Two part tariff

C. Cost-plus

D. Variable cost plus opportunity cost

-

Question 129:

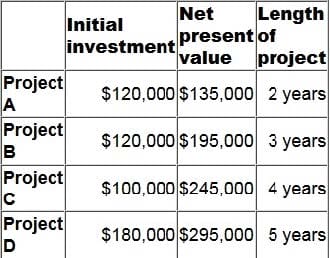

The following data are available for four projects with unequal lives.

A 10% discount rate is appropriate for all four projects.

Which project has the highest equivalent annual benefit?

A. Project A

B. Project B

C. Project C

D. Project D

-

Question 130:

An organization wishes to make its investment decisions on the basis of more than simply a financial appraisal. Which of the following will assist it to take into account both qualitative and quantitative factors?

A. Cost Benefit Analysis

B. Profitability Index

C. Discounted Payback

D. Modified Internal Rate of Return

Related Exams:

CIMA-BA1

BA1 - Fundamentals of Business EconomicsCIMA-BA2

BA2 - Fundamentals of Management AccountingCIMA-BA3

BA3 - Fundamentals of Financial AccountingCIMA-BA4

BA4 - Fundamentals of Ethics, Corporate Governance and Business LawCIMA-CS3

CS3 - Strategic Case Study 2021CIMA-E1

E1 - Managing Finance in a Digital WorldCIMA-E2

E2 - Managing PerformanceCIMA-E3

E3 - Strategic ManagementCIMA-F1

F1 - Financial ReportingCIMA-F2

F2 - Advanced Financial Reporting

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only CIMA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CIMAPRO19-P02-1 exam preparations and CIMA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.