Exam Details

Exam Code

:CCPExam Name

:Certified Cost Professional (CCP)Certification

:AACE International CertificationsVendor

:AACE InternationalTotal Questions

:115 Q&AsLast Updated

:Jul 12, 2025

AACE International AACE International Certifications CCP Questions & Answers

-

Question 21:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures

were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the 25 year after tax present worth of this project?

A. $13,738

B. $137,466

C. $(22,533)

D. $22,533

-

Question 22:

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

A contractor must purchase a piece of equipment for $150,000. It has an estimated life of 10 years with no salvage value at the end. Ten years from now it will be necessary to purchase another piece of equipment, but this time it will cost $250,000. How much will the contractor need to invest at the end of each year in order to have the right amount?

A. $15,687

B. $12,550

C. $16,273

D. $9,412

-

Question 23:

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses. If you are scheduled for a $100,000 payment at the end of each year for the next five years, what is the equivalent amount if you were to make a lump sum payment now?

A. $162,370

B. $679,397

C. $379,100

D. $500,000

-

Question 24:

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather

than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital

recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses. If the company needs to repay a loan of $100,000 in 10 uniform annual payments, how much will each payment be?

A. $16,380

B. $16,578

C. $15,937

D. $16,273

-

Question 25:

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather

than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital

recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses. Five years from now it is required the company have $100,000. How much money should be invested at the end of each year to reach this?

A. $15,937

B. $15,397

C. $16,380

D. $13,168

-

Question 26:

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses. If $20,000 is invested at the end of each fiscal year for the next 10 years, how much would our total investment be worth assuming the interest is at 10%?

A. $289,370

B. $318,740

C. $265,798

D. $420,236

-

Question 27:

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather

than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital

recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses. If $10,000 is scheduled to be paid out 5 years from now, what is the minimum amount we can invest today?

A. $3,855

B. $8,129

C. $6,209

D. $3,791

-

Question 28:

The following question requires your selection of CCC/CCE Scenario 28 (3.7.50.1.7) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses. Given a unit price contract between the owner and contractor, each assumes the following:

A. Bid unit rate, owner quantities can exceed estimate range Contractor can perform above

B. Bid unit rate, owner quantities are within estimate range

C. Contractor can perform at or below bid unit rate, owner quantities can exceed estimate range

D. Contractor can perform at or below bid unit rate, owner quantities are within estimate range

-

Question 29:

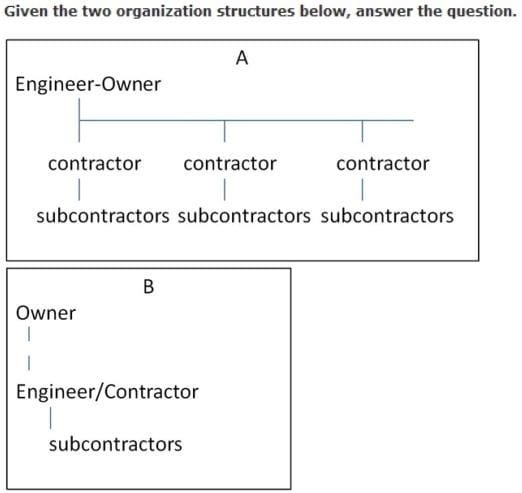

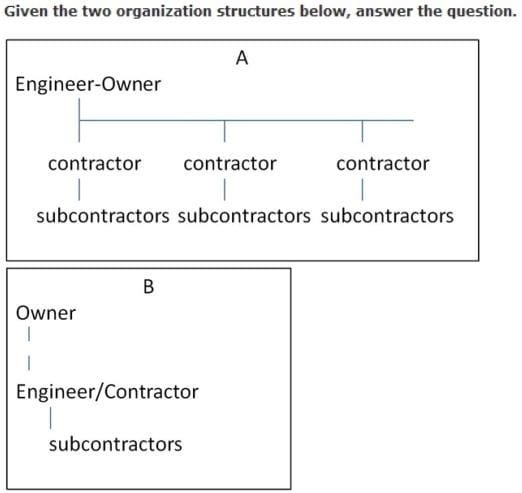

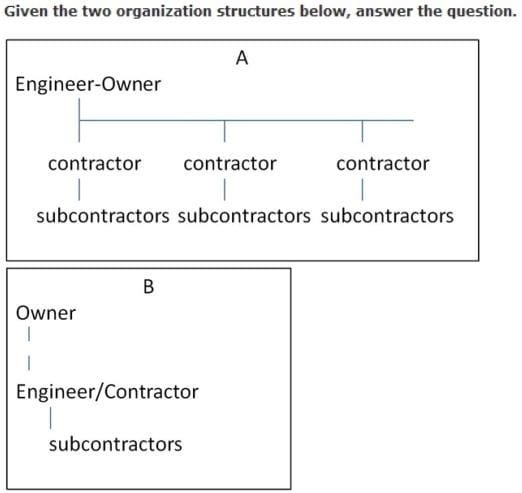

The following question requires your selection of CCC/CCE Scenario 28 (3.7.50.1.7) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses. If the owner in A has a primary goal of completion within budget, the following contract types with the engineer/contractor would be best:

A. Engineer -- cost plus, contractor fixed price

B. Engineer -- cost plus, contractor cost plus

C. Engineer fixed price, contactor cost plus

D. Engineer -- fixed price, contractor fixed price

-

Question 30:

The following question requires your selection of CCC/CCE Scenario 28 (3.7.50.1.7) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses. If the owner in B has as his primary goal to get the project completed and on line as fast as possible, then he would most likely use the ______________type of contract.

A. Cost plus

B. Lump sum

C. Unit Rate

D. Lump sum + incentive

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AACE International exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CCP exam preparations and AACE International certification application, do not hesitate to visit our Vcedump.com to find your solutions here.