Exam Details

Exam Code

:CCPExam Name

:Certified Cost Professional (CCP)Certification

:AACE International CertificationsVendor

:AACE InternationalTotal Questions

:115 Q&AsLast Updated

:Jul 12, 2025

AACE International AACE International Certifications CCP Questions & Answers

-

Question 11:

If you deposit $100 per month for two (2) years and earn interest at 12% APR (Annual Percentage Rate) compounded monthly, how much will you have at the end of the period?

A. $2,424

B. $2,976

C. $2,688

D. $2,697

-

Question 12:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

Which of the following should be included in the life-cycle cost analysis of a power plant?

A. Construction cost, operating cost, maintenance cost

B. Factory expenses, distribution expenses, mark-up

C. Capacity factor, end product units, physical dimensions

D. Resources, work activities, final cost objects

-

Question 13:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures

were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

Which of the following is considered a measure of profitability?

A. Rate of return

B. Annual Dividends

C. Total assets

D. Annual sales

-

Question 14:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures

were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The main financial objective of many enterprises is:

A. To maximize the total long-term economic return

B. Subject to a well-conceived quality control plan

C. To balance opportunities and risks

D. Dependent on the backlog projects and the availability of resources

-

Question 15:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses. Assuming a 53% tax rate, how much cumulative depreciation will have been claimed at the end of the grain elevator's life span?

A. None

B. $42,400

C. $37,600

D. $80,000

-

Question 16:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures

were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Annual estimated tax would be:

A. $3,869

B. $5,565

C. $10,500

D. $11,925

-

Question 17:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures

were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

All of the following are included in "income tax" calculations except:

A. Annual income

B. Annual expenditures

C. Depreciation

D. Initial cost of investment

-

Question 18:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures

were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Depreciation (in the United States) is calculated in accordance with which of the following?

A. Modified Accelerated Cost Recovery System (MACRS)

B. The Federal IRS Reform Act (FIRSRA)

C. Generally Accepted Accounting Practices (GAAP)

D. Accelerated Cost Recovery System (ACRS)

-

Question 19:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures

were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the "book value (BV) of the asset at the end of 5 years?

A. $64,000

B. $16,000

C. $3,200

D. $60,000

-

Question 20:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures

were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

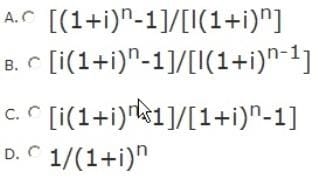

Present worth calculations is represented by which of the following equations?

A. Option A

B. Option B

C. Option C

D. Option D

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only AACE International exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CCP exam preparations and AACE International certification application, do not hesitate to visit our Vcedump.com to find your solutions here.