Exam Details

Exam Code

:CAMS-FCIExam Name

:Advanced CAMS-Financial Crimes InvestigationsCertification

:ACAMS CertificationsVendor

:ACAMSTotal Questions

:101 Q&AsLast Updated

:May 17, 2025

ACAMS ACAMS Certifications CAMS-FCI Questions & Answers

-

Question 61:

An analyst reviews an alert for high volume Automated Clearing House (ACH) activity in an account. The analyst's initial research finds the account is for a commercial daycare account that receives high volumes of large government-funded ACH transactions to support the programs. The account activity consists of checks (cheques) made payable to individual names in varying dollar amounts. One check indicates rent to another business.

An Internet search finds that the daycare company owner has previous government-issued violations for safety and classroom size needs, such as not having enough chairs and tables per enrollee. These violations were issued to a different daycare name.

Simultaneous to this investigation, another analyst sends an email about negative news articles referencing local child/adult daycare companies misusing governmental grants. This prompts the financial institution (Fl) to search all businesses for names containing daycare' or "care*. Text searches return a number of facilities as customers at the Fl and detects that three of these businesses have a similar transaction flow of high volume government ACH funding with little to no daycare expenses.

During the investigation, new suspicious patterns and trends related to check cashing are observed. The Fl decides to conduct a training to ensure that 1) the AML program is robust and 2) the training program is relevant and appropriate. Which parties should be trained on emerging trends and red flags? (Select Two.)

A. Financial crimes investigation unit

B. Loan department

C. Branch personnel

D. Senior management

E. The board of directors

-

Question 62:

A financial institution (Fl) banks a money transmitter business (MTB) located in Miami. The MTB regularly initiates wire transfers with the ultimate beneficiary in Cuba and legally sells travel packages to Cuba. The wire transfers for money remittances comply with the country's economic sanctions policies. A Fl investigator on the sanctions team reviews each wire transfer to ensure compliance with sanctions and to monitor transfer details.

An airline located in Cuba, unrelated to the business, legally sells airline tickets in Cuba to Cuban citizens wanting to travel outside of Cuba. The airline tickets are purchased using Cuban currency (CUC).

The MTB wants 100,000 USD worth of CUC. Purchasing CUC from a Cuban bank includes a 4% fee. The MTB contacts the airline to ask if the airline will trade its CUC for USD at a lower exchange fee than the Cuban bank. The airline agrees to a 1% fee. The MTB initiates a wire transfer to the airline which appears as normal activity in the monitoring system because of the business' travel package sales.

Which investigative actions should the investigator take concerning the 100.000 USD wire transfer? (Select Three.)

A. Review the wire transfer protocols for this customer.

B. Gather all account activity for Fl clients that purchased packages from the airline.

C. Review a sampling of wire transfers initiated by travel companies with Cuba travel packages.

D. Recommend a plan for the Fl's management to restrict the account relationship.

E. Review regulations applicable to foreign currency trading transactions.

F. Locate and review licenses, registrations, and account operating agreements associated with the MTB account.

-

Question 63:

An investigator at a corporate bank is conducting transaction monitoring alerts clearance.

1.

YC profile background: An entity customer, doing business offshore in Hong Kong, established a banking business relationship with the bank since 2017 for deposit and loan purposes. It acts as an offshore investment holding company. The customer declared that the ongoing source of funds to this account comes from group-related companies.

2.

X is the UBO. and owns 97% shares of this entity customer;

3.

Y is is the authorized signatory of this entity customer. This entity customer was previously the subject of a SAR/STR.

KYC PROFILE

Customer Name: AAA International Company. Ltd

Customer ID: 123456 Account Opened: June 2017

Last KYC review date: 15 Nov 2020

Country and Year of Incorporation: The British Virgin Islands, May 2017 AML risk level: High Account opening and purpose: Deposits, Loans and Trade Finance Anticipated account activities: 1 to 5 transactions per year and around 1 million per transaction amount During the investigation, the investigator reviewed remittance transactions activities for the period from Jul 2019 to Sep 2021 and noted the following transactions pattern: TRANSACTION JOURNAL Review dates: from July 2019 to Sept 2021 For Hong Kong Dollars (HKD) currency: Incoming transactions: 2 inward remittances of around 1.88 million HKD in total from different third parties Outgoing transactions: 24 outward remittances of around 9 4 million HKD in total to different third parties For United States Dollars (USD) currency: Incoming transactions: 13 inward remittances of around 3.3 million USD in total from different third parties Outgoing transactions: 10 outward remittances of around 9.4 million USD in total to different third parties. RFI Information and Supporting documents: According to the RFI reply received on 26 May 2021, the customer provided the bank with the information below: 1) All incoming funds received in HKD and USD currencies were monies lent from non- customers of the bank. Copies of loan agreements had been provided as supporting documents. All of the loan agreements were in the same format and all

the lenders are engaged in trading business.

2) Some loan agreements were signed among four parties, including among lenders. borrower (the bank's customer), guarantor, and guardian with supplemental agreements, which stated that the customer, as a borrower, who failed to repay

the loan

After reviewing the transaction journal, request for information response, and supporting documentation, the investigator determines that additional information is needed. Which additional information should the investigator request?

A. Previously filed SARVSTR unrelated to the customer, but similar in content

B. Formation document/description of the group-related companies

C. Source of the incoming funds to the group-related companies

D. Adverse news screening on all names listed in the formation documents

-

Question 64:

SAR/STR NARRATIVE

A SAR/STR has been submitted on five transactions conducted on the correspondent banking relationship with ABC Bank.

Client Information:

Remitter information: DEF Oil Resource Ltd. is the oldest member of the DEF Group. It was founded in 1977 as a general trading business with a primary focus on exports from Africa and North America. The group has business activities that

span the entire energy value chain. Their core field of endeavor is centered within the oil and gas industry and its associated sub-sectors.

Beneficiary Information:

As per the response received from ABC Bank, it was determined that the beneficiaries are related to DEF Oil Resource Ltd. These were created by DEF Oil Resource Ltd. to purchase property in a foreign country on behalf of their senior

management as part of a bonus scheme. The purpose behind this payment was for purchase of property in another country.

Payment Reference:

ABCXXXXX31PZFG2H

ABCXXXXXX51PQGEH

ABCXXXXXX214QWVG

ABCXXXXXX41PSXA2

ABCXXXXXX815QWS3

Concerns:

1.

We are unsure about the country of incorporation of the beneficiaries.

2.

We are concerned about the transactional activity since the payment made towards entities (conducted on behalf of individuals) appears to be possible tax evasion.

3.

There appears to be an attempt to conceal the identity of individuals (senior management), which again raises concerns about the source of funds.

4.

Referring to the response received from ABC Bank, we are unclear about the ultimate beneficiary of funds.

5.

The remitter is involved in a high-risk business, (i.e., oil and crude products trading), and the beneficiary is involved in a real estate business which again poses a higher risk.

The monitoring system of the correspondent institution flags the transaction as suspicious activity. The correspondent bank needs to send a request for information to the respondent bank. Which elements should be included in the request? (Select Three.)

A. Details of DEF Oil Resource Ltd parent company and the name(s) of the beneficial owner(s)

B. Full transaction history of the correspondent bank's customer

C. The account profile of the customer and their KYC data

D. The respondent bank's customer's senior management bonus plan

E. The contract pertaining to the purchase of property in another country

F. The last 6 months of transactional history

-

Question 65:

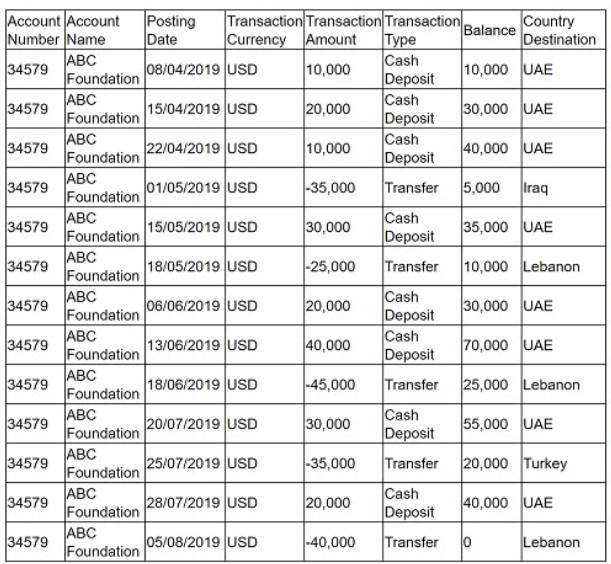

Each month the automated transaction monitoring system generates alerts based on predetermined scenarios. An alert was generated in relation to the account activity of ABC Foundation. Below is the transaction history for ABC Foundation (dates are in DD/MM/YYYY format).

The relationship manager for ABC Foundation contacts the client to request more information on the beneficiary of the transfer in Turkey. ABC Foundation advises that this is a not-for-profit charity group called 'Forever Free." Which is the best next step in the investigation?

A. Contact the financial institution in Turkey that has a relationship with Forever Free and advise them of the investigation.

B. Update the customer profile to include Forever Free as the recipient of the funds.

C. Check the junsdiction's list of known chanties with connections to terrorist activity.

D. File a SAR/STR with the new information learned about the beneficiary.

-

Question 66:

CLIENT INFORMATION FORM Client Name: ABC Tech Corp Client I.D. Number: 08125 Name: ABC Tech Corp Registered Address: Mumbai, India Work Address: Mumbai. India Cell Phone: **?quot;-- Alt Phone: Email: *?? *?

Client Profile Information:

Sector: Financial

Engaged in business from (date): 02 Jan 2020

Sub-sector: Software-Cryptocurrency Exchange

Expected Annual Transaction Amount: 125.000 USD

Payment Nature: Transfer received from client's fund

Received from: Clients

Received for: Sale of digital assets

The client identified themselves as "Cryptocurrency Exchange" Client has submitted the limited liability partnership deed. However, the bank's auditing team is unable to identify the client's exact business profile as the cryptocurrency exchange specified by the client as their major business awaits clearance from the country's regulator. The client has submitted documents/communications exchanged with the regulator and has cited the lack of governing laws in the country of their operation as the reason for the delay.

Investigators determine the ultimate beneficial owner of ABC Tech Corp is a high-net-worth client. The client owns a real estate agency left to her when her spouse died. The spouse provided seed capital for ABC Tech Corp through a direct 1,000.000 Great British Pound (GBP) deposit.

What additional information would trigger filing a SAR/STR?

A. The client's spouse's source of wealth was a salary of 250,000 GBP per annum for the past 4 years and rental of properties of 150,000 GBP per annum for the past 6 years.

B. The client's current net asset value is 8 million GBP, of which 7.5 million GBP was derived from the inheritance.

C. An open-source search revealed that the client's spouse was a PEP.

D. The funds for the seed capital were in the form of 50 cashier's checks of 10,000 GBP each and 50 money orders of 10,000 GBP.

-

Question 67:

Which is the first valid step in the Mutual Legal Assistance Treaties international cooperation process?

A. The investigator may remove the evidence collected without asking permission to do so.

B. The central authority of the requesting country sends a letter of request to the central authority of the other country.

C. An investigator from the requesting country visits the country where the information is sought and takes statements from the identified witnesses or suspects.

D. The central authority that receives the request sends it to a local judicial officer to find out if the information is available.

-

Question 68:

A financial regulator is evaluating the effectiveness of a financial institution's (Fl) anti- financial crime program. Which condition should be met to satisfy the regulator?

A. The program is aligned with the financial industry's anti-financial crime priorities.

B. The program meets the minimum requirements of anti-financial crime standards, which are published by a financial industry association.

C. In the past 3 years, internal auditing results show no high-severity issues and a maximum of three medium-seventy and four low-severity issues.

D. The program is drafted using a risk-based approach to avoid the Fl being used as a conduit for criminal activities.

-

Question 69:

An investigator at a corporate bank is conducting transaction monitoring alerts clearance. KYC profile background: An entity customer, doing business offshore in Hong Kong, established a banking business relationship with the bank in 2017 for deposit and loan purposes. It acts as an offshore investment holding company. The customer declared that the ongoing source of funds to this account comes from group-related companies.

1.

X is the UBO. and owns 97% shares of this entity customer;

2.

Y is the authorized signatory of this entity customer. This entity customer was previously the subject of a SAR/STR. KYC PROFILE Customer Name: AAA International Company. Ltd Customer ID: 123456 Account Opened: June 2017 Last KYC review date: 15 Nov 2020 Country and Year of Incorporation: The British Virgin Islands, May 2017 AML risk level: High Account opening and purpose: Deposits, Loans and Trade Finance Anticipated account activities: 1 to 5 transactions per year and around 1 million per transaction amount During the investigation, the investigator reviewed remittance transactions activities for the period from Jul 2019 to Sep 2021 and noted the following transactions pattern: TRANSACTION JOURNAL Review dates: from July 2019 to Sept 2021 For Hong Kong Dollars (HKD) currency: Incoming transactions: 2 inward remittances of around 1.88 million HKD in total from different third parties Outgoing transactions: 24 outward remittances of around 9 4 million HKD in total to different third parties For United States Dollars (USD) currency: Incoming transactions: 13 inward remittances of around 3.3 million USD in total from different third parties Outgoing transactions: 10 outward remittances of around 9.4 million USD in total to different third parties. RFI Information and Supporting documents: According to the RFI reply received on 26 May 2021, the customer provided the bank with the information below: 1) All incoming funds received in HKD and USD currencies were monies lent from non- customers of the bank. Copies of loan agreements had been provided as supporting documents. All of the loan agreements were in the same format and all

the lenders are engaged in trading business. 2) Some loan agreements were signed among four parties, including among lenders. borrower (the bank's customer), guarantor, and guardian with supplemental agreements, which stated that the customer, as a borrower, who failed to repay the loan

Based on the KYC profile and the transaction journal, the pattern of activity shows a deviation in:

A. expected vs. actual activity.

B. customer risk rating

C. product risk rating.

D. U.S. currency incoming vs. outgoing transaction rales.

-

Question 70:

A compliance officer of a financial institution is reviewing a payment for sanctions compliance between two parties in Europe and Asia. The payment is in Euros and involves the provision of services to a company located in a jurisdiction subject to Office of Foreign Assets Control secondary sanctions. Which factor is most important in determining the compliance officer's response?

A. Asset freezes only prohibit US companies from engaging in certain activities with counterparts from a sanctioned jurisdiction.

B. A one-off commercial transaction conducted between parties in Europe and Asia is not subject to secondary sanctions.

C. The threat of US sanctions against foreign individuals and entities continues to exist despite the absence of a US nexus.

D. Secondary sanctions only target specific sectors of the economy such as the banking and finance sectors.

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only ACAMS exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CAMS-FCI exam preparations and ACAMS certification application, do not hesitate to visit our Vcedump.com to find your solutions here.