Exam Details

Exam Code

:CBAPExam Name

:Cetified business analysis professional (CBAP)Certification

:IIBA CertificationsVendor

:IIBATotal Questions

:498 Q&AsLast Updated

:Jun 24, 2025

IIBA IIBA Certifications CBAP Questions & Answers

-

Question 121:

You are completing the requirements for vendor selection and need to create a procurement form that will ask the vendor to provide only a price for commercial-off-the-shelf solution. What type of procurement form will you need to provide to the vendor?

A. Request for proposal

B. Purchase order

C. Request for information

D. Request for quote

-

Question 122:

You are the business analyst for your organization. Management has asked you to create a plan that will define the proposed structure and schedule for communicating the business analysis activities to the appropriate stakeholders.

What plan does management want you to create?

A. Business Analysis Plan

B. Business Analysis Communications Plan

C. Communications management plan

D. Stakeholder Management Plan

-

Question 123:

The RGQ Organization utilizes a change log.

What is a change log?

A. It is a document that records all change requests for the project.

B. It is a document that tracks all unauthorized changes to the project solution.

C. It is a document that tracks all characteristics and status of changes that have been received.

D. It is a document that tracks the changes that have been received, including their implementation to the project solution.

-

Question 124:

A popular department store chain wants to make computer upgrades as well as conduct a major remodeling effort to increase revenue to all their 100 stores over the next 2 years. The remodeling will occur in two phases. The two phases are required at each store and can be completed in any order, but each phase must be fully completed before the next phase can begin. Phase 1 will take approximately 32 weeks and will not require a store to be temporarily closed. Phase 2 will take approximately 20 weeks and will require a store to be temporarily closed.

In order to keep inventory level and total revenue for the department store chain at an operational level, 75% of the stores must remain open to the public at all times. Against the board of director's advice, the Chief Executive Officer (CEO) made a decision to start and complete the top 25 revenue-producing stores in the first year to get those stores remodeled and fully operational.

A business analyst (BA) has been brought in to help with planning the project and gathering requirements.

Based on the CEO's executive decision, which risk tolerance attitude is the CEO exhibiting?

A. Seeking

B. Avoidance

C. Mitigation

D. Neutrality

-

Question 125:

A popular department store chain wants to make computer upgrades as well as conduct a major remodeling effort to increase revenue to all their 100 stores over the next 2 years. The remodeling will occur in two phases. The two phases are required at each store and can be completed in any order, but each phase must be fully completed before the next phase can begin. Phase 1 will take approximately 32 weeks and will not require a store to be temporarily closed. Phase 2 will take approximately 20 weeks and will require a store to be temporarily closed.

In order to keep inventory level and total revenue for the department store chain at an operational level, 75% of the stores must remain open to the public at all times. Against the board of director's advice, the Chief Executive Officer (CEO) made a decision to start and complete the top 25 revenue-producing stores in the first year to get those stores remodeled and fully operational.

A business analyst (BA) has been brought in to help with planning the project and gathering requirements.

What activity should the BA do to determine which stores will be the first to start the renovations?

A. Perform document analysis for stores annual records

B. Survey store managers for number of customers per day

C. Conduct a focus group with store managers to determine which should be first

D. Brainstorm with store managers on the current state of each store

-

Question 126:

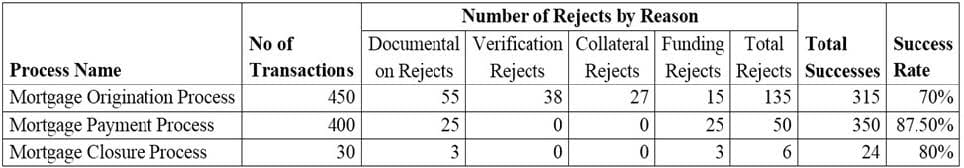

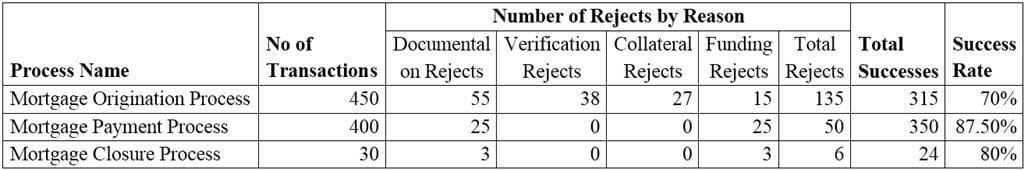

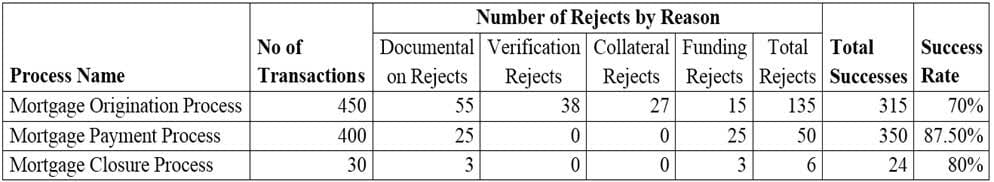

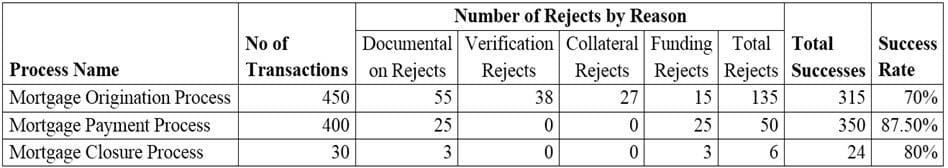

A financial institution engaged in mortgage lending has embarked on a business process improvement initiative to eliminate the activities that hinder growth to ultimately improve the success rate of its mortgage business. As a benchmark for

identification, the institution is keen on improving any business process that has less than a 75% success rate. The institution has appointed a business analyst (BA) to review the business transactions for the processes of origination,

payments, and closures, as well as identify opportunities for improvements and recommend solutions.

The BA has collected the following information over the last three months pertaining to these business processes:

?All the business processes are at their maximum capacity in terms of the current number of transactions.

?Each business process has a certain number of rejects and the reasons for rejection include documentation, verification, collateral, and funding. Funding rejects occur when the bank's customers have failed to make payment of their

mortgage processing fee or mortgage closure payment.

The BA has also recommended the use of documentation checklists as a solution to eliminate the documentation rejects.

Which of the following business processes can be identified for the process improvement initiative?

A. Mortgage payment process

B. Mortgage origination process

C. Mortgage closure process

D. Collateral verification process

-

Question 127:

A financial institution engaged in mortgage lending has embarked on a business process improvement initiative to eliminate the activities that hinder growth to ultimately improve the success rate of its mortgage business. As a benchmark for

identification, the institution is keen on improving any business process that has less than a 75% success rate. The institution has appointed a business analyst (BA) to review the business transactions for the processes of origination,

payments, and closures, as well as identify opportunities for improvements and recommend solutions.

The BA has collected the following information over the last three months pertaining to these business processes:

?All the business processes are at their maximum capacity in terms of the current number of transactions.

?Each business process has a certain number of rejects and the reasons for rejection include documentation, verification, collateral, and funding. Funding rejects occur when the bank's customers have failed to make payment of their

mortgage processing fee or mortgage closure payment.

The BA has also recommended the use of documentation checklists as a solution to eliminate the documentation rejects.

Assuming the BA's recommendation to be true, what will be the new success rate of the mortgage closure process?

A. 90%

B. 85%

C. 10%

D. 20%

-

Question 128:

A financial institution engaged in mortgage lending has embarked on a business process improvement initiative to eliminate the activities that hinder growth to ultimately improve the success rate of its mortgage business. As a benchmark for

identification, the institution is keen on improving any business process that has less than a 75% success rate. The institution has appointed a business analyst (BA) to review the business transactions for the processes of origination,

payments, and closures, as well as identify opportunities for improvements and recommend solutions.

The BA has collected the following information over the last three months pertaining to these business processes:

?All the business processes are at their maximum capacity in terms of the current number of transactions.

?Each business process has a certain number of rejects and the reasons for rejection include documentation, verification, collateral, and funding. Funding rejects occur when the bank's customers have failed to make payment of their

mortgage processing fee or mortgage closure payment.

The BA has also recommended the use of documentation checklists as a solution to eliminate the documentation rejects.

If an additional recommendation to reduce Verification Rejects by 50% were to be introduced into the mortgage origination process, what is the potential success rate of the mortgage origination process?

A. 86%

B. 83%

C. 70%

D. 74%

-

Question 129:

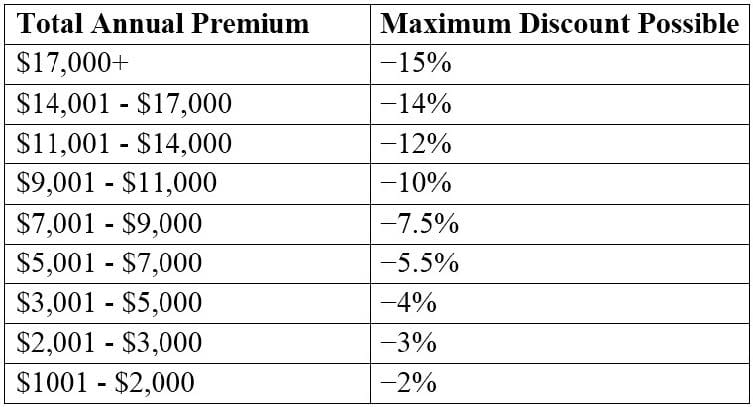

An insurance company wants to increase sales by 15% and customer retention by 10% within 1 calendar year. Various strategies to achieve this were considered and a restructure to the existing pricing model is selected to help achieve these goals.

A business analyst (BA) works with stakeholders such as actuaries, product specialists, sales staff, risk managers, and underwriters who agree to applying varying levels of discounts to customers based on:

?Total annual premium the customer has with the company (Financial worth)

?Time with the insurance company (Loyalty)

Various financial models are considered but the stakeholders agree that an initial applicable discount is determined based on the customer's overall premium:

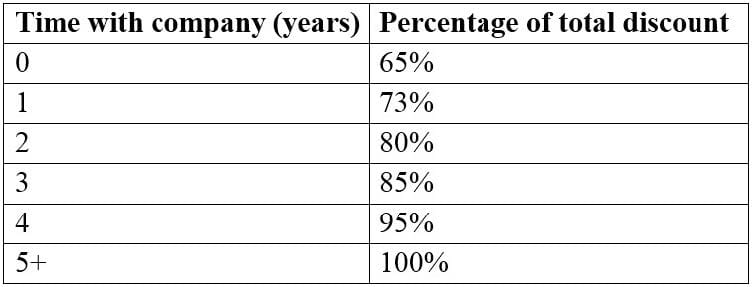

The percentage of the maximum possible discount available to the customer is adjusted based on time with the company:

As the new pricing structure was being implemented, the chief executive officer (CEO) of the company wanted to change the premiums and associated discounts offered to customers. The BA investigated the cost, anticipated benefits and the length of time the change would likely take to complete before presenting the results back to the CEO.

What type of analysis has the BA just conducted?

A. Impact

B. Capability

C. Market

D. Document

-

Question 130:

A financial institution engaged in mortgage lending has embarked on a business process improvement initiative to eliminate the activities that hinder growth to ultimately improve the success rate of its mortgage business. As a benchmark for

identification, the institution is keen on improving any business process that has less than a 75% success rate. The institution has appointed a business analyst (BA) to review the business transactions for the processes of origination,

payments, and closures, as well as identify opportunities for improvements and recommend solutions.

The BA has collected the following information over the last three months pertaining to these business processes:

?All the business processes are at their maximum capacity in terms of the current number of transactions.

?Each business process has a certain number of rejects and the reasons for rejection include documentation, verification, collateral, and funding. Funding rejects occur when the bank's customers have failed to make payment of their

mortgage processing fee or mortgage closure payment.

The BA has also recommended the use of documentation checklists as a solution to eliminate the documentation rejects.

If the financial institution always works at full capacity month to month and the new success rate continues to remain the same after implementing the BA's recommendation, what is the average number of successes per month for the mortgage closure process, if the current process capability were increased by 50%?

A. 15

B. 14

C. 12

D. 11

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IIBA exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your CBAP exam preparations and IIBA certification application, do not hesitate to visit our Vcedump.com to find your solutions here.