Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 27, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 981:

A firm must select from among several methods of financing arrangements when meeting its capital requirements. To acquire additional growth capital while attempting to maximize earnings per share, a firm should normally

A. Attempt to increase both debt and equate in equal proportions, which preserves a stable capital structure and maintains investor confidence.

B. Select debt over equity' initially, even though increased debt is accompanied by interest costs and a degree of risk.

C. Select equity over debt initially, which minimizes risk and avoids interest costs.

D. Discontinue dividends and use current cash flow, which avoids the cost and risk of increased debt and the dilution of EPS through increased equity.

-

Question 982:

Prior to the introduction of the euro, 0 and B Company, a U.S. corporation, is in possession of accounts receivable denominated in Deutsche marks. To what type of risk are they exposed?

A. Liquidity risk.

B. Liquidity risk.

C. Exchange-rate risk.

D. Price risk.

-

Question 983:

When purchasing temporary investments, which one of the following best describes the risk associated with the ability to sell the investment in a short period of time without significant price concessions?

A. Interest-rate risk.

B. Purchasing-power risk.

C. Financial risk.

D. Liquidity risk.

-

Question 984:

The risk that securities cannot be sold ate reasonable price on short notice is called

A. Default risk.

B. Interest-rate risk.

C. Purchasing-power risk.

D. Liquidly risk.

-

Question 985:

The type of risk that is not diversifiable and affects the value of a portfolio is

A. Purchasing-power risk.

B. Market risk.

C. Nonmarket risk.

D. Interest-rate risk.

-

Question 986:

Which of the following are components of interest-rate risk?

A. Purchasing-power risk and default risk.

B. Price risk and market risk.

C. Portfolio risk and reinvestment-rate risk.

D. Price risk and reinvestment-rate risk.

-

Question 987:

Catherine and Co. has extra cash at the end of the year and is angling the beltways invest the funds. The company should invest in a project only if the

A. Expected return on the project exceeds the return on investments of comparable risk.

B. Return on investments of comparable risk exceeds the expected return on the project.

C. Expected return on the project is equal to the return on investments of comparable risk.

D. Return on investments of comparable risk equals the expected return on the project.

-

Question 988:

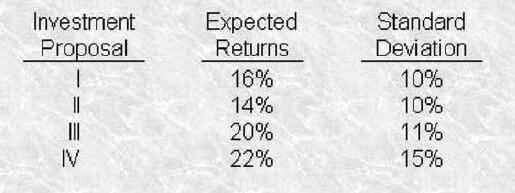

Russell1 Inc. is evaluating four independent investment proposals. The expected returns and standard deviations for each of these proposals are presented below.

Which one of the investment proposals has the least relative level of risk?

A. Investment I.

B. Investment II.

C. Investment Ill.

D. Investment IV.

-

Question 989:

The expected rate of return for the stock of Cornhusker Enterprises is 20%, with a standard deviation of 1 5%.The expected rate of return for the stock of Mustang Associates is 10%, with a standard deviation of 9%.The riskier stock is

A. Cornhusker because the return is higher.

B. Cornhusker because the standard deviation is higher.

C. Mustang because the standard deviation is higher.

D. Mustang because the coefficient of variation is higher.

-

Question 990:

City' Development, Inc. is considering a new investment project which will involve building a large office

block in Frankfurt-am-Main. The firm's financial analysis department has estimated that the proposed

investment has the following estimated rate of return distributions. Rate of Return Probability' (5%) 30%

10% 50%

20% 20%

Calculate the expected rate of return.

A. 5.5%

B. 7.5%

C. 10.5%

D. 117%

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.