Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 27, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 911:

A man offers to buyyourcarwith4 equal annual payments of $3,000, beginning 2 years from today. Assuming you're indifferent to cash versus credit, that you can invest at 10%, and that you want to receive $9000 for the car, should you accept?

A. Yes; present value is $9,510.

B. Yes; present value is $11,373.

C. No; present value is $8646.

D. No; present value is $7461.

-

Question 912:

As a company becomes more conservative in its working capital policy, it would tend to have a(n)

A. Decrease in its acid-test ratio.

B. Increase in the ratio of current liabilities to concurrent liabilities.

C. Increase in the ratio of current assets to units of output.

D. Increase in funds invested in common stock and a decrease in funds invested in marketable securities.

-

Question 913:

Since Marsh, Inc. is experiencing a sharp increase in sales activity and a steady increase in production, the management of Marsh has adopted an aggressive working capital policy. Therefore, the company's current level of net working capital

A. Would most likely be the same as in any other type of business condition as business cycles tend to balance out overtime?

B. Would most likely be lower than under other business conditions in order that the company can maximize profits while minimizing working capital investment.

C. Would most likely be higher than under other business conditions so that there will be sufficient funds to replenish assets.

D. Would most likely be higher than under other business conditions as the company's profits are increasing.

-

Question 914:

Determining the appropriate level of working capital for firm requires

A. Evaluating the risks associated with various levels of fixed assets and the types of debt used to finance these assets.

B. Changing the capital structure and dividend policy for the firm.

C. Maintaining short-term debt at the lowest possible level because it is ordinarily more expensive than long-term debt.

D. Offsetting the profitability of current assets and current liabilities against the probability of technical insolvency.

-

Question 915:

Management of a firm does not want to violate a working capital restriction contained in its bond indenture. If the firm's current ratio falls below 2.0 to 1, technically it will have defaulted. The firm's current ratio is now

2.2 to 1. If current liabilities are $200 million, the maximum new commercial paper that can be issued to finance inventory expansion is

A. $20 million.

B. $40 million.

C. $240 million.

D. $180 million.

-

Question 916:

Claus on, Inc. grants credit terms of 1/15. Net 30 and projects gross sales for next year of $2,000,000. The credit manager estimates that 40% of their customers pay on the discount date1 40% on the net due date, and 20% pay 15 days after the net due date. Assuming uniform sales and a 360-day year1 what is the projected days' sales outstanding (rounded to the nearest whole day)?

A. 20 days.

B. 24 days.

C. 27 days.

D. 30 days.

-

Question 917:

Which one of the following statements is most likely to be true if a seller extends creditor a purchaser for a period of time longer than the purchaser's operating cycle? The seller A. Will have a lower level of accounts receivable than those companies whose credit period is shorter than the purchaser's operating cycle.

A. Will have a lower level of accounts receivable than those companies whose credit period is shorter than the purchaser's operating cycle.

B. Is, in effect, financing more than just the purchaser's inventory needs.

C. Can be certain that the purchaser will be able to convert the inventory into cash before payment is due.

D. Has no need for a stated discount rate or credit period.

-

Question 918:

A change in credit policy has caused an increase in sales, an increase in discounts taken, a reduction in the investment in accounts receivable, and a reduction in the number of doubtful accounts. Based upon this information, we know that

A. Net profit has increased.

B. The average collection period has decreased.

C. Gross profit has declined.

D. The size of the discount offered has decreased.

-

Question 919:

Speech Co.'s budgeted sales and budgeted cost of sales for the coming year are $212,000,000 and $132,500,000, respectively. Short-term interest rates are expected to average 5%. If Speech could increase inventory turnover from its current 8.0 times permeate 10.0 times per year, its expected cost savings in the current year would be

A. $165,625

B. $0

C. $3,312,500

D. $828,125

-

Question 920:

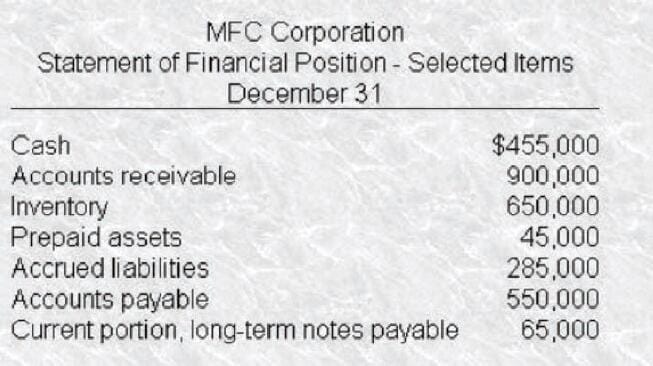

MEC Corporation has 100,000 shares of stock outstanding. Below is part of Mac's Statement of Financial Position for the last fiscal year.

What is the maximum amount MEC can pay in cash dividends per share and maintain a minimum current ratio of 2 to 1? Assume that all accounts other than cash remain unchanged.

A. $2.05

B. $2.50

C. $3.35

D. $3.80

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.