Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 27, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 781:

The cost of funds from the sale of common stock for Williams. Inc. is

A. 7.0%

B. 7.6%

C. 7,4%

D. 8.1%

-

Question 782:

Global Company Press has $150 par value preferred stock with a market price of $120 a share, The organization pays a $15 per share annual dividend. Global's current marginal tax rate is 40%. Looking to the future, the company anticipates maintaining its current capital structure. What is the component cost of preferred stock to Global?

A. 4

B. 5%

C. 10%

D. 125%

-

Question 783:

Without prejudice to your answers from any other questions, assume that the after-tax cost of debt financing is 10%. the cost of retained earnings is 14%. and the cost of new common stock is 16%. What is the marginal cost of capital to - FLF Corporation for any projected capital expansion in excess of $7 million?

A. 10%

B. 12.74%

C. 136%

D. 16%

-

Question 784:

Without prejudice to your answers from any other questions, assume that the after-tax cost of debt financing is 10%, the cost of retained earnings is 14%, and the cost of new common stock is 16%. If capital expansion needs to be $7 million for the coming year, what is the after-tax weighted-average cost of capital to FLF Corporation?

A. 11 14%

B. 1274%

C. 13.6%

D. 16%

-

Question 785:

The cost of using FLF Corporation retained earnings for financing is

A. 5%

B. 9%

C. 10%

D. 15%

-

Question 786:

The maximum capital expansion that FLF Corporation can support in the coming year without resorting to external equity financing is

A. $2 million.

B. $3 million.

C. $5 million.

D. Cannot determine from the information given.

-

Question 787:

The after-tax cost to FLF Corporation of the new bond issue is

A. 4%

B. 6%

C. 10%

D. 14%

-

Question 788:

If FLF Corporation must assume a 20% flotation cost on new stock issuances. what is the cost of new common stock'?

A. 6.25%

B. 15%

C. 16.25%

D. 10%

-

Question 789:

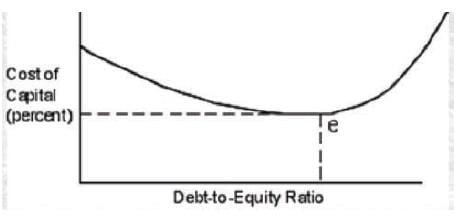

In referring to the graph of a firm's cost of capital, if e is the current position, which one of the following statements best explains the saucer or U-shaped curve'?

A. The composition of debt and equity does not affect the firm's cost of capital.

B. The cost of capital is almost always favorably influenced by increases in financial leverage.

C. The cost of capital is almost always negatively influenced by increases in financial leverage.

D. Use of at least some debt financing will enhance the value of the firm.

-

Question 790:

Osgood Products has announced that it plans to finance future investments so that the firm will achieve an optimum capital structure. Which one of the following corporate objectives is consistent with this announcement?

A. Maximize earnings per share.

B. Minimize the cost of debt.

C. Maximize the net worth of the firm.

D. Minimize the cost of equity.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.