Exam Details

Exam Code

:IMANET-CMAExam Name

:Certified Management Accountant (CMA)Certification

:IMANET CertificationsVendor

:IMANETTotal Questions

:1336 Q&AsLast Updated

:Jul 27, 2025

IMANET IMANET Certifications IMANET-CMA Questions & Answers

-

Question 751:

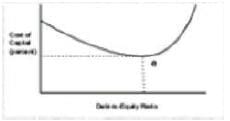

In referring to the graph of a firm's cost of capital, if e is the current position, which one of the following statements best explains the saucer or U-shaped curve?

A. The cost of capital is almost always favorably' influenced by increases in financial leverage

B. The cost of capital is almost always negative' influenced by increases in financial leverage.

C. The financial markets will penalize firms that borrow even in moderate amounts

D. Use of at least some debt financing will enhance the value of the firm.

-

Question 752:

A firm seeking to optimize its capital budget has calculated its marginal cost of capital and projected rates of return on several potential projects. The optimal capital budget is determined by

A. Calculating the point at which marginal cost of capital meets the projected rate of return, assuming that the most profitable projects are accepted first.

B. Calculating the point at which average marginal cost meets average projected rate of return, assuming the largest projects are accepted first.

C. Accepting all potential projects with projected rates of return exceeding the lowest marginal cost of capital

D. Accepting all potential projects with projected rates of return lower than the highest marginal cost of capital.

-

Question 753:

A firm's optimal capital structure

A. Minimizes the firm's tax liability.

B. Minimizes the firm's risk.

C. Maximizes the firm's degree of financial leverage

D. Maximizes the price of the firm's stock.

-

Question 754:

The interest rate on the bonds is greater to Rogers. Inc. for the second alternative consisting of pure debt than it is for the first alternative consisting of both debt and equity because the

A. Diversity of the combination alternative creates greater risk for the investor.

B. Pure debt alternative would flood the market and be more difficult to sell.

C. Pure debt alternative carries the risk of increasing the probability of default,

D. Combination alternative carries the risk of increasing dividend payments.

-

Question 755:

The after-tax cost of the common stock proposed in Rogers' first financing alternative would be

A. 16.00%

B. 16.53%

C. 16.60%

D. 17.16%

-

Question 756:

Assuming the after-tax cost of common stock is 15%, the after-tax weighted marginal cost of capital for Rogers' first financing alternative consisting of bonds, preferred stock, and common stock would be

A. 7.285%

B. 8725%

C. 10.375%

D. 11.700%

-

Question 757:

The after-tax weighted marginal cost of capital for Rogers' second financing alternative consisting solely of bonds would be

A. 5.13%

B. 5.40%

C. 6.27%

D. 6.60%

-

Question 758:

Which of the following is true regarding the calculation of a firms cost of capital?

A. The cost of capital of a firm is the weighted-average cost of its various financing components

B. All costs should be expressed as pre-tax costs

C. The time value of money should be excluded from the calculations.

D. The cost of capital is the cost of equity.

-

Question 759:

When calculating a firm's cost of capital, all of the following are true except that

A. The cost of capital of a firm is the weighted average cost of its various financing components.

B. The calculation of the cost of capital should focus on the historical costs of alternative forms of financing rather than market or current costs.

C. All costs should be expressed as after-tax costs.

D. The time value of money should be incorporated into the calculations.

-

Question 760:

The DCL Corporation is preparing to evaluate the capital expenditure proposals for the coming year.

Because the firm employs discounted cash flow methods of analyses. the cost of capital for the firm must

be estimated. The following information for DCL Corporation is provided.

Market price of common stock is $50 per share.

The dividend next year is expected to be $2.50 per share.

Expected growth in dividends is a constant 10%.

New bonds can be issued at face value with a 13% coupon rate.

The current capital structure of 40% long-term debt and 60% equity is considered to be optimal

Anticipated earnings to be retained in the coming year are $3 million.

The firm has a 40% marginal tax rate.

If the firm must assume a 10% flotation cost on new stock issuances. what is the cost of new common

stock?

A. 1611%.

B. 15.56%.

C. 15.05%.

D. 15.00%.

Related Exams:

Tips on How to Prepare for the Exams

Nowadays, the certification exams become more and more important and required by more and more enterprises when applying for a job. But how to prepare for the exam effectively? How to prepare for the exam in a short time with less efforts? How to get a ideal result and how to find the most reliable resources? Here on Vcedump.com, you will find all the answers. Vcedump.com provide not only IMANET exam questions, answers and explanations but also complete assistance on your exam preparation and certification application. If you are confused on your IMANET-CMA exam preparations and IMANET certification application, do not hesitate to visit our Vcedump.com to find your solutions here.